3 Dividend Stocks Offering Yields Between 3% And 7.7%

As global markets continue to navigate a complex economic landscape, U.S. stocks have reached new highs amid the kickoff of earnings season, despite mixed economic signals such as modestly higher inflation and rising jobless claims. In this environment, dividend stocks offering yields between 3% and 7.7% can present appealing opportunities for investors seeking income stability and potential growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.41% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.11% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.24% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.18% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.70% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

Click here to see the full list of 2055 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

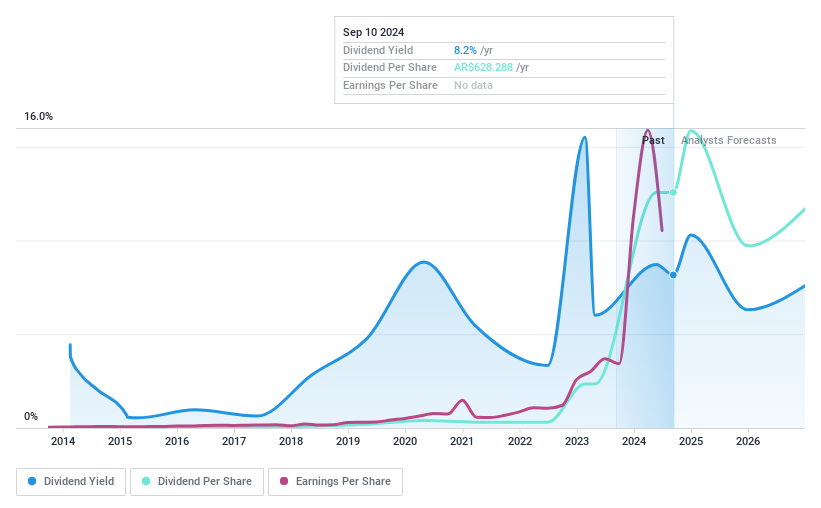

Banco Macro (BASE:BMA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Macro S.A. offers a range of banking products and services to retail and corporate clients in Argentina with a market capitalization of ARS5.51 trillion.

Operations: Banco Macro S.A.'s revenue from its banking business segment amounts to ARS3.47 billion.

Dividend Yield: 7.1%

Banco Macro's dividend yield of 7.15% ranks in the top 25% among Argentinian stocks, yet its dividend history is volatile, with past drops exceeding 20%. Despite recent financial challenges, including a net loss of AR$233.71 billion in Q2 2024, dividends are currently covered by earnings at an 85.2% payout ratio and are forecasted to be well-covered in three years at 34.7%. The stock's price-to-earnings ratio of 11.9x suggests good value compared to the market average.

- Take a closer look at Banco Macro's potential here in our dividend report.

- Upon reviewing our latest valuation report, Banco Macro's share price might be too optimistic.

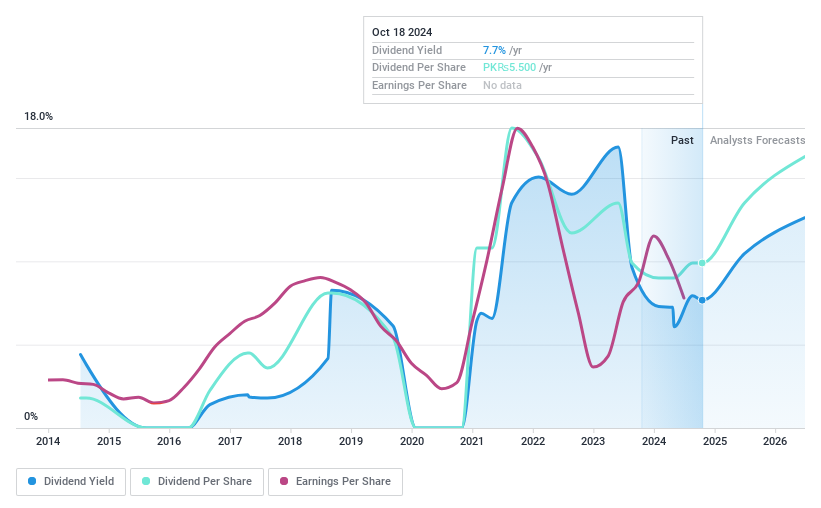

International Steels (KASE:ISL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: International Steels Limited manufactures and sells flat steel products in Pakistan, with a market cap of PKR30.91 billion.

Operations: International Steels Limited generates revenue primarily from the sales of steel products, amounting to PKR69.30 billion.

Dividend Yield: 7.7%

International Steels' dividend yield of 7.74% lags behind the top 25% in Pakistan, and its dividend history is marked by volatility. The company's dividends are covered by earnings with a payout ratio of 65.5% and cash flows at 75.5%. Earnings have grown annually by 12.9% over five years, supporting dividend sustainability despite past instability. Recent leadership changes may influence future performance, as new CEO Samir M. Chinoy focuses on digital transformation and supply chain improvements.

- Get an in-depth perspective on International Steels' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that International Steels is trading beyond its estimated value.

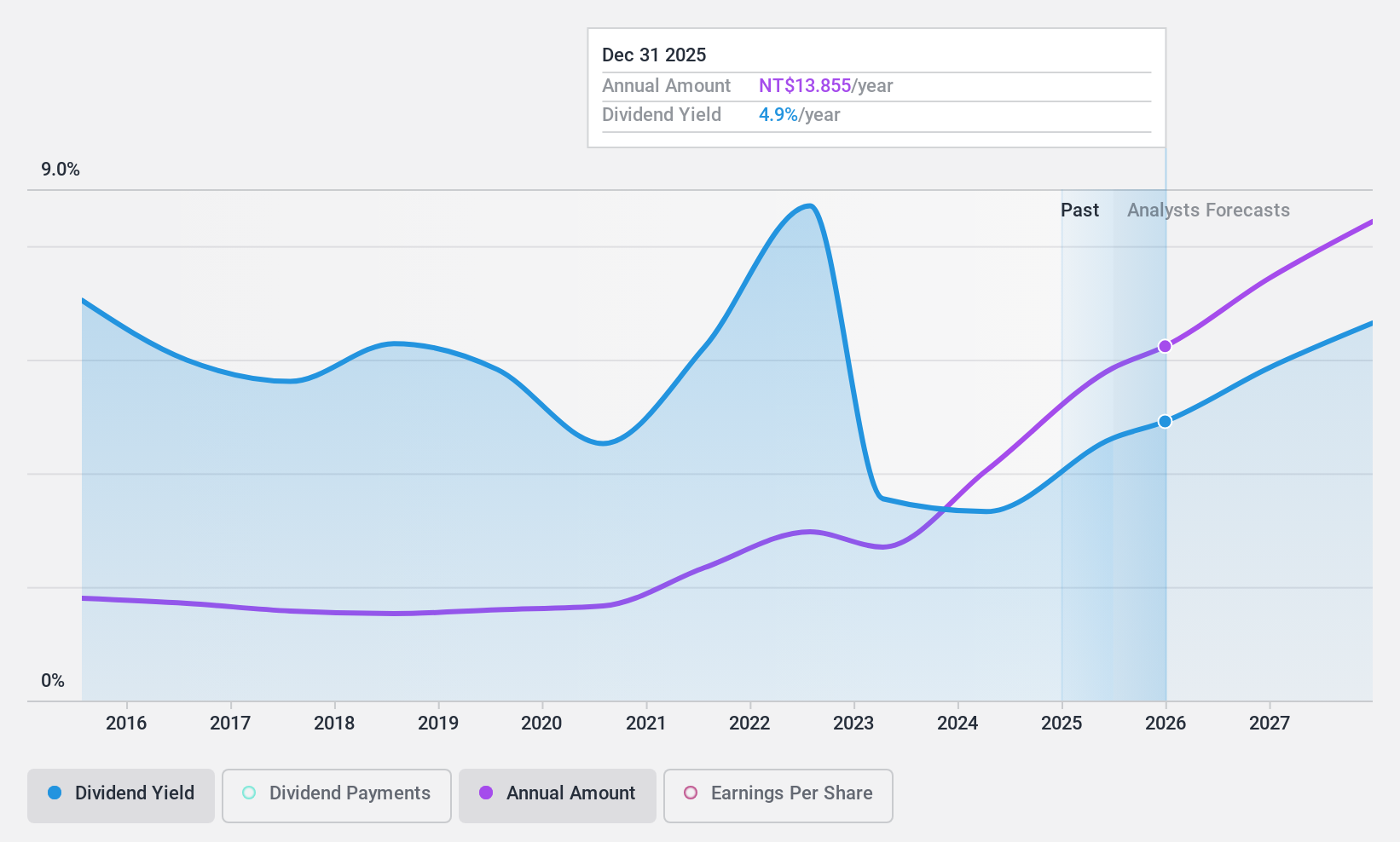

Quanta Computer (TWSE:2382)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with a market cap of NT$1.09 trillion.

Operations: Quanta Computer Inc. generates revenue of NT$2.50 billion from its Electronics Sector segment.

Dividend Yield: 3.1%

Quanta Computer's dividend yield of 3.05% is below the top 25% in Taiwan, yet its dividends are reliably covered by earnings (payout ratio: 69%) and cash flows (cash payout ratio: 79.5%). Despite recent share price volatility, Quanta's dividends have been stable and growing over the past decade. Recent earnings growth of 44.3% enhances dividend sustainability, while a $1 billion convertible bond issuance could support future strategic initiatives without impacting dividend reliability.

- Click to explore a detailed breakdown of our findings in Quanta Computer's dividend report.

- Our expertly prepared valuation report Quanta Computer implies its share price may be lower than expected.

Turning Ideas Into Actions

- Embark on your investment journey to our 2055 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal