Silver is still three steps away from a major breakthrough!

Independent precious metals analyst Jesse Colombo wrote in Substack that as long as the three conditions are met, he expects silver to take off like gold. The following is the full text.

Just two months ago, due to the fluctuating and tepid trend of precious metals prices in the summer, investors felt more and more depressed. At the time, I always urged investors to be patient because I thought gold denominated in non-US currencies was about to explode. Sure enough, this is exactly what happened, and I'm sure there will be more increases in the future.

Now, I notice investors are similarly frustrated with silver, as it has been stagnating for the past five months. In this article, my goal is to encourage investors to be patient with silver because I believe that once three key conditions are met, silver is on the verge of a strong breakthrough, just like gold.

The first condition was simple, but largely overlooked by investors, and proved surprisingly challenging to achieve: the spot price of silver must resolutely close above the $32.50 resistance level, supported by strong trading volume.

The $32.50 resistance level was at the May high, after which silver retreated and remained stagnant throughout the summer. Silver tried to break through this level on September 26 and October 4, but both efforts failed, leading to a subsequent pullback. However, I believe silver will eventually break through and close above this level, triggering a sharp rebound. Once this happens, I expect silver to rapidly soar to around $50.

The second condition is that silver, which is denominated in euros, must resolutely close above the 30 euro resistance level formed by the May peak. This would help confirm its closing price above $32.50, greatly reducing the possibility of it becoming a false breakthrough.

I found it meaningful to analyze the price of silver in euros because this approach removes the effects of dollar fluctuations and allows a clearer understanding of silver's inherent strengths or weaknesses. It is worth noting that integer barriers such as €26, €27, and €28 are generally important for silver denominated in euros. Silver's key support and resistance levels are often in these positions, so they are worth watching closely.

The last condition is a bit more profound, but I believe it will greatly reduce the possibility that the upcoming silver breakthrough is a false breakthrough, that is, the “synthetic silver price index” I developed must close above the key resistance zone between 2560-2640.

The index represents the average of the price of gold and copper, which is adjusted (multiplied by 540) to prevent the increase in gold prices from having a disproportionate impact on the index. The price of copper is an often overlooked factor affecting the performance of silver, and its influence is comparable to that of gold. The index closely reflects the price movement of silver, but surprisingly, the price of silver itself isn't even a factor.

As I said earlier in this article, once these three conditions are met, silver is likely to rapidly rise to $50. I'm using $50 as a relatively short-term goal because it's an important psychological level and peaked during the 1980 and 2011 rebounds. One of the reasons I'm so optimistic about silver is that its monthly chart shows that silver recently broke through a 20-year large-scale triangle pattern. This breakthrough marks that silver is on the verge of a strong bull market:

What is exciting is that after drawing a logarithmic chart of silver prices since the 1960s, I discovered a cup pattern, which means that in this bull market, the price of silver may reach several hundred dollars. Confirmation of this scenario, however, would require closing above the $50 resistance level.

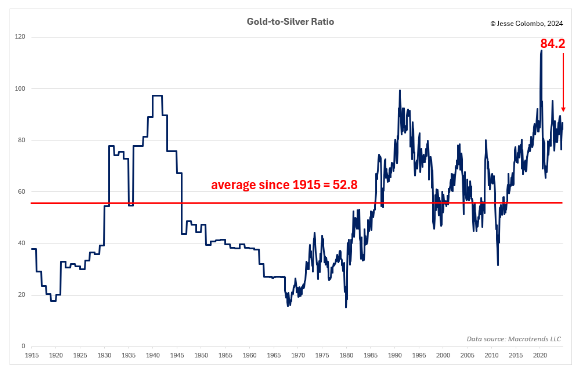

Although silver has surged nearly 50% this year, there are plenty of reasons to believe the rise has only just begun. One reason is that long-term gold to silver ratio charts show that compared to gold, silver is currently seriously undervalued. If the ratio were to return to the historical average of 52.8 since 1915, even if there were no increases in the price of gold, the price of silver would be $50.36 per ounce.

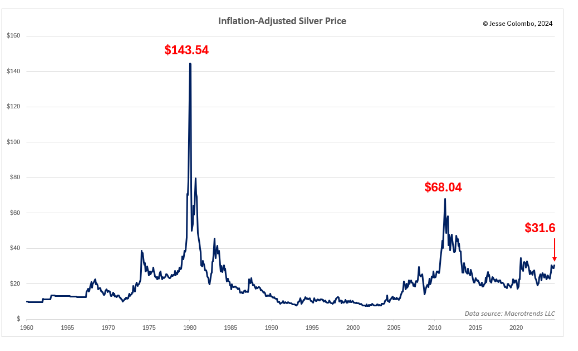

The inflation-adjusted price of silver further highlights that the price of silver is seriously undervalued by historical standards. During the surge in silver prices triggered by the Hunter Brothers silver manipulation case in 1980, the inflation-adjusted price of silver reached $143.54. In the 2011 bull market, driven by quantitative easing, this price hit $68.04. In contrast, the current trading price of silver is less than $32, and there is still plenty of room to rise if it is to catch up with the previous inflation-adjusted peak.

Another way to assess whether silver is undervalued or overvalued is by comparing it to various money supply metrics. The chart below shows the ratio of the price of silver to the M2 money supply in the US. You can learn more about whether silver keeps pace with, exceeds, or lags behind the growth in the money supply.

If the growth rate of the silver price clearly exceeds the growth rate of the money supply, then the possibility of a strong correction will increase. Conversely, if the price of silver lags behind the growth in the money supply, it indicates that it may be in a strong period in the future. Since the mid-10s of this century, silver has lagged slightly behind M2 growth. Combined with other factors discussed in this article, silver prices are likely to rebound strongly.

All in all, silver is building up energy for major breakthroughs. While investors are understandably frustrated after months of stagnation, technical and fundamental indicators suggest that silver is building momentum for an impressive trend. Silver prices denominated in dollars and euros have broken through key resistance levels, and confirmation of the “synthetic silver price index” will mark the official beginning of the rebound. However, its historical trend and undervalued status will further support the upward outlook, and silver may be on the verge of a sharp rise to $50 or higher.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal