The soaring US stocks may stage a “empty-handed surge”, and Wall Street frantically raised expectations

As the US stock market experienced its strongest rebound in nearly 30 years, surpassed previously set targets and reached a record high, Wall Street strategists are scrambling to improve their predictions for the US stock market.

Over the past month, analysts in investment banks such as Bank of Montreal Capital Markets (BMO Capital Markets), Goldman Sachs, and UBS raised their year-end expectations for the S&P 500 index. It is expected that the index will continue its cumulative increase of 22% in 2024. Since 1997, the S&P 500 has never seen such a large annual increase.

These trends reflect the remarkable resilience of the economy and corporate profits this year, as investors continue to pour into tech stocks that are expected to benefit from AI breakthroughs, so gains have exceeded expectations.

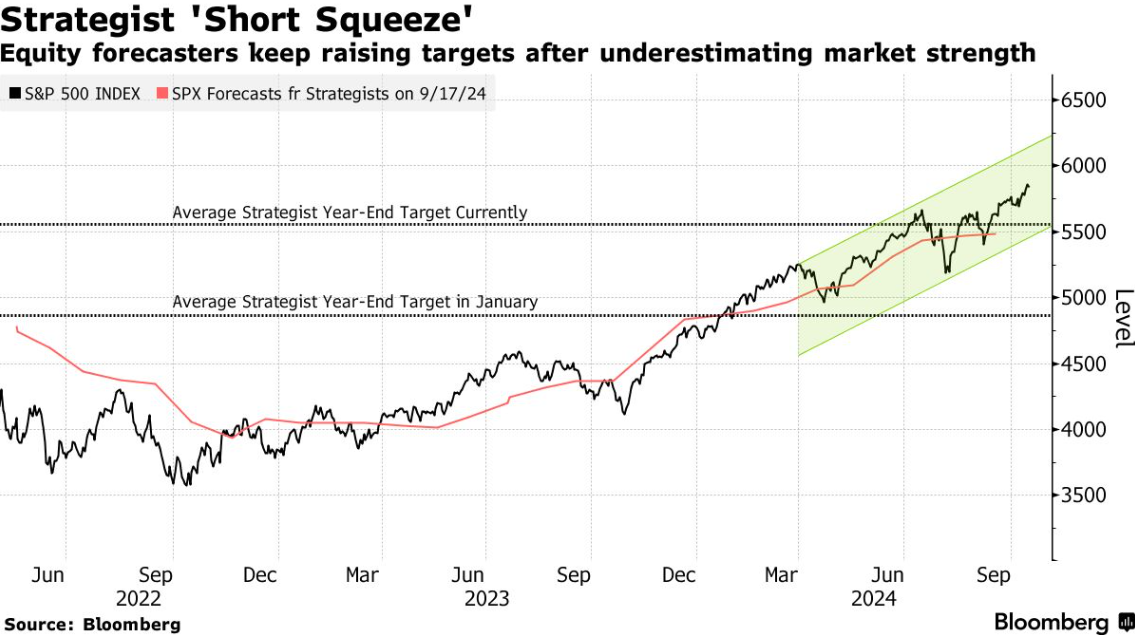

The sharp rise in stock prices is prompting Wall Street forecasters to scramble to raise their outlook for the final phase of 2024 — this is the so-called “strategist short squeeze,” similar to a rapid rise in stock prices forcing traders to make up for bearish positions. Reminiscent of last year, when the S&P 500 surged by 24%, they were caught off guard.

As the S&P 500 surpassed 5,800 points, UBS Group's Jonathan Golub (Jonathan Golub) and Patrick Palfrey (Patrick Palfrey) recently raised their year-end expectations for the index on Tuesday. They raised the forecast value from 5,600 points to 5,850 points, and raised the 2025 forecast from 6,000 points to 6,400 points. Although their expectations for 2024 mean that the stock index will not rise further, they believe the index will rise another 9% over the next 15 months. This is the fourth time since UBS strategists released their annual outlook at the end of last year.

Earlier this month, Goldman Sachs chief stock strategist David Kostin (David Kostin) raised his expectations for the S&P index to 6000 points in December. This is also his fourth increase since the last few months of 2023, and its price target ranks second among forecasters tracked by Bloomberg.

Bank of Montreal's Brian Belski (Brian Belski) said in September that the S&P index could soar to 6,100 points before the end of this year, and is currently the most optimistic predictor of the S&P index.

While raising the forecast, Belsky told customers, “We are still surprised by the strong market gains and have decided once again that in addition to gradual adjustments, more adjustments are needed.”

Despite the risks of a constantly bubbling market: next month's tense US presidential election, the Middle East war, and uncertainty about the trajectory of the Federal Reserve's easing policy after last month's job market and inflation data surpassed expectations, they remained optimistic.

Golub wrote on Tuesday: “Fiscal and monetary policy uncertainties, as well as potential election results, make the return in 2025 far uncertain.”

But that doesn't prevent him from betting that the stock market will continue to strengthen. He pointed out that as inflation slows, the Federal Reserve cuts interest rates, low-end consumption and business activities improve, and widespread profit growth, market risks are biased upward.

Confidence that the stock market can overcome looming uncertainty comes from the accumulation of experience. Many strategists have underestimated the rise in US stocks time and time again. In January of this year, the average forecast value for the S&P 500 index at the end of the year was 4,867 points, about 17% lower than the index's trading level on Tuesday. The forecast value for early 2023 is 4,050 points, which is 15% lower than the S&P 500 index's level at the end of the year.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal