3 Swedish Growth Stocks With Up To 34% Insider Ownership

In recent weeks, European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising amid hopes for quicker interest rate cuts by the ECB and potential economic stimulus from China. As investors navigate these evolving market conditions, stocks with significant insider ownership often draw attention due to the confidence they reflect in a company's growth prospects.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.7% | 21.7% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| LumenRadio (OM:LUMEN) | 33.7% | 31.8% |

| Yubico (OM:YUBICO) | 37.5% | 42.2% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| InCoax Networks (OM:INCOAX) | 20.1% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Underneath we present a selection of stocks filtered out by our screen.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK14.38 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to SEK299.35 million.

Insider Ownership: 34%

BioArctic, a Swedish company with significant insider ownership, has shown promising developments despite recent financial challenges. The company's revenue is projected to grow at 42.4% annually, outpacing the market. While it reported a net loss for the first half of 2024, its strategic focus on innovative treatments like exidavnemab and lecanemab offers potential growth avenues. Recent executive changes reflect strong shareholder influence with approximately 84% voting power held by major insiders and funds.

- Get an in-depth perspective on BioArctic's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that BioArctic's share price might be on the cheaper side.

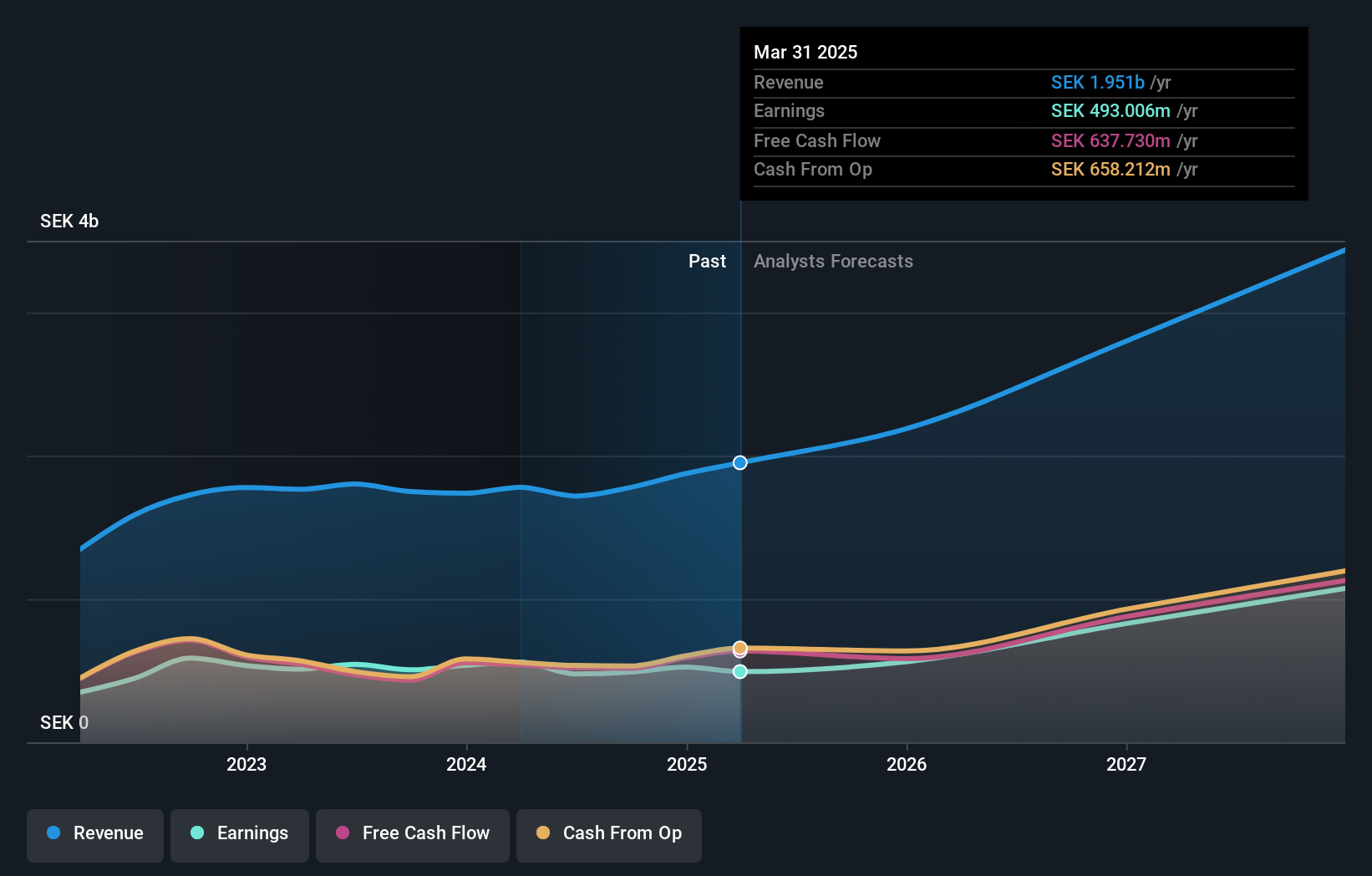

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK55.72 billion.

Operations: The company's revenue segments include Imaging IT Solutions at SEK2.67 billion and Secure Communications at SEK388.55 million, alongside Business Innovation contributing SEK90.77 million.

Insider Ownership: 30.3%

Sectra, a Swedish firm with substantial insider ownership, is poised for significant earnings growth of 21.21% annually over the next three years, outpacing the Swedish market's 15.6%. Recent financial results show a robust increase in revenue and net income, with Q1 sales reaching SEK 736.75 million. The company's strategic expansion into cloud-based imaging services through agreements like the one with MaineGeneral Health underscores its potential for sustained growth in healthcare IT solutions.

- Dive into the specifics of Sectra here with our thorough growth forecast report.

- Our valuation report here indicates Sectra may be overvalued.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK15.60 billion.

Operations: The company generates revenue primarily from its communications software segment, which accounts for SEK1.72 billion.

Insider Ownership: 29.7%

Truecaller, with strong insider ownership, is expected to see significant earnings growth of 21.7% annually, surpassing the Swedish market's average. Analysts predict a 27.2% stock price increase, while the company trades below estimated fair value. Recent developments include a strategic partnership with Halan and key executive appointments in India to bolster regulatory support. Despite a drop in recent earnings compared to last year, Truecaller's revenue growth remains robust at over 20% per year.

- Take a closer look at Truecaller's potential here in our earnings growth report.

- Our expertly prepared valuation report Truecaller implies its share price may be lower than expected.

Next Steps

- Take a closer look at our Fast Growing Swedish Companies With High Insider Ownership list of 80 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal