Should You Buy Netflix ETFs Ahead of Q3 Earnings?

Netflix NFLX is set to release third-quarter 2024 results on Oct. 17 after market close. It is worth taking a look at the fundamentals of the world’s largest video-streaming company ahead of its results.

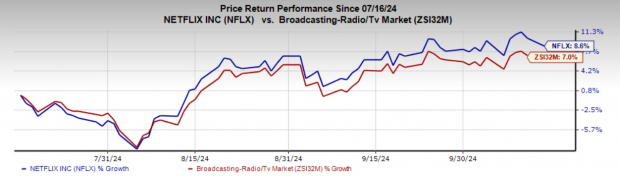

Netflix shares have risen 8.6% in the past three months, slightly outperforming the broader industry’s rise of 7% in the same time frame. The strong trend will likely continue, given that Netflix is expected to beat this earnings season.

Image Source: Zacks Investment Research

As a result, ETFs with the largest allocation to this streaming giant like MicroSectors FANG+ ETN FNGS, Invesco Next Gen Media and Gaming ETF GGME, First Trust Dow Jones Internet Index Fund FDN, Communication Services Select Sector SPDR Fund XLC and First Trust S-Network Streaming & Gaming ETF BNGE are in focus.

Earnings Whispers

Netflix has an Earnings ESP of +1.37% and a Zacks Rank #2 (Buy). According to our methodology, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The online video-streaming giant saw no earnings estimate revision over the past seven or 30 days for the to-be-reported quarter. Netflix is expected to report earnings growth of 35.9% and revenue growth of 14.3% for the to-be-reported quarter. The company’s earnings surprise history is impressive, as it delivered an earnings surprise of 6.15%, on average, over the past four quarters. Netflix belongs to a top-ranked Zacks industry (placed at the top 41% of 250+ industries).

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Netflix currently has an average brokerage recommendation (ABR) of 1.89 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 40 brokerage firms. The current ABR compares to an ABR of 1.91 a month ago based on 39 recommendations.

Of the 40 recommendations deriving the current ABR, 23 are Strong Buy and two are Buy. Strong Buy and Buy, respectively, account for 57.5% and 5% of all recommendations. A month ago, Strong Buy made up 53.85%, while Buy represented 5.13% (read: 5 Top-Ranked ETFs Beating the S&P 500 in 2024).

Based on short-term price targets offered by 36 analysts, the average price target for Netflix comes to $715.75. The forecasts range from a low of $545.00 to a high of $900.00.

Growth Prospects

Netflix is poised for strong growth on a paid-sharing initiative and revenue growth from advertising. Many analysts believe that Netflix's crackdown on password sharing has successfully attracted new users.

The streaming giant has expanded into live and sports programming this year, encroaching on traditional TV’s domain. It plans to stream National Football League (NFL) games on its platform this Christmas. Analysts believe the move into live events could help Netflix to reduce subscriber churn and attract new viewers (read: 5 Top-Ranked ETFs Beating the S&P 500 in 2024).

Netflix expects revenues to grow 13.9% year over year to $9.73 billion and earnings per share of $5.10 for the third quarter. It expects fewer subscriber additions in the third quarter compared with the year-ago period.

Valuations

Netflix shares look expensive at current levels, with a P/E ratio of 37.81 versus 10.60 for the industry. However, it has a strong Growth Score of B, indicating that it is primed for more growth. This justifies its high valuation.

ETFs in Focus

MicroSectors FANG+ ETN (FNGS)

MicroSectors FANG+ ETN is linked to the performance of the NYSE FANG+ Index, which is an equal-dollar-weighted index. It is designed to provide exposure to a group of highly traded growth stocks of next-generation technology and tech-enabled companies. It holds 10 stocks in its basket in equal proportion, with Netflix’s share coming in at 10%.

MicroSectors FANG+ ETN has accumulated $380 million in its asset base and charges 58 bps in annual fees. It trades in a moderate volume of 154,000 shares a day on average and has a Zacks ETF Rank #3 (Hold).

Invesco Next Gen Media and Gaming ETF (GGME)

Invesco Next Gen Media and Gaming ETF offers exposure to companies with significant exposure to technologies or products that contribute to future media through direct revenues. It tracks the STOXX World AC NexGen Media Index, holding 89 stocks in its basket. Netflix is the third firm, accounting for 8% of the GGME assets.

Invesco Next Gen Media and Gaming ETF has amassed $41.1 million in its asset base and charges 60 bps in annual fees. It has a Zacks ETF Rank #3.

First Trust Dow Jones Internet Index Fund (FDN)

First Trust Dow Jones Internet Index Fund follows the Dow Jones Internet Composite Index, giving investors exposure to the broad Internet industry. It holds about 41 stocks in its basket, with Netflix occupying the third spot at 7.8%.

First Trust Dow Jones Internet Index Fund is the most popular and liquid ETF in the broad technology space, with AUM of $6 billion and an average daily volume of around 218,000 shares. FDN charges 51 bps in fees per year and has a Zacks ETF Rank #1 (Strong Buy) with a High risk outlook.

Communication Services Select Sector SPDR Fund (XLC)

Communication Services Select Sector SPDR Fund offers exposure to companies from telecommunication services, media, entertainment and interactive media & services and has accumulated $18.2 billion in its asset base. It follows the Communication Services Select Sector Index and holds 22 stocks in its basket, with Netflix occupying the fourth position at 6.1% share. About 42% of the portfolio is allocated to interactive media & services, while entertainment and media round off the next two (read: Verizon to Acquire Frontier Communications: ETFs in Focus).

Communication Services Select Sector SPDR Fund charges 9 bps in annual fees and trades in an average daily volume of 3.6 million shares. It has a Zacks ETF Rank #2 (Buy).

First Trust S-Network Streaming & Gaming ETF (BNGE)

First Trust S-Network Streaming & Gaming ETF tracks the S-Network Streaming & Gaming Index and holds 45 stocks in its basket. Netflix takes the fourth spot, accounting for 4.9% of the assets. From a sector look, entertainment takes the largest share at 44.9%, while hotels, restaurants & leisure, interactive media & services, and semiconductors & semiconductor equipment round off the next three spots with double-digit exposure each.

First Trust S-Network Streaming & Gaming ETF has accumulated $3.9 million in its asset base and trades in an average daily volume of about 3,000 shares. It charges 70 bps in annual fees.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week.

Get it free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX): Free Stock Analysis Report

First Trust Dow Jones Internet ETF (FDN): ETF Research Reports

Communication Services Select Sector SPDR ETF (XLC): ETF Research Reports

MicroSectors FANG+ ETN (FNGS): ETF Research Reports

First Trust S-Network Streaming & Gaming ETF (BNGE): ETF Research Reports

Invesco Next Gen Media and Gaming ETF (GGME): ETF Research Reports

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal