Discover 3 SEHK Growth Companies With High Insider Ownership

As global markets navigate a complex landscape marked by economic uncertainties and shifting investor sentiment, the Hong Kong market has experienced its share of volatility, with the Hang Seng Index recently facing significant declines. Despite these challenges, growth companies with high insider ownership continue to capture investor interest due to their potential for resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Akeso (SEHK:9926) | 20.5% | 53% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.4% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

| MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

Let's review some notable picks from our screened stocks.

Beauty Farm Medical and Health Industry (SEHK:2373)

Simply Wall St Growth Rating: ★★★★★☆

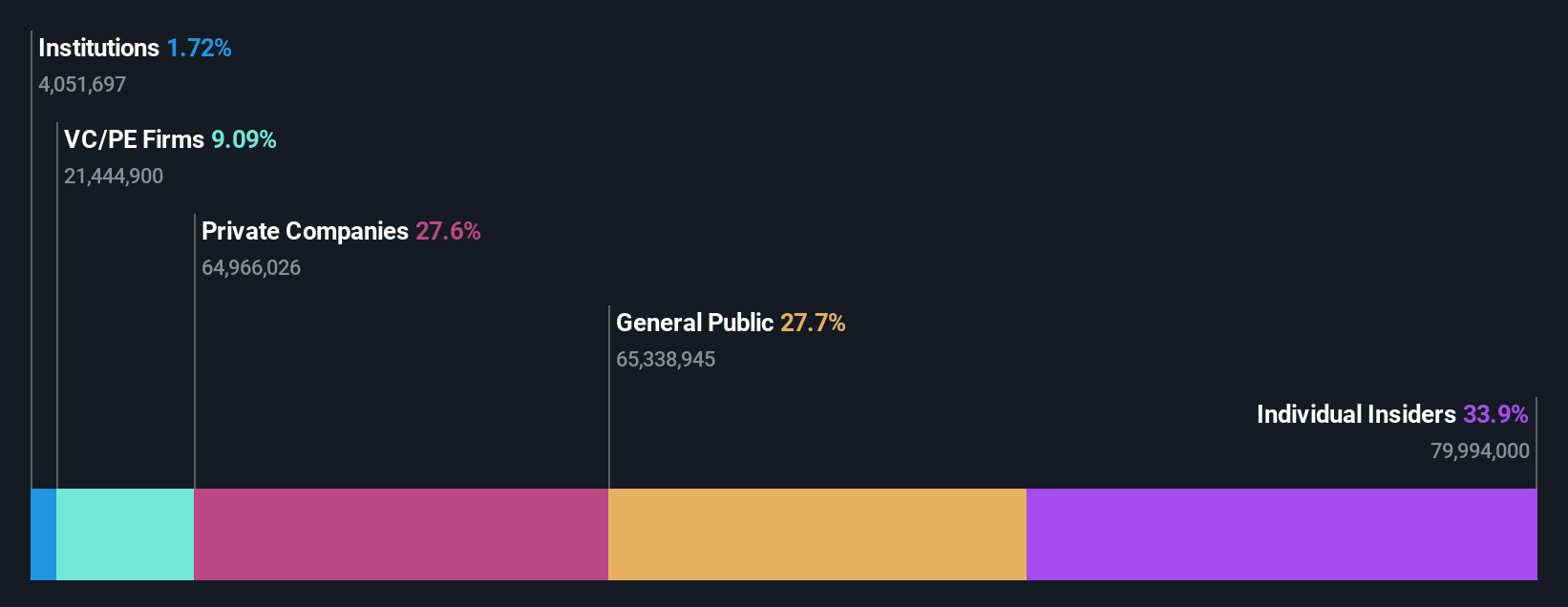

Overview: Beauty Farm Medical and Health Industry Inc. operates in the healthcare sector, focusing on medical and health services, with a market cap of HK$4.02 billion.

Operations: The company's revenue is derived from several key segments: Aesthetic Medical Services (CN¥851.81 million), Subhealth Medical Services (CN¥125.69 million), Beauty and Wellness Services - Direct Stores (CN¥1.14 billion), and Beauty and Wellness Services - Franchisee and Others (CN¥131.48 million).

Insider Ownership: 33.9%

Earnings Growth Forecast: 20.2% p.a.

Beauty Farm Medical and Health Industry shows strong growth potential with forecasted earnings growth of 20.2% annually, outpacing the Hong Kong market. Recent half-year results reported sales of CNY 1.14 billion, a year-over-year increase, indicating solid revenue momentum. Despite no significant insider trading activity recently, high insider ownership aligns management interests with shareholders. The company trades significantly below estimated fair value, suggesting potential undervaluation amid expected robust profit expansion over the next three years.

- Unlock comprehensive insights into our analysis of Beauty Farm Medical and Health Industry stock in this growth report.

- The valuation report we've compiled suggests that Beauty Farm Medical and Health Industry's current price could be inflated.

Jiangxi Rimag Group (SEHK:2522)

Simply Wall St Growth Rating: ★★★★★☆

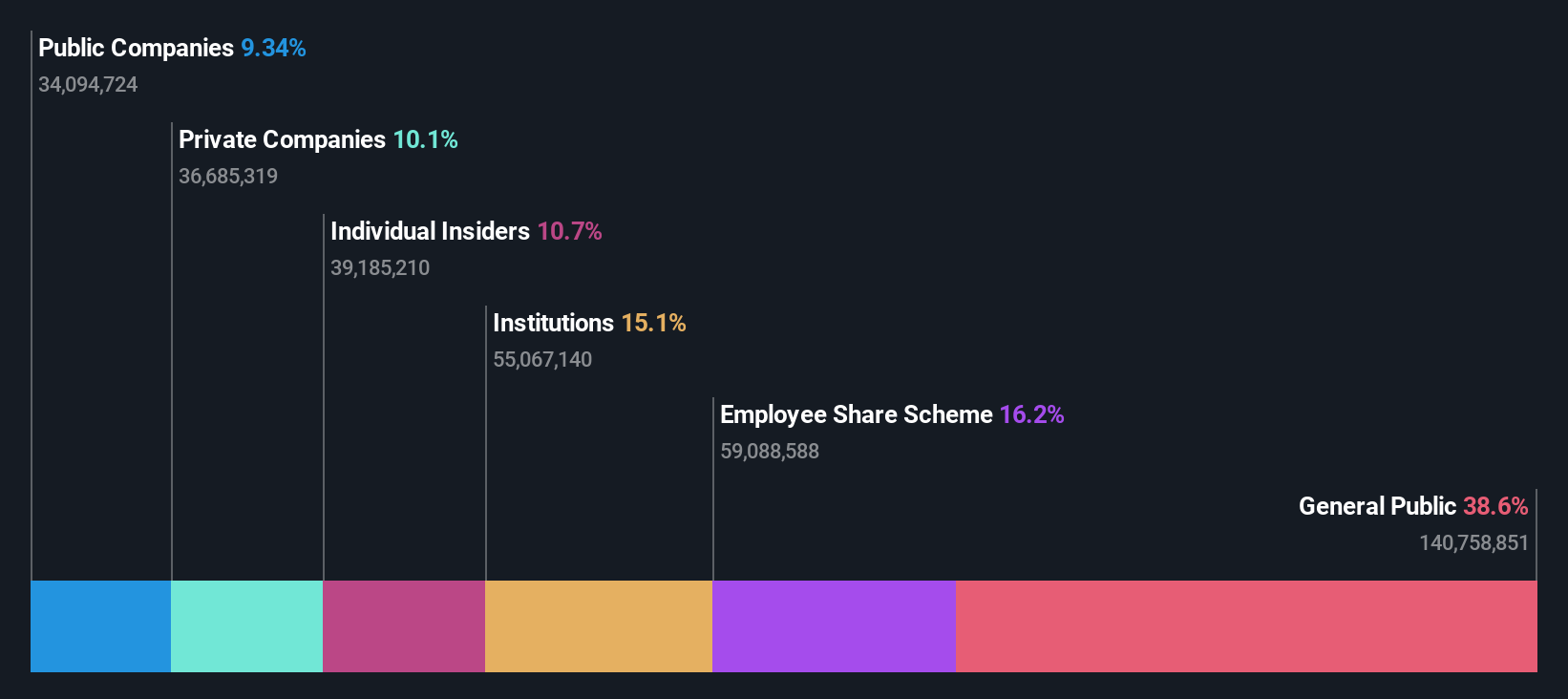

Overview: Jiangxi Rimag Group Co., Ltd. operates medical imaging centers in China with a market cap of HK$10.87 billion.

Operations: The company generates revenue of CN¥812.85 million from its medical labs and research segment.

Insider Ownership: 24.3%

Earnings Growth Forecast: 71.8% p.a.

Jiangxi Rimag Group shows promising growth potential with forecasted earnings growth of 71.8% annually, significantly outpacing the Hong Kong market. Despite a decline in recent half-year sales to CNY 413.71 million and net income to CNY 3.84 million, revenue is expected to grow at an impressive rate of 30% per year. High insider ownership may align management interests with shareholders, although no substantial insider trading activity has been noted recently.

- Navigate through the intricacies of Jiangxi Rimag Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Jiangxi Rimag Group shares in the market.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

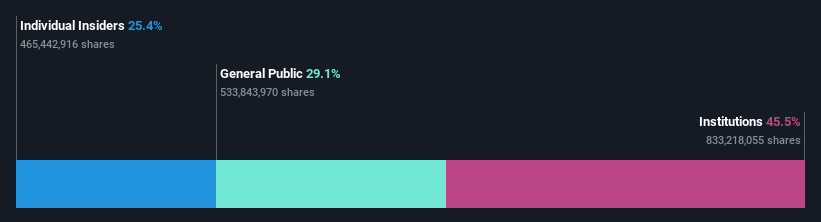

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of approximately HK$207.81 billion.

Operations: The company's revenue is primarily derived from its Power Equipment segment at $13.23 billion and its Floorcare & Cleaning segment at $965.09 million.

Insider Ownership: 25.4%

Earnings Growth Forecast: 15.3% p.a.

Techtronic Industries, with strong insider ownership, has shown consistent earnings growth of 7.8% over the past year and is forecasted to grow at 15.3% annually, surpassing the Hong Kong market's average. Recent board appointments could enhance strategic direction given their extensive industry experience. The company's revenue is expected to increase by 8.5% per year, slightly above market expectations, while trading below estimated fair value suggests potential investment appeal despite moderate profit growth projections.

- Delve into the full analysis future growth report here for a deeper understanding of Techtronic Industries.

- The analysis detailed in our Techtronic Industries valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Access the full spectrum of 47 Fast Growing SEHK Companies With High Insider Ownership by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal