Exploring SHIFT And 2 Other High Growth Tech Stocks In Japan

As Japan's stock markets have shown resilience with the Nikkei 225 Index gaining 2.45% recently, driven by yen weakness and a favorable export outlook, attention is turning to high-growth tech stocks that may capitalize on these conditions. In this context, identifying promising stocks involves looking for companies with robust growth potential and adaptability to current economic trends, such as those in Japan's dynamic tech sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.04% | 68.45% | ★★★★★★ |

We'll examine a selection from our screener results.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥275.54 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing and development-related services, with ¥68.64 billion from software testing and ¥33.55 billion from software development services.

SHIFT Inc. is shaping up as a formidable contender in Japan's tech arena, driven by its robust earnings growth and strategic R&D investments. With earnings expected to surge by 32.6% annually, outpacing the broader Japanese market's 8.8%, SHIFT is demonstrating its capability to expand profitably. Moreover, the company’s commitment to innovation is underscored by significant R&D spending, aligning with revenue growth forecasts of 19.7% per year—well above the national average of 4.3%. Recently, SHIFT announced a share repurchase program valued at ¥1 billion, signaling confidence in its future and dedication to shareholder value, set against a backdrop of high-quality earnings and an aggressive growth strategy that slightly lags behind industry peers with last year’s performance increase at 6.2% compared to the industry's 10.1%.

- Click here to discover the nuances of SHIFT with our detailed analytical health report.

Gain insights into SHIFT's historical performance by reviewing our past performance report.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations primarily in Japan with a market cap of ¥342.65 billion.

Operations: The company's revenue primarily stems from its Platform Services Business, generating ¥36.16 billion.

Money Forward, Inc. is navigating Japan's tech landscape with a focus on financial technology solutions, despite facing profitability challenges. The company's aggressive R&D spending aligns with its revenue growth projections of 21% annually, significantly outpacing the broader market's 4.3%. This investment in innovation is crucial as it transitions towards profitability, with earnings expected to grow by an impressive 68.4% per year. Recent strategic moves include forming potential partnerships and business restructures, such as the proposed joint venture with Sumitomo Mitsui Card Company and transferring fintech operations to its subsidiary Money Forward Kessai, signaling a proactive approach to overcoming current financial hurdles and capitalizing on future growth opportunities in the fintech sector.

- Dive into the specifics of Money Forward here with our thorough health report.

Evaluate Money Forward's historical performance by accessing our past performance report.

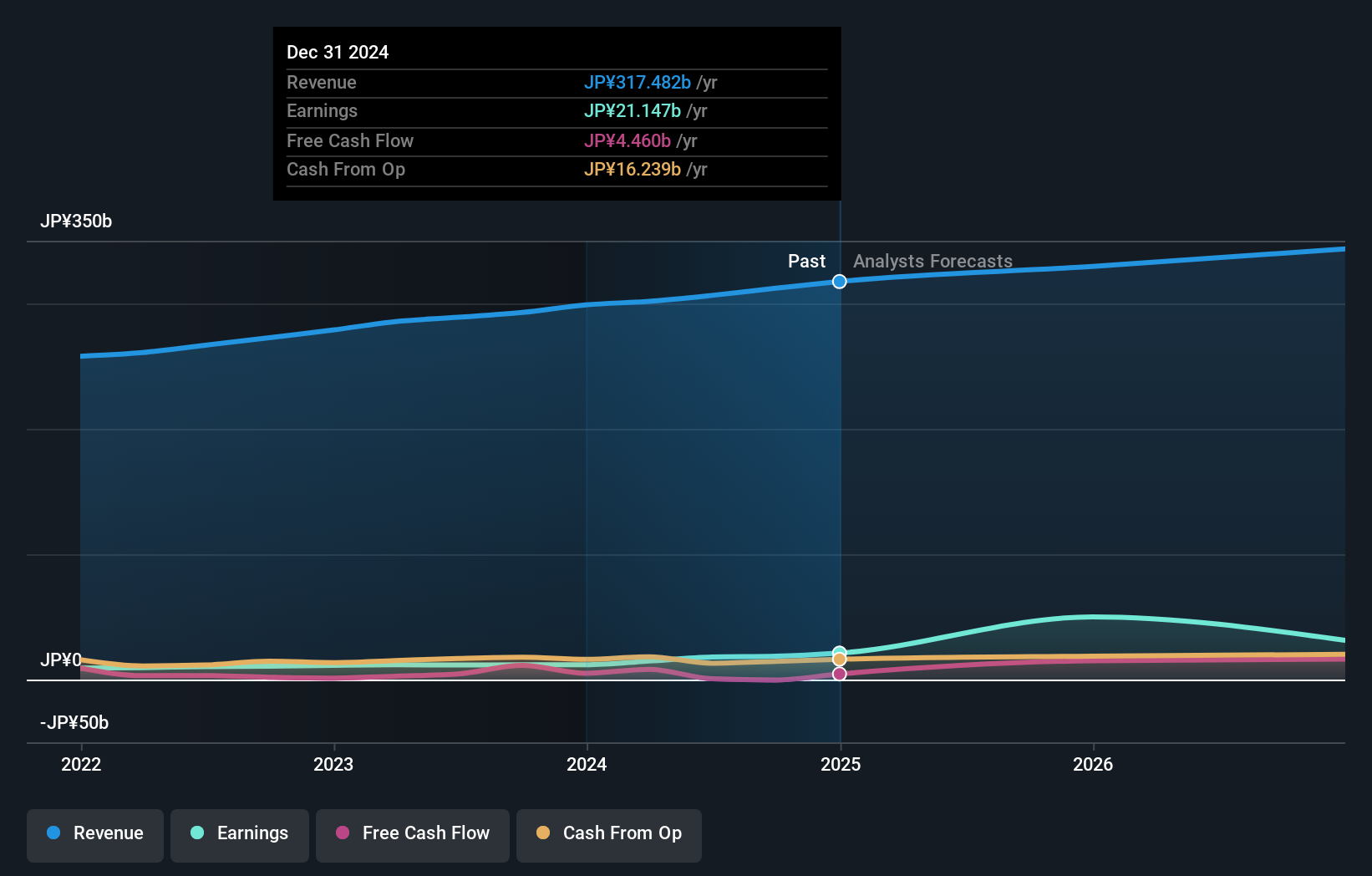

Fuji Soft (TSE:9749)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fuji Soft Incorporated is an IT company that provides a range of technology services both in Japan and internationally, with a market cap of ¥608.91 billion.

Operations: Fuji Soft generates revenue primarily from its SI Business, amounting to ¥290.11 billion, and also engages in Facility Business with revenues of ¥3.42 billion.

Fuji Soft is at the center of Japan's tech evolution, with recent bids from Bain Capital and KKR highlighting its strategic value amidst a transformative digital landscape. The company's R&D expenditure has been robust, aligning with its 21.7% forecasted annual earnings growth, which significantly outpaces the broader market's expectations. These investments are critical as Fuji Soft adapts to emerging technologies like cloud computing and AI, ensuring it remains competitive in a rapidly advancing sector. Moreover, the proposed acquisitions underscore a premium valuation reflective of Fuji Soft’s potential in revolutionizing IT services across Japan.

Where To Now?

- Discover the full array of 118 Japanese High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal