Exploring Three High Growth Tech Stocks in Australia

In the last week, the Australian market has been flat, yet it is up 17% over the past year with earnings forecasted to grow by 12% annually. In this context of steady growth, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential in line with these positive market trends.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 20.19% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 63 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$19.89 billion.

Operations: Pro Medicus generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$161.50 million. The company's offerings focus on imaging software and radiology information systems, serving clients in various regions including Australia, North America, and Europe.

Pro Medicus, a standout in the Australian tech landscape, is demonstrating robust growth with earnings projected to increase by 18.9% annually, surpassing the broader market's average of 12.2%. This growth trajectory is bolstered by a significant revenue rise of 17% per year, outpacing the Australian market's 5.5%. The company's commitment to innovation is evident from its R&D spending trends which have consistently aligned with expanding its technological capabilities in healthcare imaging solutions. Recent financial outcomes underscore this momentum; for FY2024, Pro Medicus reported a revenue surge to AUD 166.33 million from AUD 127.33 million in the previous year and an impressive jump in net income to AUD 82.79 million up from AUD 60.65 million. Moreover, Pro Medicus has enhanced shareholder returns through strategic capital management evidenced by a recent dividend hike to 40 cents fully franked—an increase of over one-third compared to last year—reflecting confidence in sustained profitability and cash flow positivity. These financial maneuvers not only highlight their fiscal prudence but also reinforce their stature within high-growth sectors driven by advanced software solutions and client-centric innovations.

- Navigate through the intricacies of Pro Medicus with our comprehensive health report here.

Gain insights into Pro Medicus' past trends and performance with our Past report.

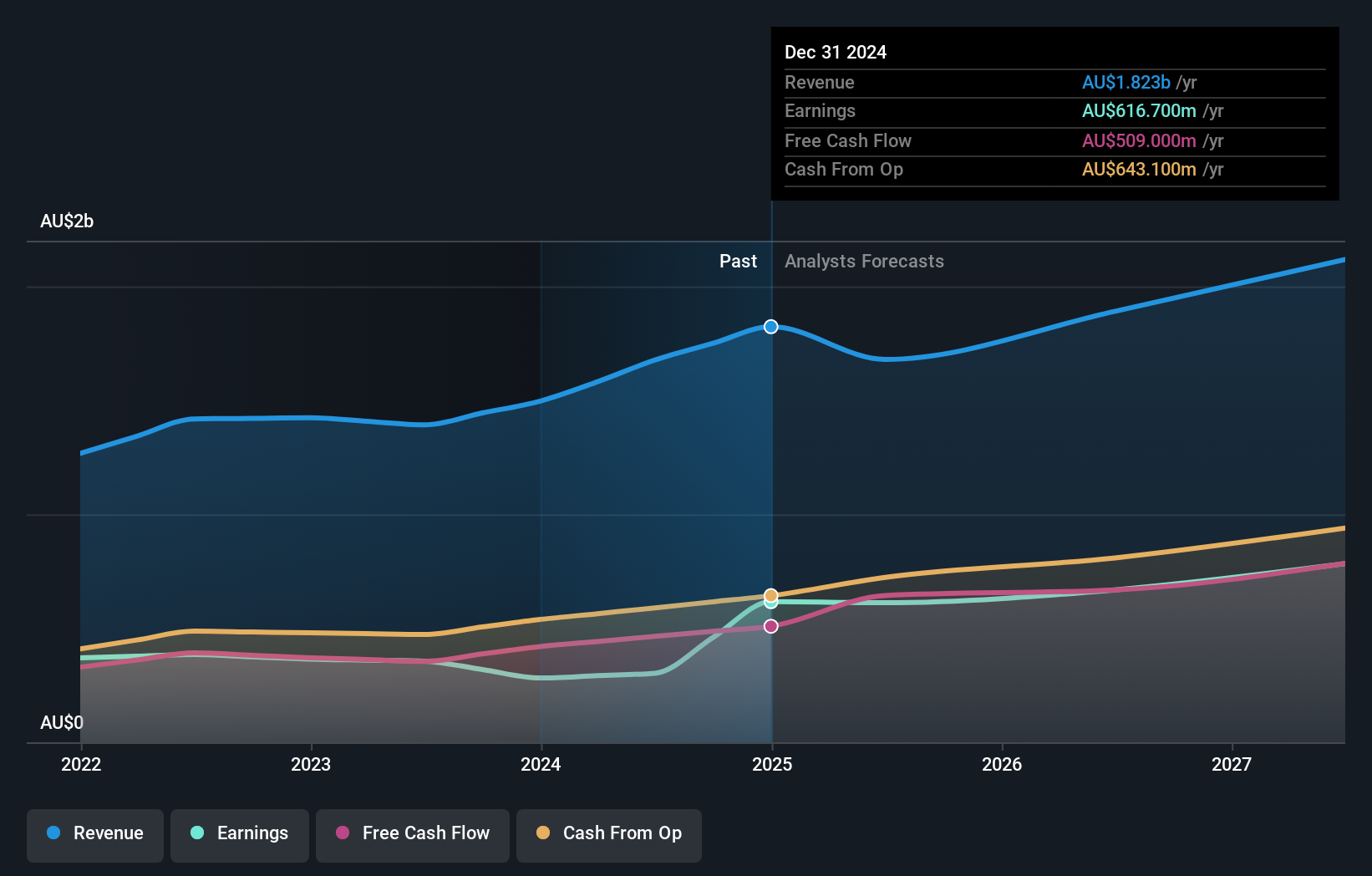

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally with a market capitalization of A$29.59 billion.

Operations: The company generates revenue primarily from its property and online advertising segment in Australia, which contributes A$1.25 billion, followed by financial services in Australia at A$320.60 million and operations in India with A$103.10 million. The focus on these key regions highlights a diversified approach to capturing market opportunities across different geographies.

REA Group, navigating through a challenging year with a 15% dip in earnings, still forecasts robust revenue growth at 6.5% annually, outpacing the Australian market's average of 5.5%. This resilience is underscored by an anticipated surge in earnings growth at 16.8% per year. The company's commitment to innovation and development is evident from its significant R&D expenditure, which aligns closely with its strategic goals to enhance interactive media and services capabilities. Despite recent financial setbacks marked by a one-off loss of AUD 153.6 million, REA Group has demonstrated fiscal prudence through a dividend increase to AUD 1.02 per share fully franked, reflecting confidence in future cash flow and profitability prospects within the competitive tech landscape of Australia.

- Click here to discover the nuances of REA Group with our detailed analytical health report.

Gain insights into REA Group's historical performance by reviewing our past performance report.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xero Limited is a software as a service company that offers online business solutions for small businesses and their advisors in Australia, New Zealand, and internationally, with a market cap of A$22.88 billion.

Operations: Xero generates revenue by providing online solutions for small businesses and their advisors, with reported revenue of NZ$1.71 billion. The company's business model focuses on delivering software as a service to its target markets across Australia, New Zealand, and internationally.

Xero, amid leadership transitions and innovative product launches, is setting a brisk pace in the tech sector with its new inventory management solutions aimed at enhancing small business operations in the U.S. With expected revenue growth of 14% per year outstripping the Australian market forecast of 5.5%, Xero demonstrates robust potential in revenue generation. Furthermore, its commitment to R&D is underscored by an impressive forecasted annual earnings growth rate of 24.6%. This focus on innovation and market expansion is exemplified by recent integrations with major platforms like Amazon's FBA and Caseware, positioning Xero favorably for sustained competitive advantage in both local and international markets.

- Click here and access our complete health analysis report to understand the dynamics of Xero.

Understand Xero's track record by examining our Past report.

Next Steps

- Unlock more gems! Our ASX High Growth Tech and AI Stocks screener has unearthed 60 more companies for you to explore.Click here to unveil our expertly curated list of 63 ASX High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal