Top Indian Growth Companies With Insider Ownership October 2024

The Indian market has experienced a robust performance, rising 1.0% in the last week and surging 39% over the past year, with earnings projected to grow by 17% annually in the coming years. In such a thriving environment, growth companies with significant insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 30.6% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| KEI Industries (BSE:517569) | 19.2% | 21.9% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP)

Simply Wall St Growth Rating: ★★★★★☆

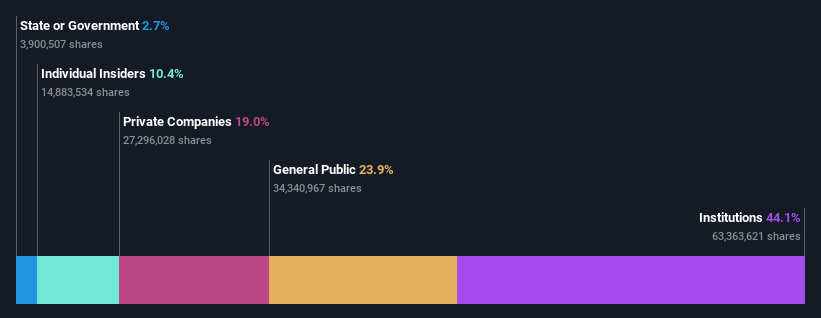

Overview: Apollo Hospitals Enterprise Limited, along with its subsidiaries, provides healthcare services in India and internationally, with a market cap of ₹1.03 trillion.

Operations: The company's revenue segments include Healthcare Services at ₹102.83 billion, Retail Health & Diagnostics at ₹14.12 billion, and Digital Health & Pharmacy Distribution at ₹81.04 billion.

Insider Ownership: 10.4%

Return On Equity Forecast: 22% (2027 estimate)

Apollo Hospitals Enterprise is poised for significant growth, with earnings forecasted to grow at 32.3% annually, outpacing the Indian market's average. Despite a high debt level, the company's robust financial performance is evident from its recent earnings report showing substantial revenue and net income increases compared to the previous year. Recent board decisions include issuing preference shares and adopting an employee stock option plan, reflecting strategic moves to support future expansion.

- Delve into the full analysis future growth report here for a deeper understanding of Apollo Hospitals Enterprise.

- According our valuation report, there's an indication that Apollo Hospitals Enterprise's share price might be on the expensive side.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

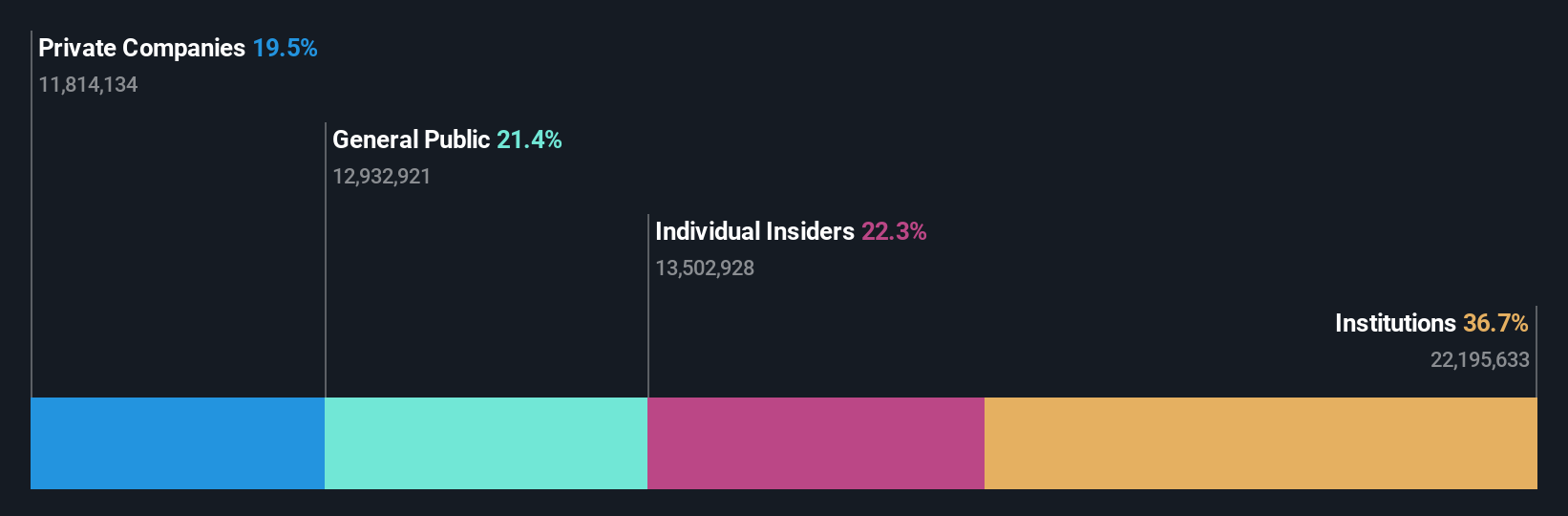

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services both domestically and internationally, with a market cap of ₹921.75 billion.

Operations: The company's revenue segments include Home Appliances at ₹12.51 billion, Lighting Products at ₹7.92 billion, Mobile & EMS Division at ₹143.16 billion, and Consumer Electronics & Appliances at ₹41.21 billion.

Insider Ownership: 24.6%

Return On Equity Forecast: 32% (2027 estimate)

Dixon Technologies (India) shows promising growth prospects, with earnings expected to increase significantly at 30.6% annually, surpassing the Indian market average. Recent financial results highlight robust performance, with revenue reaching ₹65.88 billion and net income doubling compared to last year. The company's high insider ownership aligns management interests with shareholders, while recent strategic appointments in senior management support its expansion plans. Despite no substantial insider trading activity recently, Dixon's growth trajectory remains strong.

- Take a closer look at Dixon Technologies (India)'s potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Dixon Technologies (India)'s share price might be too optimistic.

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

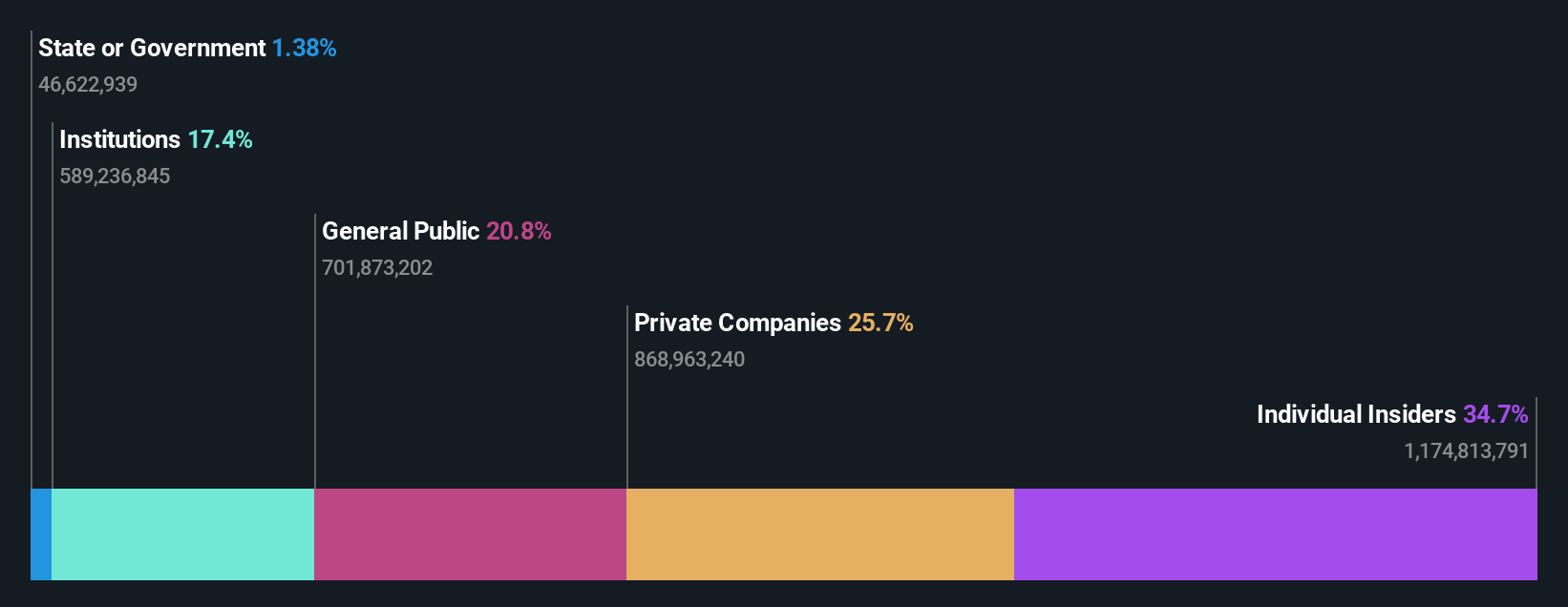

Overview: Varun Beverages Limited, along with its subsidiaries, operates as a franchisee for carbonated and non-carbonated beverages under PepsiCo trademarks, with a market cap of ₹1.98 trillion.

Operations: The company's revenue segment focuses on the manufacturing and sale of beverages, generating ₹180.52 billion.

Insider Ownership: 36.2%

Return On Equity Forecast: 30% (2027 estimate)

Varun Beverages demonstrates strong growth potential, with earnings forecasted to grow significantly at 22.4% annually, outpacing the Indian market. The company plans to raise ₹75 billion through a Qualified Institutional Placement to fund expansion and reduce debt, enhancing its financial position. Recent investments in the Democratic Republic of the Congo highlight strategic international growth. Despite high debt levels, Varun Beverages benefits from substantial insider ownership aligning management interests with shareholders.

- Dive into the specifics of Varun Beverages here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Varun Beverages is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Get an in-depth perspective on all 90 Fast Growing Indian Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal