High Growth Tech Stocks In France For October 2024

As European markets show resilience with the pan-European STOXX Europe 600 Index rising amid hopes for quicker interest rate cuts from the ECB, France's CAC 40 Index has also seen a modest increase, reflecting a positive sentiment in the region. In this environment, identifying high-growth tech stocks involves looking for companies that can leverage favorable economic conditions and potential policy shifts to drive innovation and expansion.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 25.98% | 77.41% | ★★★★★☆ |

| Valneva | 22.83% | 17.91% | ★★★★★☆ |

| Munic | 42.94% | 174.09% | ★★★★★☆ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| Valbiotis | 33.52% | 39.79% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.72% | ★★★★★★ |

| beaconsmind | 26.32% | 74.88% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Genfit (ENXTPA:GNFT)

Simply Wall St Growth Rating: ★★★★☆☆

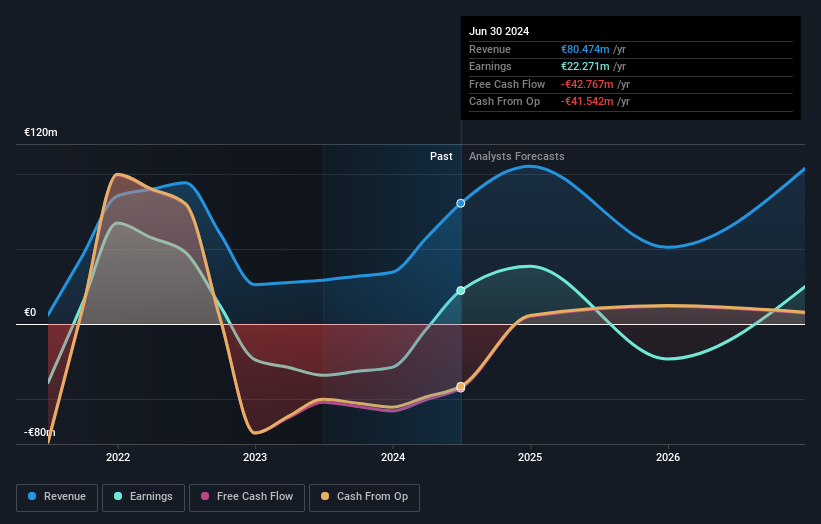

Overview: Genfit S.A. is a late-stage biopharmaceutical company focused on discovering and developing drug candidates and diagnostic solutions for metabolic and liver-related diseases, with a market cap of €271.45 million.

Operations: The company generates revenue primarily from the research and development of innovative medicines and diagnostic solutions, amounting to €80.47 million.

Genfit has demonstrated a remarkable turnaround, with its first-half 2024 revenues soaring to €61.2 million from €15.37 million in the previous year, reflecting a significant operational upswing. This growth is underpinned by an impressive earnings leap from a net loss of €20.85 million to a net income of €30.31 million, showcasing effective management and strategic execution. Despite this rapid progress, the company's share price remains volatile, indicating potential market uncertainties or investor hesitations about its long-term stability. Moreover, while Genfit's revenue growth forecast at 17.8% annually outpaces the French market's 5.6%, its projected earnings growth rate at 33.8% per year suggests robust future profitability that exceeds broader market expectations (12.1%). These figures highlight Genfit’s potential in harnessing R&D innovations to convert substantial revenue increases into bottom-line results, though it must navigate inherent risks associated with high volatility in its share pricing.

- Click here to discover the nuances of Genfit with our detailed analytical health report.

Review our historical performance report to gain insights into Genfit's's past performance.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

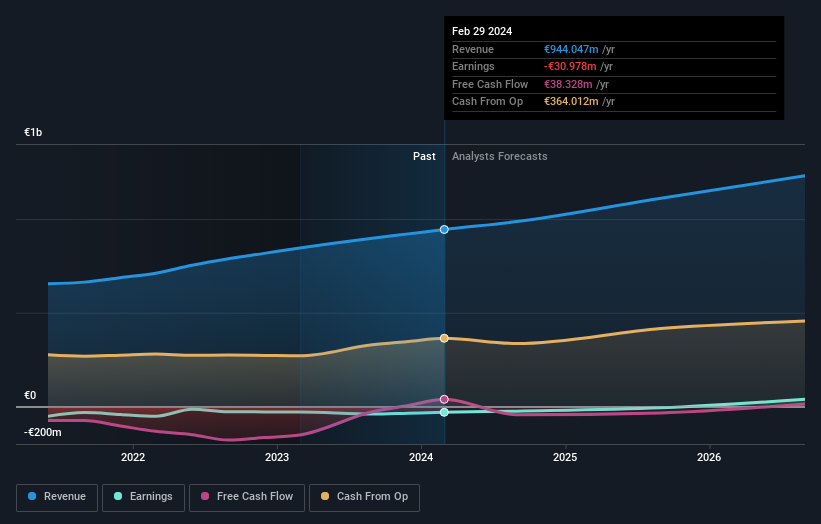

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.28 billion.

Operations: OVH Groupe generates revenue primarily from its Private Cloud segment, contributing €589.61 million, followed by Public Cloud and Web Cloud services at €169.01 million and €185.43 million, respectively. The company's diverse offerings in cloud solutions cater to a global market demand for both public and private infrastructure services.

OVH Groupe, amidst a challenging landscape for unprofitable tech firms, is navigating its path with a forecasted revenue growth of 9.7% annually, outpacing the French market's average of 5.6%. This growth trajectory is bolstered by an anticipated surge in earnings, expected to climb by 101.4% per year. Significantly, OVH has maintained a positive free cash flow status and is on track to achieve profitability within three years—a notable feat given the current economic pressures on tech startups. The company's commitment to innovation is evident from its R&D spending trends which are critical in sustaining long-term competitiveness in the high-stakes cloud services sector.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is a global entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa and has a market cap of approximately €10.35 billion.

Operations: The company's primary revenue streams include Canal+ Group (€6.20 billion) and Havas Group (€2.92 billion), with additional contributions from Gameloft, Prisma Media, New Initiatives, and Vivendi Village. The business model is diversified across various segments in the entertainment and media industry.

Vivendi SE, amidst a dynamic media landscape, has demonstrated robust financial health with its first-half sales doubling to €9.05 billion from €4.7 billion the previous year, though net income slightly dipped to €159 million. This growth is underpinned by a significant R&D commitment, crucial for maintaining its competitive edge in content and media services. Impressively, the company's revenue and earnings are projected to grow at 9.4% and 30.6% annually, respectively—outperforming the broader French market trends. Additionally, Vivendi has actively repurchased shares worth €184 million this year, reinforcing its confidence in ongoing business strategies and future prospects.

- Delve into the full analysis health report here for a deeper understanding of Vivendi.

Gain insights into Vivendi's historical performance by reviewing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 37 Euronext Paris High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal