3 German Stocks That May Be Undervalued In October 2024

As the German economy faces a projected contraction for the second consecutive year, with factory orders sharply declining, investors are increasingly looking for opportunities within a challenging landscape. Despite these economic headwinds, certain stocks may be undervalued, offering potential opportunities for those who can identify companies with strong fundamentals and resilience in turbulent times.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.75 | €30.89 | 45.8% |

| init innovation in traffic systems (XTRA:IXX) | €36.70 | €52.19 | 29.7% |

| 2G Energy (XTRA:2GB) | €23.40 | €41.15 | 43.1% |

| Formycon (XTRA:FYB) | €52.40 | €81.78 | 35.9% |

| CeoTronics (DB:CEK) | €5.30 | €9.99 | 47% |

| Schweizer Electronic (XTRA:SCE) | €3.80 | €7.19 | 47.2% |

| OTRS (DB:TR9) | €10.40 | €17.07 | 39.1% |

| Your Family Entertainment (DB:RTV) | €2.42 | €4.33 | 44.1% |

| MTU Aero Engines (XTRA:MTX) | €303.90 | €560.69 | 45.8% |

| Basler (XTRA:BSL) | €8.63 | €12.60 | 31.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

adidas (XTRA:ADS)

Overview: adidas AG, along with its subsidiaries, designs, develops, produces, and markets athletic and sports lifestyle products across various global regions including Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America; it has a market cap of approximately €42.80 billion.

Operations: The company's revenue segments include Greater China with €3.26 billion, Latin America at €2.39 billion, and North America contributing €5.07 billion.

Estimated Discount To Fair Value: 10.7%

adidas AG appears undervalued, trading at €239.7, below its estimated fair value of €268.48. Recent earnings reports show strong growth with net income reaching €360 million for the first half of 2024, a significant increase from the previous year. Despite currency challenges affecting profitability, adidas has raised its full-year guidance and expects an operating profit around €1 billion. Earnings are forecast to grow significantly over the next three years, outpacing market averages.

- In light of our recent growth report, it seems possible that adidas' financial performance will exceed current levels.

- Dive into the specifics of adidas here with our thorough financial health report.

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG develops, manufactures, markets, and maintains commercial and military aircraft engines as well as aero-derivative industrial gas turbines globally, with a market cap of approximately €16.36 billion.

Operations: The company's revenue segments include €4.45 billion from the Commercial Maintenance Business (MRO) and €1.32 billion from the Commercial and Military Engine Business (OEM).

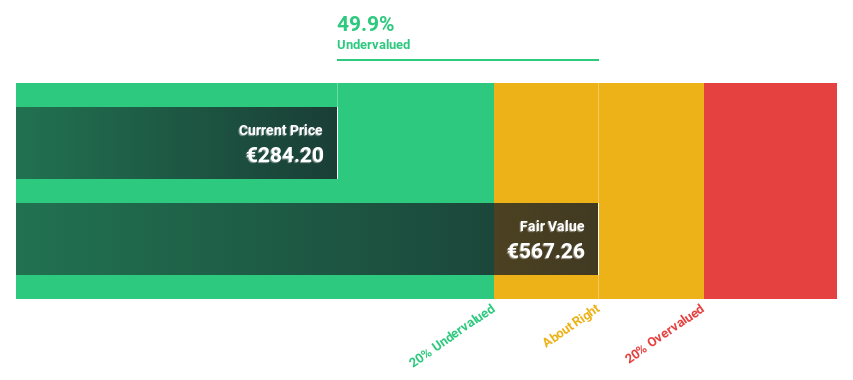

Estimated Discount To Fair Value: 45.8%

MTU Aero Engines is trading at €303.9, significantly below its estimated fair value of €560.69, indicating potential undervaluation based on cash flows. The company reported half-year sales of €3.39 billion and net income of €285 million, both up from the previous year. Recent fixed-income offerings raised approximately €745.88 million, enhancing financial flexibility as MTU's earnings are forecast to grow 34.86% annually with expected profitability within three years, surpassing market averages.

- Upon reviewing our latest growth report, MTU Aero Engines' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of MTU Aero Engines stock in this financial health report.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market capitalization of approximately €244.07 billion.

Operations: The company's revenue primarily comes from its Applications, Technology & Services segment, which generated €32.54 billion.

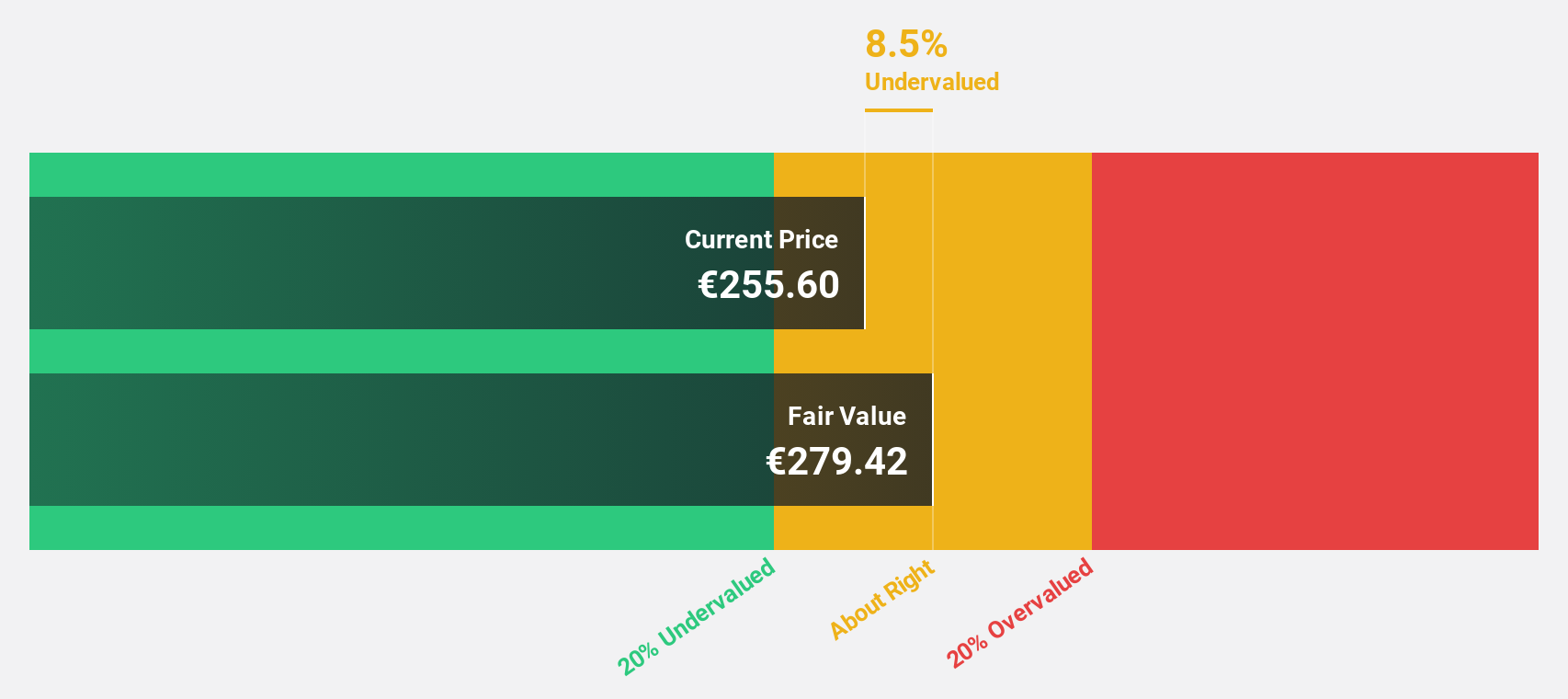

Estimated Discount To Fair Value: 23.7%

SAP is trading at €209.8, over 23% below its estimated fair value of €275.01, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 37.9% annually, outpacing the German market average of 20%. While revenue growth is expected to be moderate at 9.5% per year, it still surpasses the broader market's rate of 5.5%. Recent AI innovations and strategic partnerships enhance SAP's business transformation capabilities and operational efficiency.

- Our earnings growth report unveils the potential for significant increases in SAP's future results.

- Delve into the full analysis health report here for a deeper understanding of SAP.

Summing It All Up

- Investigate our full lineup of 21 Undervalued German Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal