3 Top KRX Dividend Stocks With Up To 9.9% Yield

The South Korean market has remained flat over the last week but is up 3.8% over the past year, with earnings forecasted to grow by 30% annually. In this environment, identifying dividend stocks with strong yields can be a strategic way to capitalize on potential growth while securing regular income.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.62% | ★★★★★★ |

| Hansae (KOSE:A105630) | 3.04% | ★★★★★☆ |

| Kangwon Land (KOSE:A035250) | 5.50% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.46% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.88% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.41% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.88% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.73% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.01% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.52% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top KRX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hyundai Marine & Fire Insurance (KOSE:A001450)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Marine & Fire Insurance Co., Ltd. is a South Korean company providing a range of insurance products and services, with a market cap of ₩2.50 trillion.

Operations: Hyundai Marine & Fire Insurance Co., Ltd. generates revenue primarily from the Financial Industry segment, amounting to ₩1.58 trillion, with an additional contribution from the Non-Financial Industry segment at ₩14.89 billion.

Dividend Yield: 6.5%

Hyundai Marine & Fire Insurance's recent earnings report shows a significant increase in net income, highlighting strong financial performance. Despite its dividend payments being volatile and unreliable over the past five years, the company offers a high dividend yield of 6.47%, placing it among the top 25% in South Korea. The dividends are well-covered by both earnings and cash flows, with low payout ratios of 17.7% and 7.6%, respectively, suggesting sustainability despite historical volatility.

- Take a closer look at Hyundai Marine & Fire Insurance's potential here in our dividend report.

- The analysis detailed in our Hyundai Marine & Fire Insurance valuation report hints at an deflated share price compared to its estimated value.

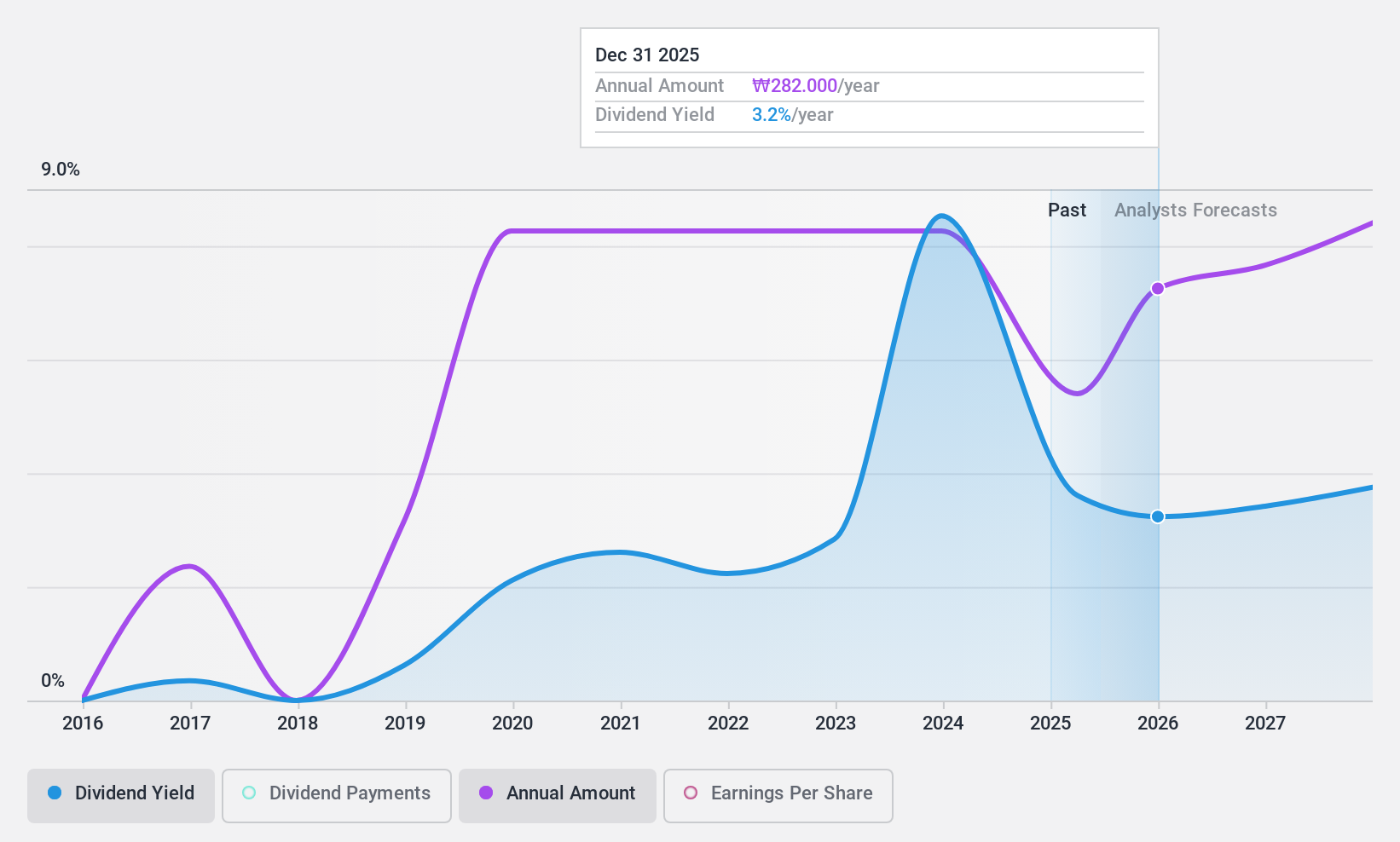

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai G.F. Holdings Co., Ltd. is involved in the rental and investment businesses, with a market cap of ₩712.48 billion.

Operations: Hyundai G.F. Holdings Co., Ltd.'s revenue segments focus on rental and investment activities.

Dividend Yield: 4.4%

Hyundai G.F. Holdings offers a competitive dividend yield of 4.38%, ranking in the top 25% of South Korean dividend payers. Its dividends are well-covered by earnings and cash flows, with low payout ratios of 1.8% and 27.2%, respectively, indicating sustainability despite a history of volatility over its nine-year payment period. The stock trades at a significant discount to estimated fair value, though its non-cash earnings raise concerns about profit quality stability in the long term.

- Delve into the full analysis dividend report here for a deeper understanding of Hyundai G.F. Holdings.

- Our comprehensive valuation report raises the possibility that Hyundai G.F. Holdings is priced lower than what may be justified by its financials.

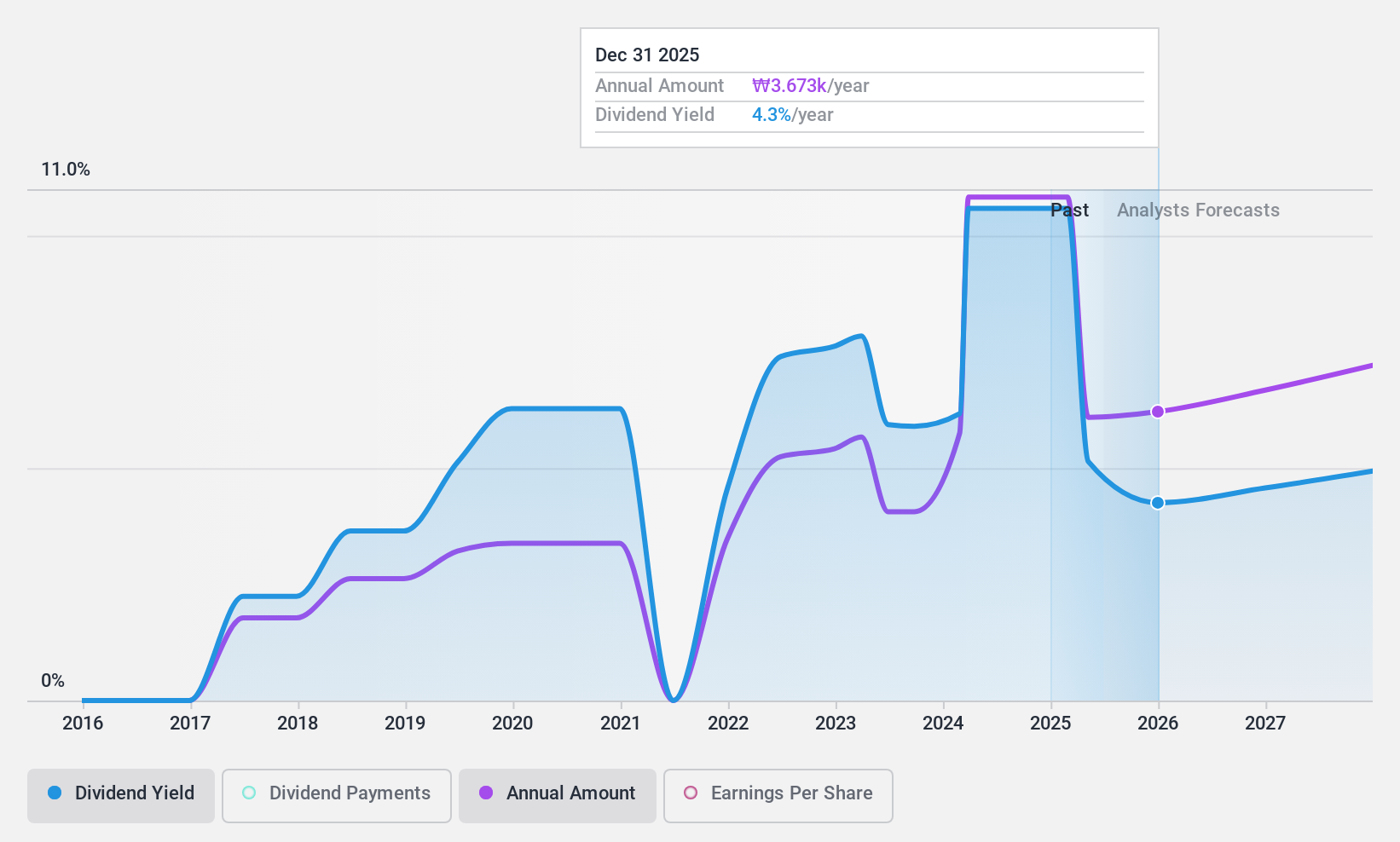

Hana Financial Group (KOSE:A086790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hana Financial Group Inc. operates as a financial services provider in South Korea through its subsidiaries, with a market cap of ₩18.22 trillion.

Operations: Hana Financial Group Inc.'s revenue segments include Banking with ₩8.99 billion, Capital Division at ₩1.06 billion, Securities Sector generating ₩314.33 million, and Credit Card Sector contributing ₩539.94 million.

Dividend Yield: 9.9%

Hana Financial Group offers a high dividend yield of 9.94%, placing it among the top 25% of South Korean dividend payers. Despite its attractive yield, the company has a volatile seven-year dividend history and an unstable track record. However, dividends are well-covered by earnings with a payout ratio of 39.7%, forecasted to improve to 28.4% in three years, suggesting sustainability. The stock trades significantly below estimated fair value, enhancing its appeal for value-focused investors.

- Unlock comprehensive insights into our analysis of Hana Financial Group stock in this dividend report.

- Our valuation report here indicates Hana Financial Group may be undervalued.

Turning Ideas Into Actions

- Explore the 75 names from our Top KRX Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal