3 Undervalued Small Caps In Australia With Insider Buying Activity

In the last week, the Australian market has been flat, yet it has experienced a robust 17% increase over the past year with earnings projected to grow by 12% annually. In such a dynamic environment, identifying small-cap stocks with insider buying activity can be an intriguing strategy for investors seeking potential opportunities in undervalued segments of the market.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 8.1x | 5.1x | 33.29% | ★★★★★☆ |

| GWA Group | 17.0x | 1.6x | 39.93% | ★★★★★☆ |

| SHAPE Australia | 14.5x | 0.3x | 33.07% | ★★★★☆☆ |

| Collins Foods | 18.6x | 0.7x | 5.51% | ★★★★☆☆ |

| Eagers Automotive | 11.2x | 0.3x | 36.22% | ★★★★☆☆ |

| Aurelia Metals | NA | 1.1x | 49.08% | ★★★★☆☆ |

| Fiducian Group | 18.2x | 3.4x | 6.52% | ★★★☆☆☆ |

| Mader Group | 23.0x | 1.5x | 44.93% | ★★★☆☆☆ |

| Dicker Data | 21.4x | 0.8x | -75.75% | ★★★☆☆☆ |

| Abacus Storage King | 12.3x | 7.7x | -31.02% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

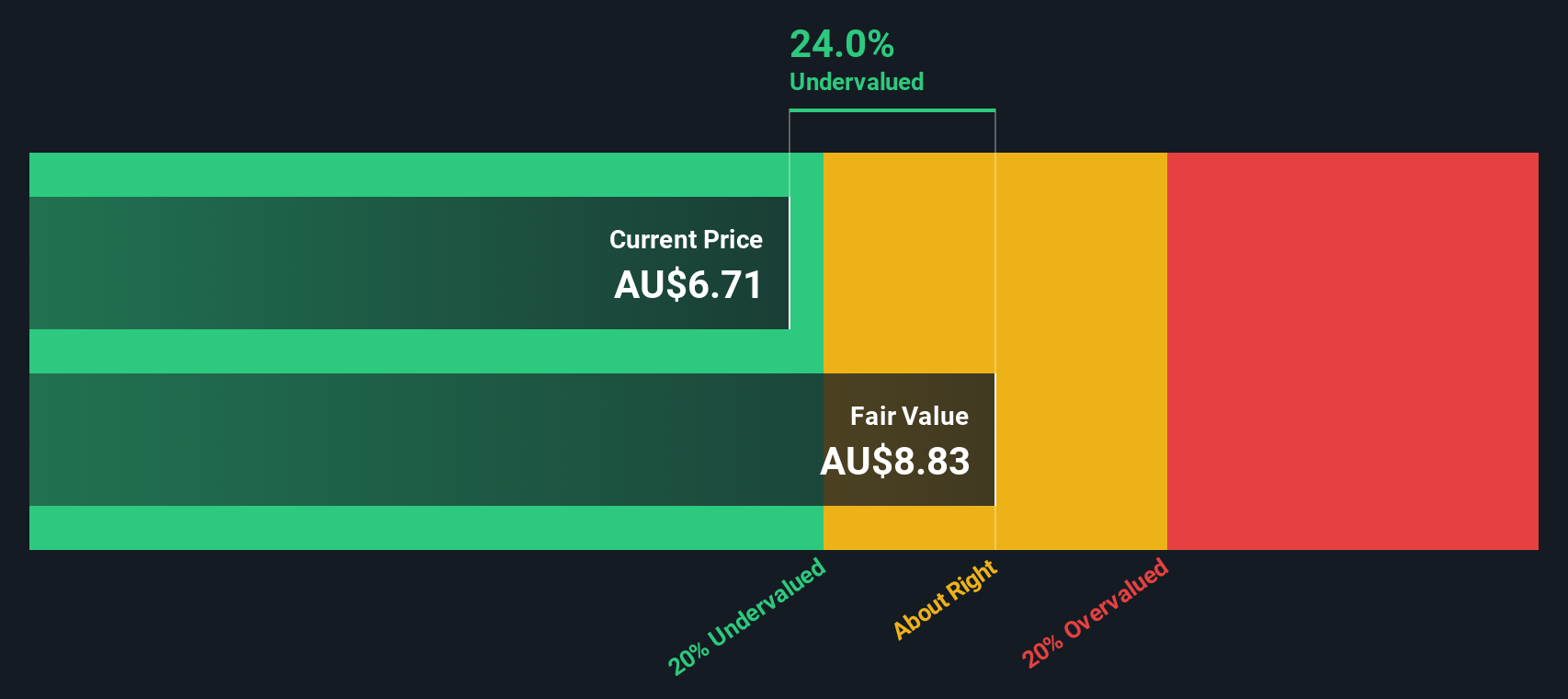

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mader Group is a company specializing in staffing and outsourcing services, with operations centered around providing skilled labor solutions, and it has a market capitalization of A$1.08 billion.

Operations: Mader Group's revenue primarily stems from its staffing and outsourcing services, with a recent figure of A$774.47 million. The company's cost structure includes significant components such as COGS at A$612.49 million and operating expenses at A$89.97 million for the latest period. Notably, the gross profit margin has shown an upward trend, reaching 22.92% as of June 2024, indicating improved efficiency in managing production costs relative to sales growth over time.

PE: 23.0x

Mader Group, a dynamic player in Australia's market, has shown insider confidence with recent share purchases. They reported A$774 million in sales for fiscal 2024, up from A$609 million the previous year. Forecasts suggest revenue growth to at least A$870 million for fiscal 2025, alongside a net profit after tax of A$57 million. With its addition to the S&P Global BMI Index and increased dividends by 34%, Mader is positioning itself for continued growth despite relying solely on external borrowing.

- Delve into the full analysis valuation report here for a deeper understanding of Mader Group.

Gain insights into Mader Group's historical performance by reviewing our past performance report.

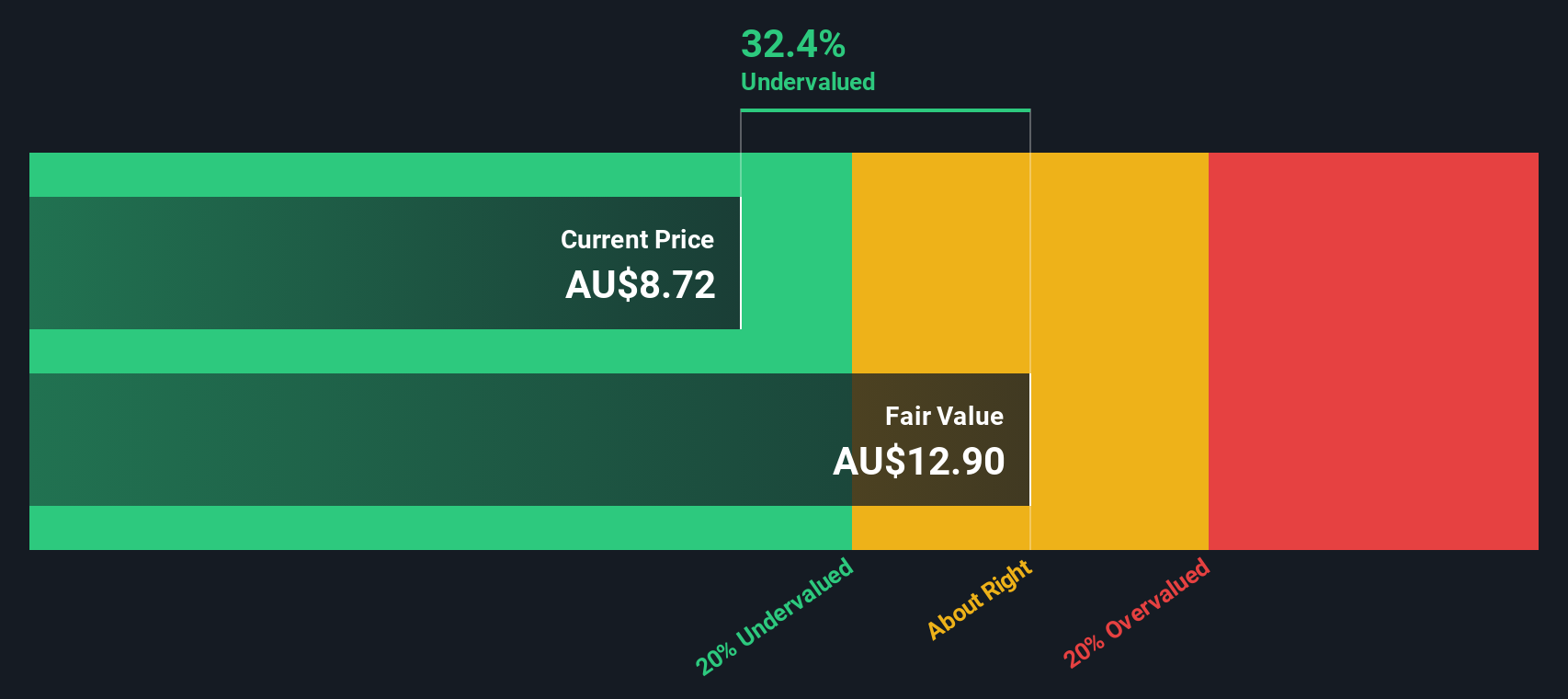

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management company specializing in global equities and infrastructure, with a market capitalization of A$4.98 billion.

Operations: Magellan Financial Group generates revenue primarily through Investment Management Services, with additional contributions from Fund and Corporate Investments. The company has shown a gross profit margin trend fluctuating between 72.86% and 90.26% over various periods, reflecting changes in cost management and revenue efficiency.

PE: 8.1x

Magellan Financial Group, a smaller player in Australia's investment landscape, has shown insider confidence with recent share repurchases totaling 4.97 million shares for A$52.47 million since March 2022. Despite a forecasted earnings decline of 9.2% annually over the next three years and reliance on higher-risk external borrowing, Magellan's net income rose to A$238.76 million from A$182.66 million year-on-year, reflecting resilience amidst challenges. With dividends increasing to A$0.357 per share for the six months ending June 2024, investors may find potential value in its current market position as it extends its buyback plan into April 2025.

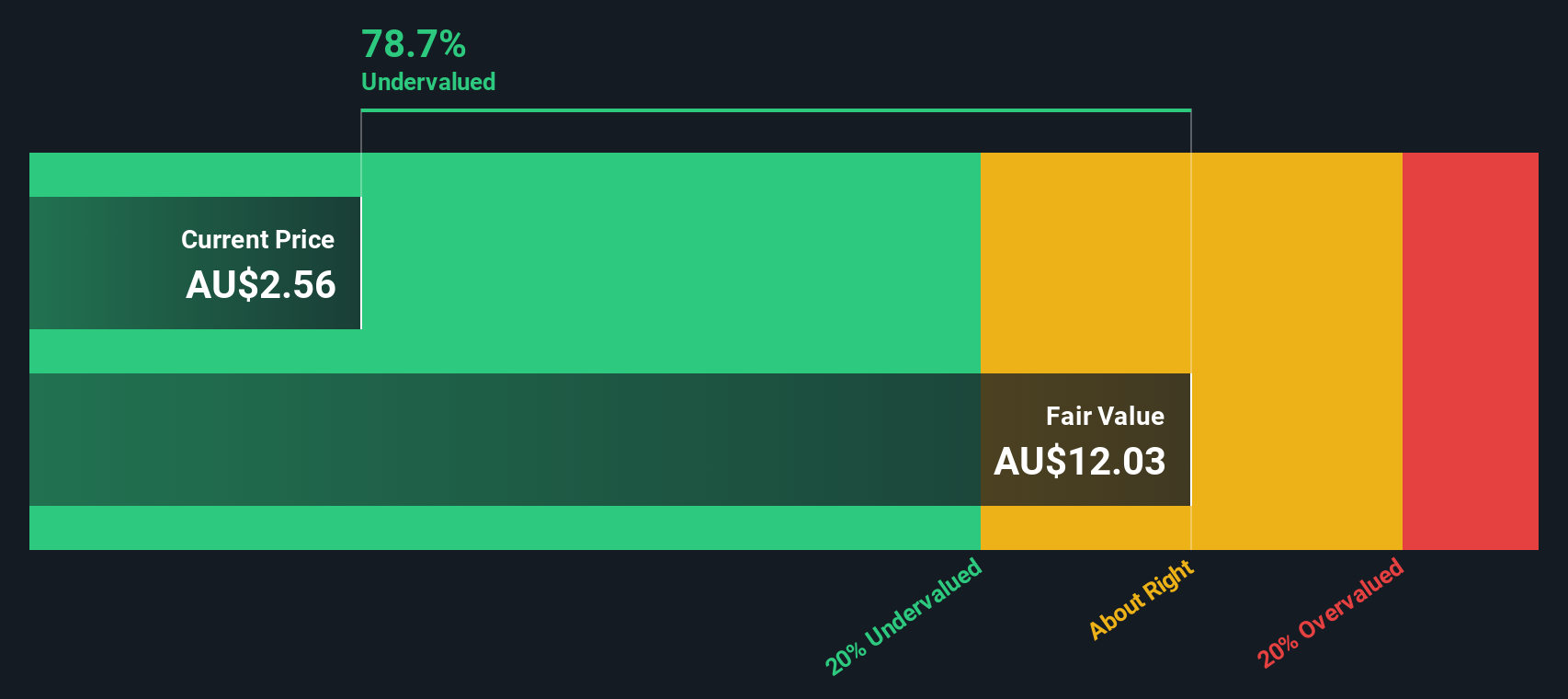

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Westgold Resources is an Australian gold producer with operations primarily in the Bryah and Murchison regions, boasting a market cap of A$1.05 billion.

Operations: Bryah and Murchison contribute to the company's revenue streams, with Murchison being the larger segment. The cost of goods sold (COGS) is a significant expense impacting profitability. Over recent periods, gross profit margin showed fluctuations, reaching 21.91% in June 2024. Operating expenses and non-operating expenses also affect financial outcomes, with notable variations across different periods.

PE: 25.7x

Westgold Resources, an Australian mining company, recently reported a record production of 77,369 ounces of gold in the first quarter of fiscal year 2025. Following its merger with Karora Resources in August 2024, Westgold's production guidance for fiscal year 2025 increased significantly to between 400,000 and 420,000 ounces. The company has also been added to the S&P/ASX 200 Index as of September. With insider confidence shown through share purchases and strategic leadership changes like appointing Aaron Rankine as COO starting January 2025, Westgold is positioning itself for growth amidst its expanding operations at Beta Hunt and Bluebird-South Junction mines.

- Click here and access our complete valuation analysis report to understand the dynamics of Westgold Resources.

Assess Westgold Resources' past performance with our detailed historical performance reports.

Key Takeaways

- Dive into all 24 of the Undervalued ASX Small Caps With Insider Buying we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal