3 US Growth Companies With Insider Ownership From 11% To 25%

As the U.S. stock market reaches new heights, with major indices like the S&P 500 and Dow Jones Industrial Average hitting record levels, investors are increasingly drawn to growth companies that show strong potential amid a tech-driven rally. In this thriving environment, stocks with significant insider ownership can be particularly appealing, as they often indicate confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.5% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 34.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here we highlight a subset of our preferred stocks from the screener.

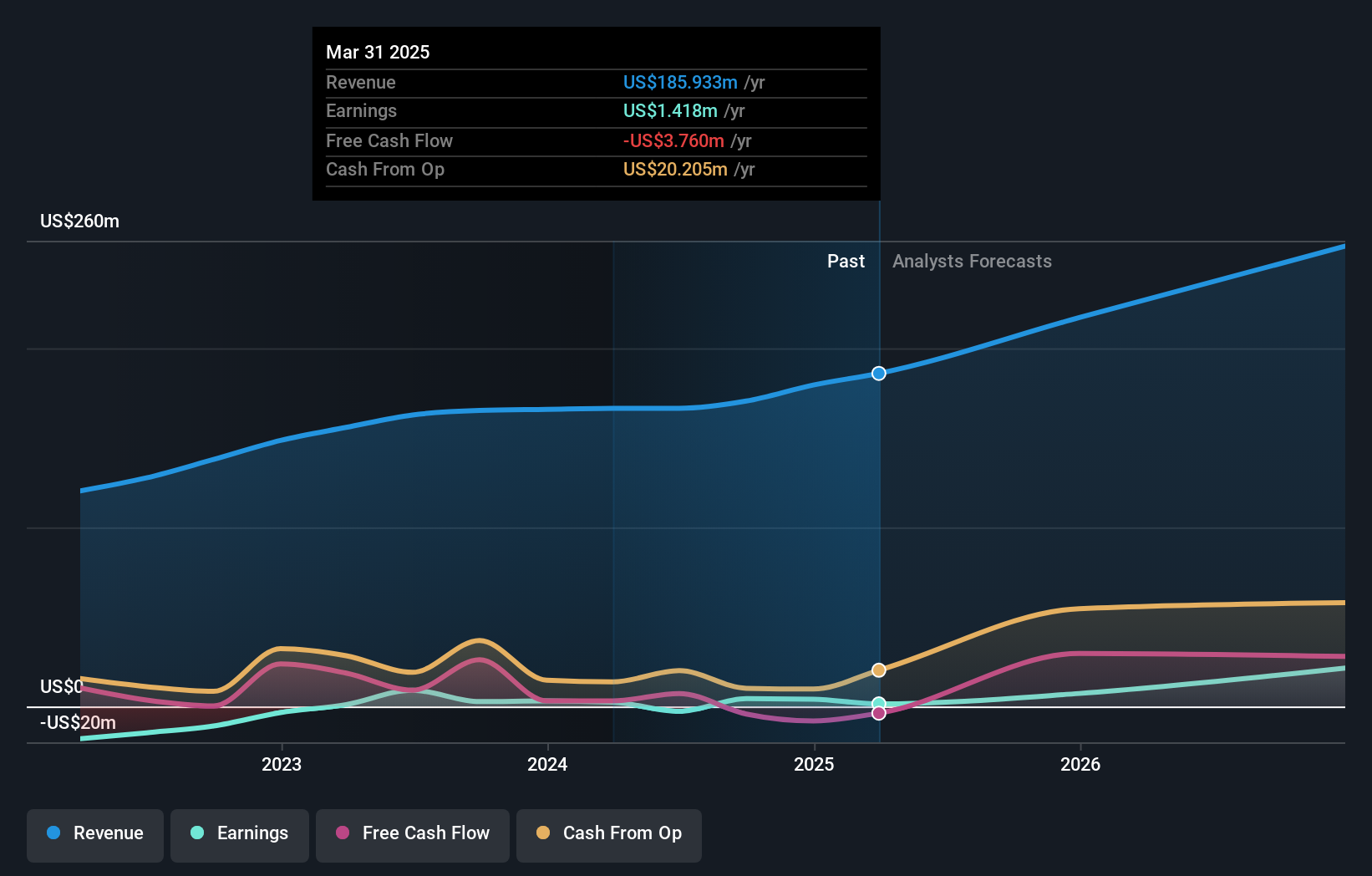

PDF Solutions (NasdaqGS:PDFS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property products for integrated circuit designs, electrical measurement hardware tools, methodologies, and professional services across the United States, China, Japan, and internationally with a market cap of $1.20 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $166.45 million.

Insider Ownership: 17.5%

PDF Solutions is poised for significant growth, with revenue expected to increase by 21% annually, outpacing the US market. The company is forecasted to become profitable within three years, marking above-average market growth. Despite trading below estimated fair value and analyst price targets suggesting a potential 36.6% rise, recent earnings show a decline in net income from US$6.84 million to US$1.71 million year-over-year for Q2 2024.

- Click to explore a detailed breakdown of our findings in PDF Solutions' earnings growth report.

- Upon reviewing our latest valuation report, PDF Solutions' share price might be too pessimistic.

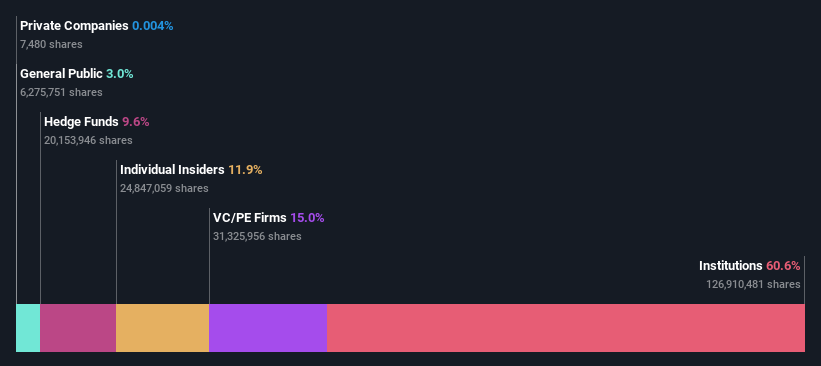

Genius Sports (NYSE:GENI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries with a market cap of $1.59 billion.

Operations: The company's revenue segment includes Data Processing, which generated $444.07 million.

Insider Ownership: 11.9%

Genius Sports is expanding its market presence with innovative platforms like FANHub and GeniusIQ, enhancing sports fan engagement through advanced data analytics. Recent board and executive appointments, including former Microsoft executive Robbie Bach, bolster its strategic direction in technology-driven consumer experiences. Despite a net loss of US$21.79 million for Q2 2024, the company anticipates significant revenue growth to US$510 million by year-end. Trading significantly below fair value, Genius Sports is forecasted to achieve profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Genius Sports.

- Our comprehensive valuation report raises the possibility that Genius Sports is priced higher than what may be justified by its financials.

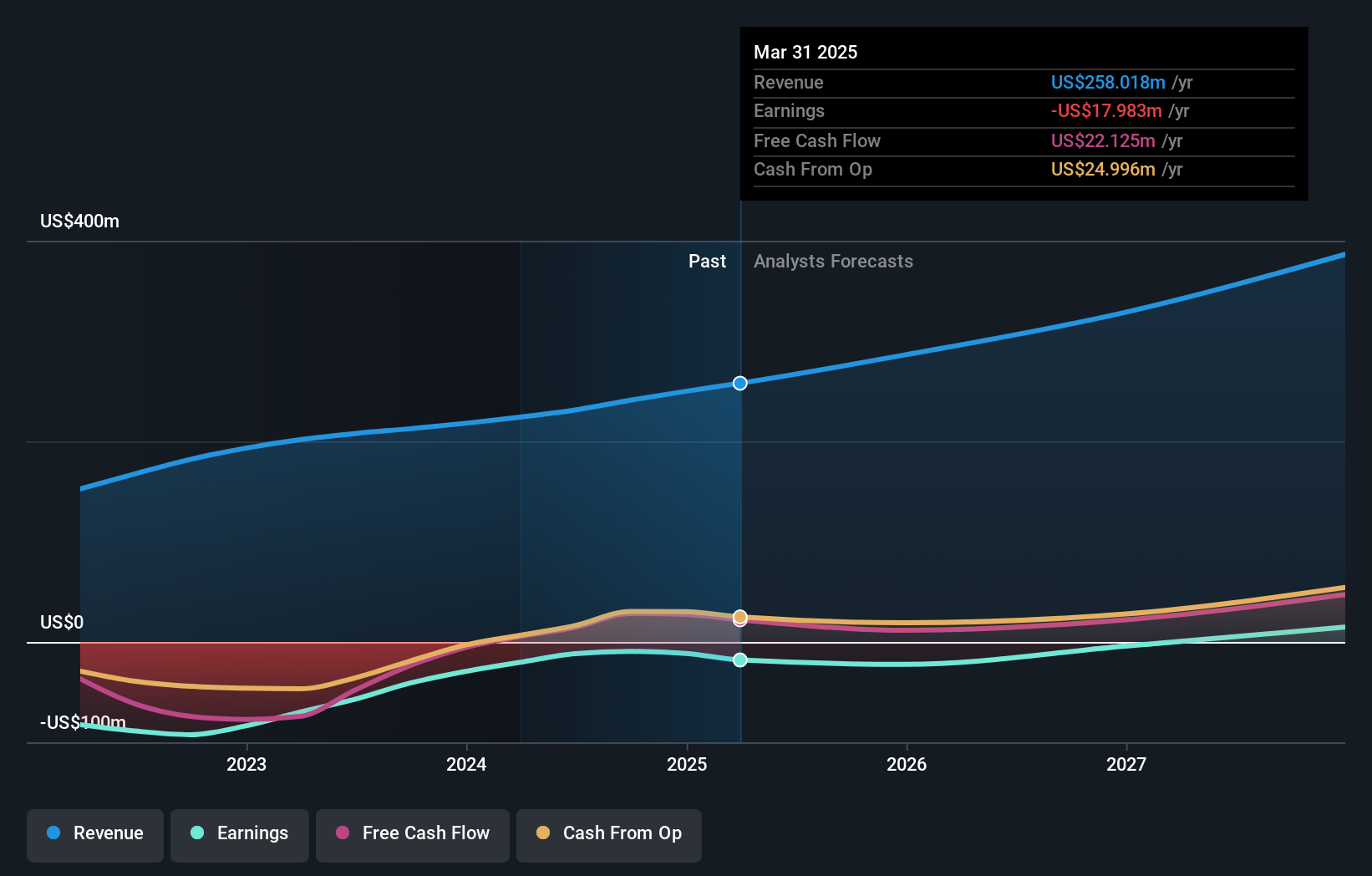

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions globally, with a market cap of $721.05 million.

Operations: The company generates revenue of $231.21 million from its online financial information provider services.

Insider Ownership: 25.6%

Similarweb's growth trajectory is supported by recent strategic board appointments, including Kipp Bodnar from HubSpot, enhancing its marketing and global expansion efforts. The company reported a reduced net loss for Q2 2024 at US$0.738 million and increased revenue guidance to US$246-248 million for the year. Despite shareholder dilution from a recent US$27.475 million equity offering, Similarweb trades well below fair value and is expected to achieve profitability within three years with strong revenue growth forecasts.

- Navigate through the intricacies of Similarweb with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Similarweb's share price might be on the cheaper side.

Make It Happen

- Click through to start exploring the rest of the 178 Fast Growing US Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal