High Growth Tech Stocks To Watch In October 2024

The United States market has shown robust performance recently, climbing 1.5% in the last 7 days and up 33% over the past year, with earnings forecasted to grow by 16% annually. In this environment, a good high-growth tech stock typically demonstrates strong revenue growth potential and innovative capabilities that align with these optimistic market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.59% | 43.53% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.33% | 62.45% | ★★★★★★ |

| Travere Therapeutics | 27.18% | 69.88% | ★★★★★★ |

| MediaAlpha | 22.72% | 61.31% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA)

Simply Wall St Growth Rating: ★★★★☆☆

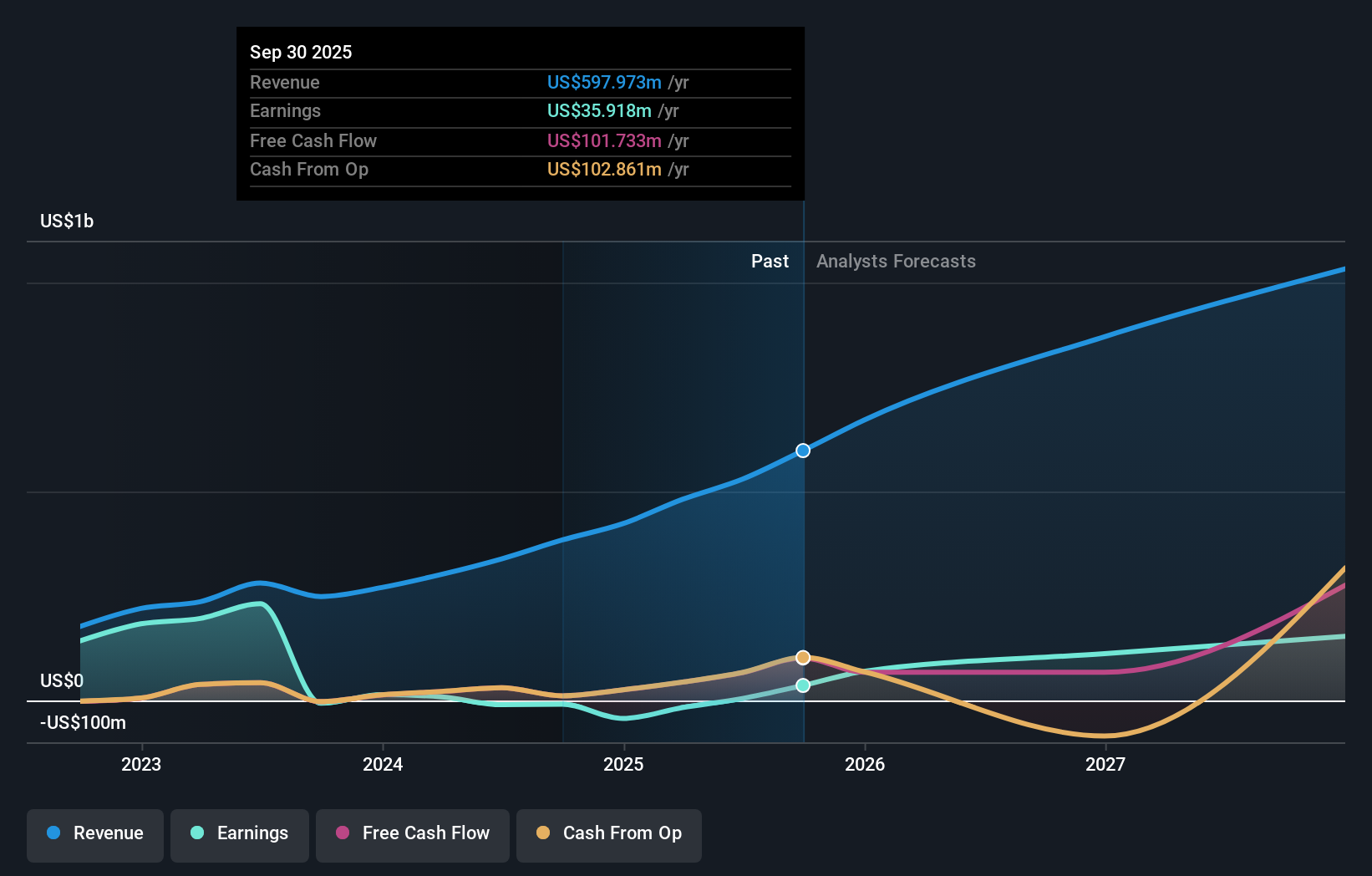

Overview: Kiniksa Pharmaceuticals International, plc is a biopharmaceutical company dedicated to discovering, acquiring, developing, and commercializing therapeutic medicines for patients with debilitating diseases that have significant unmet medical needs globally, with a market cap of approximately $1.89 billion.

Operations: Kiniksa Pharmaceuticals generates revenue primarily from developing and delivering therapeutic medicines, amounting to $338.93 million. The company focuses on addressing significant unmet medical needs in debilitating diseases globally.

Kiniksa Pharmaceuticals International, despite recent challenges such as being dropped from key indexes, shows promise with a robust 17.8% projected annual revenue growth and an anticipated shift to profitability within three years, outpacing the broader US market's 8.8% growth expectation. This potential is underscored by a significant forecast of earnings growth at 53.19% annually. The company's strategic R&D investments are crucial, aligning with its forward-looking revenue guidance revision upwards to between $405 million and $415 million for 2024, reflecting confidence in its pipeline and market strategy. Recent board expansions and executive appointments also suggest a strengthening of governance that could support these ambitious growth targets in the competitive biotech landscape.

Okta (NasdaqGS:OKTA)

Simply Wall St Growth Rating: ★★★★☆☆

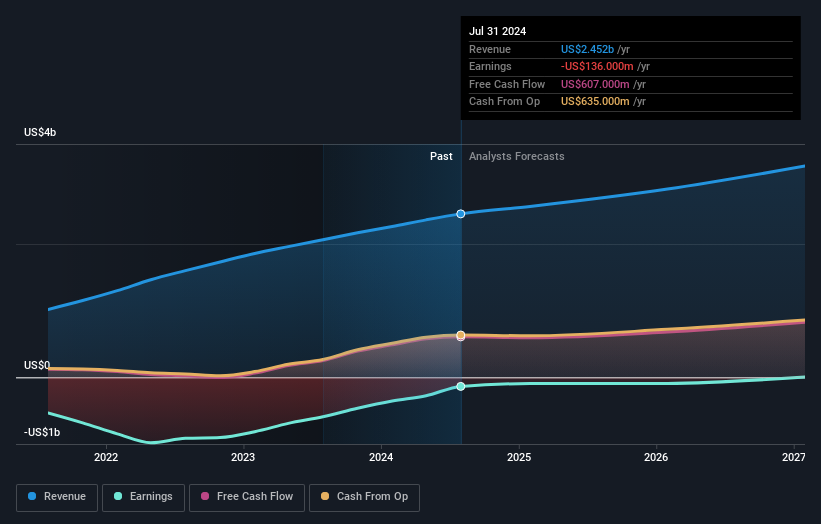

Overview: Okta, Inc. operates as an identity partner providing secure access management solutions in the United States and internationally, with a market capitalization of approximately $13.14 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $2.45 billion. As an identity partner, it provides secure access management solutions globally.

Okta's recent pivot towards profitability is underscored by its impressive second-quarter revenue jump to $646 million, up from $556 million year-over-year, coupled with a net income shift from a loss of $111 million to a gain of $29 million. This financial turnaround is paralleled by an aggressive R&D strategy, with expenses aimed at fostering innovation in identity and access management solutions. Notably, the company's earnings are projected to surge by 47.85% annually, reflecting robust growth prospects in the tech sector. Okta's strategic partnerships, like those with Jamf and Zimperium, enhance its product offerings and market position by integrating advanced security features that cater to evolving enterprise needs. These collaborations not only extend Okta's ecosystem but also solidify its role in shaping future tech landscapes through enhanced security protocols and identity solutions.

- Delve into the full analysis health report here for a deeper understanding of Okta.

Assess Okta's past performance with our detailed historical performance reports.

RingCentral (NYSE:RNG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc. offers cloud-based communications, video meetings, collaboration, and contact center software-as-a-service solutions globally with a market capitalization of approximately $3 billion.

Operations: RingCentral generates revenue primarily from its Internet Software & Services segment, amounting to $2.31 billion. The company's business model revolves around providing cloud-based solutions for communications and collaboration on a global scale.

RingCentral's strategic expansion into India, securing a PAN-India license to operate UCaaS and CCaaS solutions across 22 circles, underscores its commitment to broadening its global footprint and enhancing connectivity for multinational corporations. This move is pivotal as it positions RingCentral at the forefront of the cloud communications market in one of the world's fastest-growing economies. Financially, while RingCentral reported a net loss of $14.75 million in Q2 2024, down from $21.48 million year-over-year, it anticipates revenue growth with projections indicating an increase from $592.91 million to between $600.5 million and $603.5 million in Q3 2024—a year-over-year growth rate of approximately 8%. The company’s focus on R&D remains robust with expenses aimed at driving innovation within its telecommunications solutions; this investment is crucial as it navigates competitive markets and regulatory environments like India’s complex telecom landscape.

- Navigate through the intricacies of RingCentral with our comprehensive health report here.

Examine RingCentral's past performance report to understand how it has performed in the past.

Next Steps

- Investigate our full lineup of 253 US High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal