Top Dividend Stocks On SIX Swiss Exchange For October 2024

The Swiss market experienced a modest decline recently as investors processed regional economic data and anticipated the European Central Bank's upcoming monetary policy announcement. In this fluctuating environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking reliable returns amidst market uncertainty.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 4.99% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.74% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.73% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.43% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.91% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.83% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.72% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.41% | ★★★★★☆ |

Let's dive into some prime choices out of the screener.

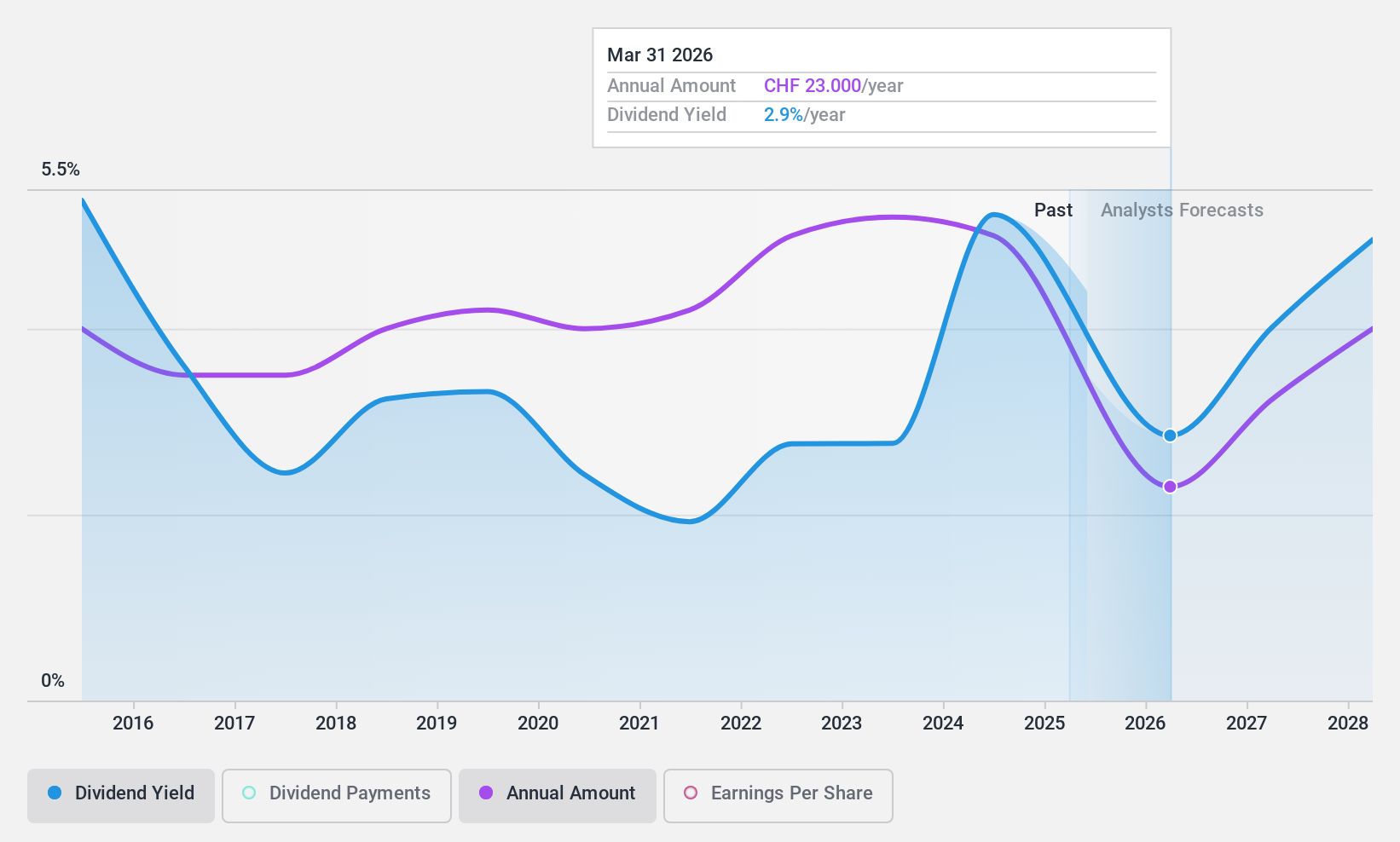

LEM Holding (SWX:LEHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market cap of CHF1.41 billion.

Operations: LEM Holding SA generates its revenue by providing electrical measurement solutions across diverse regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Dividend Yield: 4%

LEM Holding's dividend payments have shown reliability and growth over the past decade, although current coverage by earnings and cash flows is inadequate with a high cash payout ratio of 125.8%. Despite a stable dividend history, the recent drop in net income to CHF 4.78 million from CHF 20.54 million raises concerns about sustainability. Trading at 10.3% below fair value estimates offers potential upside, but high debt levels and share price volatility add risk factors for investors seeking stability in Swiss dividend stocks.

- Click here to discover the nuances of LEM Holding with our detailed analytical dividend report.

- According our valuation report, there's an indication that LEM Holding's share price might be on the cheaper side.

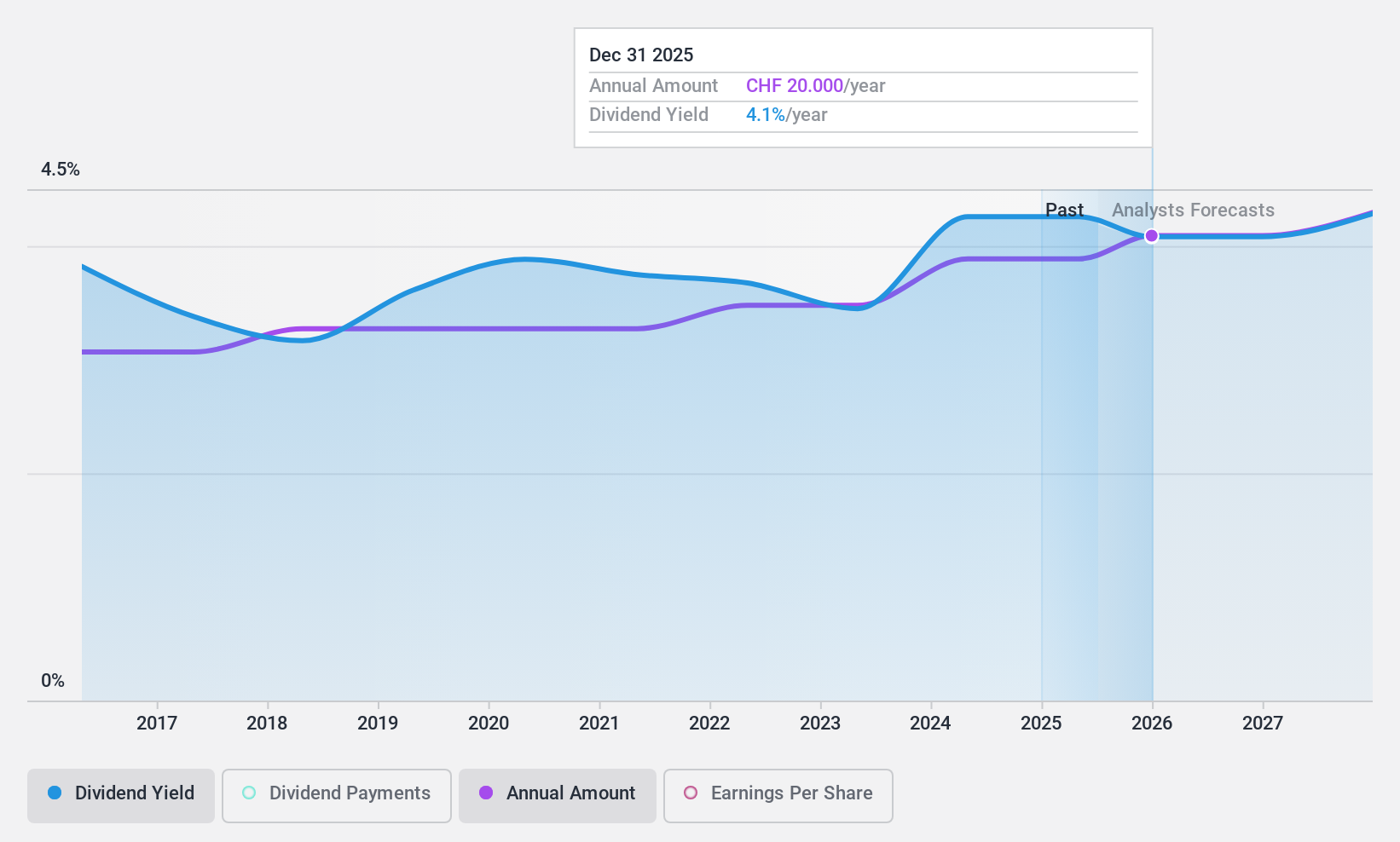

St. Galler Kantonalbank (SWX:SGKN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG is a cantonal bank offering banking products and services to the local population and small to medium-sized enterprises in the Cantons of St., with a market cap of CHF2.51 billion.

Operations: St. Galler Kantonalbank AG generates revenue through its banking products and services tailored for residents and SMEs in the Cantons of St., contributing to its market presence.

Dividend Yield: 4.5%

St. Galler Kantonalbank has maintained reliable and growing dividend payments over the past decade, with a current yield of 4.49%, placing it in the top quartile among Swiss dividend payers. The bank's dividends are well-covered by earnings, with a payout ratio of 57.1% and forecasted to remain sustainable at 52.1%. Despite a decline in net interest income and net income for H1 2024, its valuation remains attractive, trading significantly below estimated fair value.

- Take a closer look at St. Galler Kantonalbank's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of St. Galler Kantonalbank shares in the market.

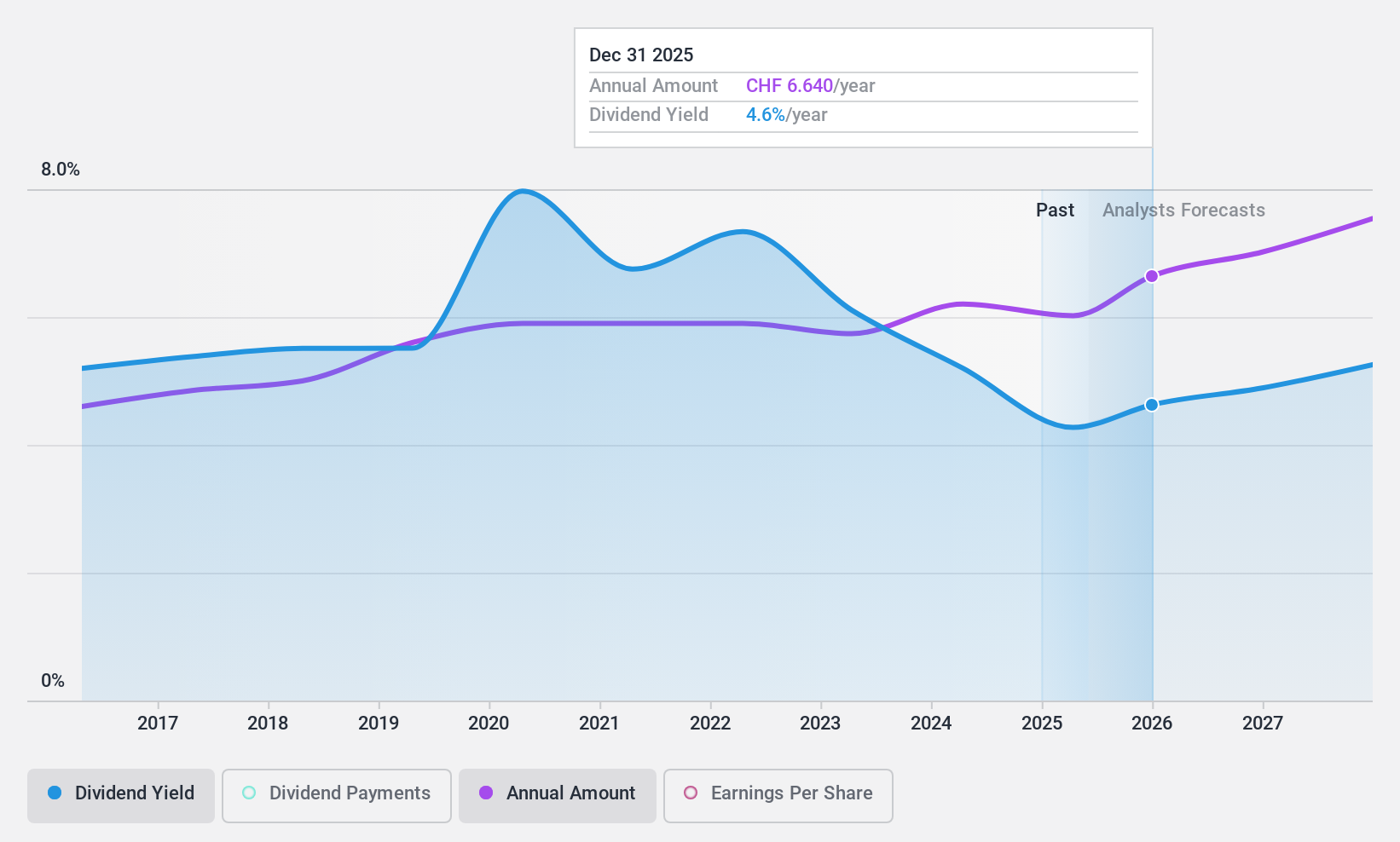

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, along with its subsidiaries, offers wholesale reinsurance, insurance, and other risk transfer services globally, with a market cap of CHF34.31 billion.

Operations: Swiss Re AG generates revenue through its primary segments, which include Property & Casualty Reinsurance at $25.39 billion, Life & Health Reinsurance at $18.71 billion, and Corporate Solutions at $6.10 billion.

Dividend Yield: 5%

Swiss Re's dividend yield of 5% ranks in the top quartile among Swiss stocks, supported by a payout ratio of 55.8%, indicating coverage by earnings and cash flows. Despite recent earnings growth, the dividend history has been volatile over the past decade, raising concerns about reliability. The stock trades at a significant discount to estimated fair value, suggesting potential value for investors despite its unstable dividend track record.

- Unlock comprehensive insights into our analysis of Swiss Re stock in this dividend report.

- Upon reviewing our latest valuation report, Swiss Re's share price might be too pessimistic.

Turning Ideas Into Actions

- Dive into all 26 of the Top SIX Swiss Exchange Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal