Concentric And 2 Other Stocks That May Be Trading Below Their Estimated Worth On The Swedish Exchange

As the European markets experience a cautious optimism with the pan-European STOXX Europe 600 Index edging higher, investors are keenly observing opportunities amid shifting economic policies and forecasts. In Sweden, this environment presents a potential for identifying stocks that may be undervalued, offering intriguing prospects for those looking to capitalize on discrepancies between market price and estimated worth. Identifying such stocks often involves assessing fundamental factors like earnings potential and market position, especially in light of recent economic developments that could influence valuations.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK45.44 | SEK88.97 | 48.9% |

| Concentric (OM:COIC) | SEK217.00 | SEK404.87 | 46.4% |

| Biotage (OM:BIOT) | SEK183.40 | SEK364.80 | 49.7% |

| Lindab International (OM:LIAB) | SEK276.60 | SEK527.57 | 47.6% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK86.76 | SEK168.39 | 48.5% |

| Wall to Wall Group (OM:WTW A) | SEK55.40 | SEK105.54 | 47.5% |

| Securitas (OM:SECU B) | SEK129.95 | SEK258.69 | 49.8% |

| Nexam Chemical Holding (OM:NEXAM) | SEK4.00 | SEK7.91 | 49.4% |

| MilDef Group (OM:MILDEF) | SEK92.40 | SEK181.85 | 49.2% |

| BHG Group (OM:BHG) | SEK14.14 | SEK26.55 | 46.7% |

Let's explore several standout options from the results in the screener.

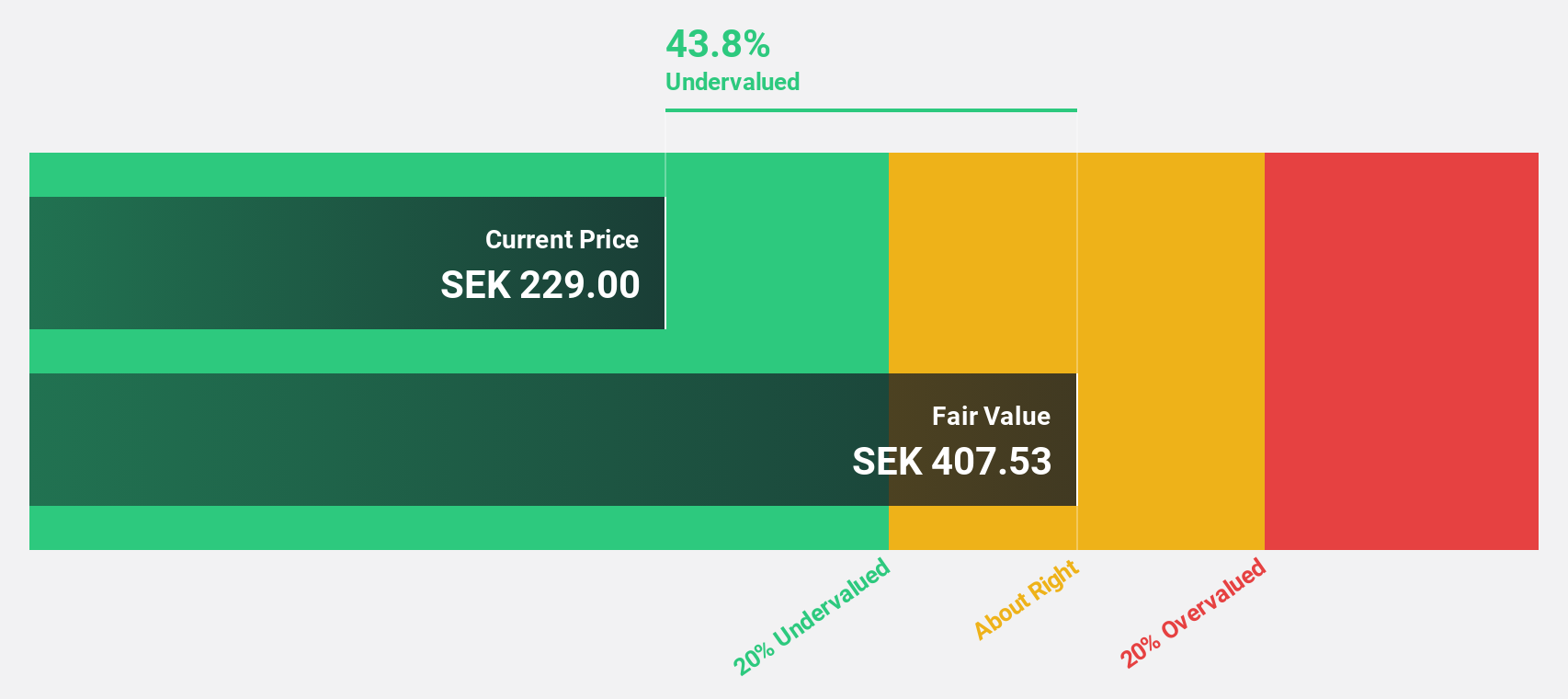

Concentric (OM:COIC)

Overview: Concentric AB (publ) designs, develops, manufactures, and distributes hydraulic and engine solutions in Sweden and internationally, with a market cap of SEK8.06 billion.

Operations: The company's revenue is primarily generated from its Engines segment, contributing SEK2.71 billion, and its Hydraulics segment, adding SEK1.25 billion.

Estimated Discount To Fair Value: 46.4%

Concentric is trading at SEK 217, significantly below its estimated fair value of SEK 404.87, indicating potential undervaluation based on cash flows. Despite a volatile share price and declining profit margins, earnings are forecast to grow annually by 24.4%, surpassing the Swedish market average. Recent M&A activity with A.P. Møller Holding A/S proposing a SEK 8.59 billion acquisition may influence future valuations and strategic direction amidst leadership changes in the Hydraulics division.

- The growth report we've compiled suggests that Concentric's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Concentric.

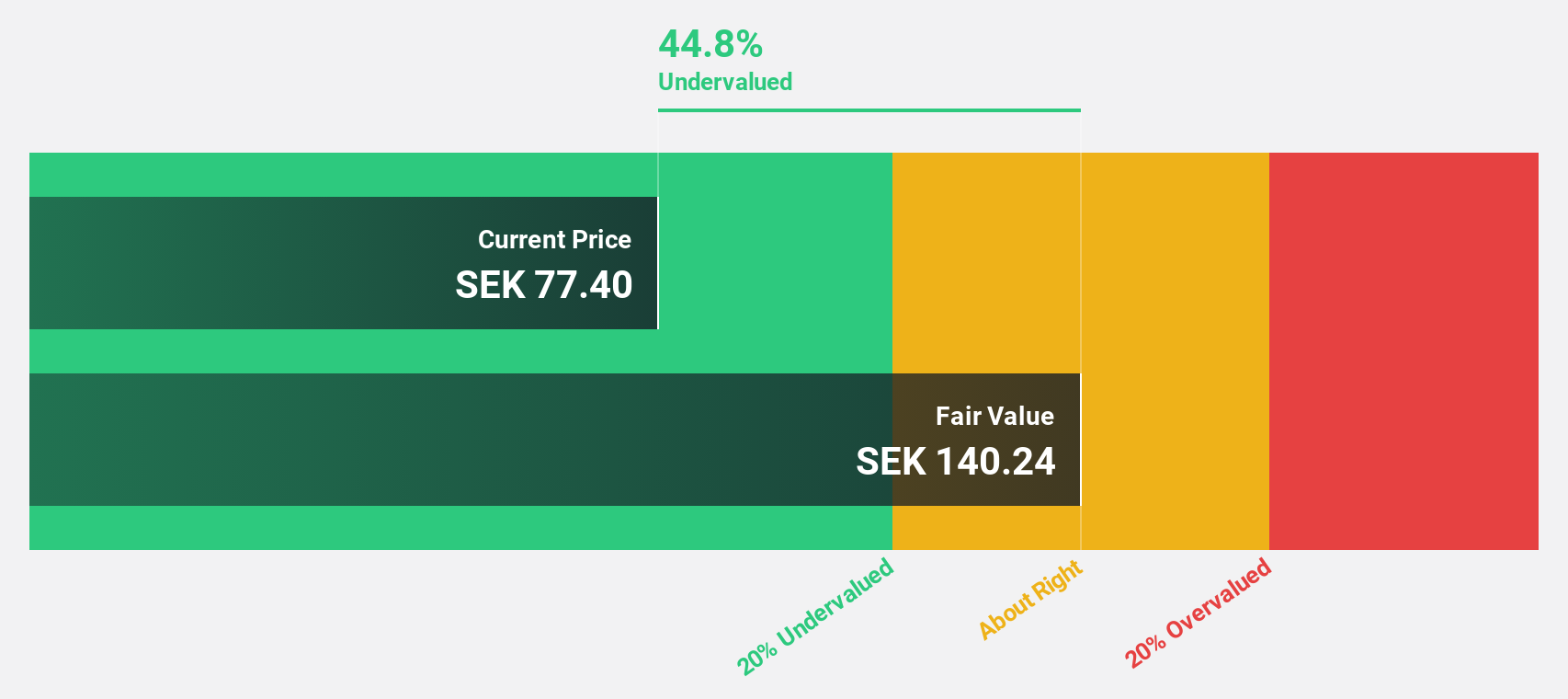

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions, including North America, Europe, and Asia, with a market cap of approximately SEK289.21 billion.

Operations: Telefonaktiebolaget LM Ericsson's revenue segments include mobile connectivity solutions for telecom operators and enterprise customers across various global regions.

Estimated Discount To Fair Value: 48.5%

Telefonaktiebolaget LM Ericsson is trading at SEK 86.76, well below its estimated fair value of SEK 168.39, suggesting it may be undervalued based on cash flows. Despite a recent decline in sales and net income improvement from a significant loss to a profit in Q3 2024, earnings are forecast to grow substantially by 83.65% annually. Strategic partnerships and deployments in Vietnam and the U.S. further bolster its growth prospects amidst ongoing financial challenges with dividend coverage.

- Insights from our recent growth report point to a promising forecast for Telefonaktiebolaget LM Ericsson's business outlook.

- Navigate through the intricacies of Telefonaktiebolaget LM Ericsson with our comprehensive financial health report here.

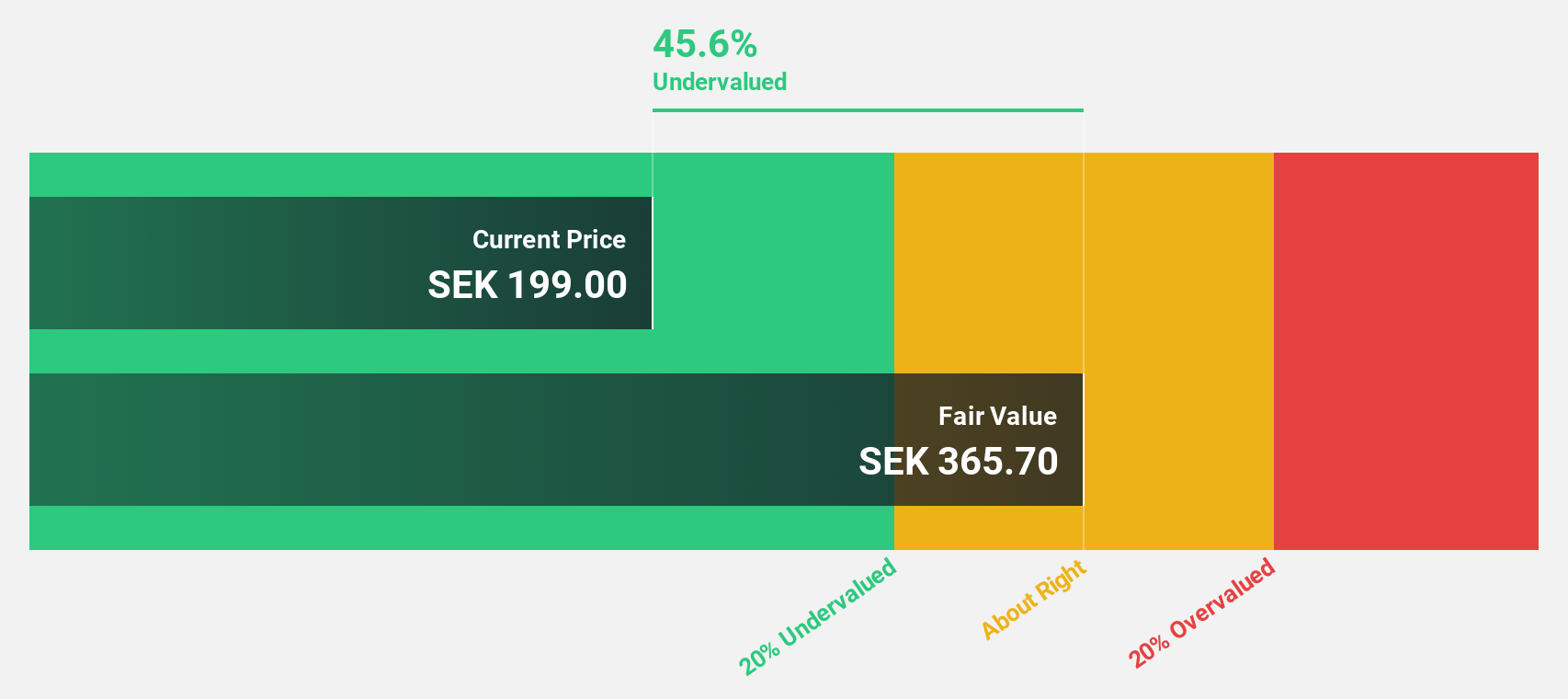

Lindab International (OM:LIAB)

Overview: Lindab International AB (publ) manufactures and sells ventilation system products and solutions in Europe, with a market cap of SEK21.26 billion.

Operations: Lindab International AB generates revenue from two main segments: Ventilation Systems, contributing SEK9.95 billion, and Profile Systems, contributing SEK3.28 billion.

Estimated Discount To Fair Value: 47.6%

Lindab International is trading at SEK 276.6, significantly below its estimated fair value of SEK 527.57, highlighting potential undervaluation based on cash flows. Despite a recent dip in net income for Q2 2024 to SEK 213 million from SEK 240 million the previous year, earnings are projected to grow substantially by 25.9% annually over the next three years. The company also maintains a reliable dividend yield of 1.95%.

- In light of our recent growth report, it seems possible that Lindab International's financial performance will exceed current levels.

- Click here to discover the nuances of Lindab International with our detailed financial health report.

Next Steps

- Unlock our comprehensive list of 47 Undervalued Swedish Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal