Axway Software And 2 Other Undiscovered Gems With Strong Potential

As European markets experience a modest uptick, with France's CAC 40 Index gaining 0.48%, investors are increasingly looking towards small-cap stocks for potential opportunities amid hopes of quicker interest rate cuts by the European Central Bank. In this dynamic environment, identifying promising companies with robust business models and growth potential becomes crucial for navigating market fluctuations and capitalizing on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Axway Software (ENXTPA:AXW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Axway Software SA is an infrastructure software publisher operating across France, the rest of Europe, the Americas, and the Asia Pacific with a market capitalization of €723.26 million.

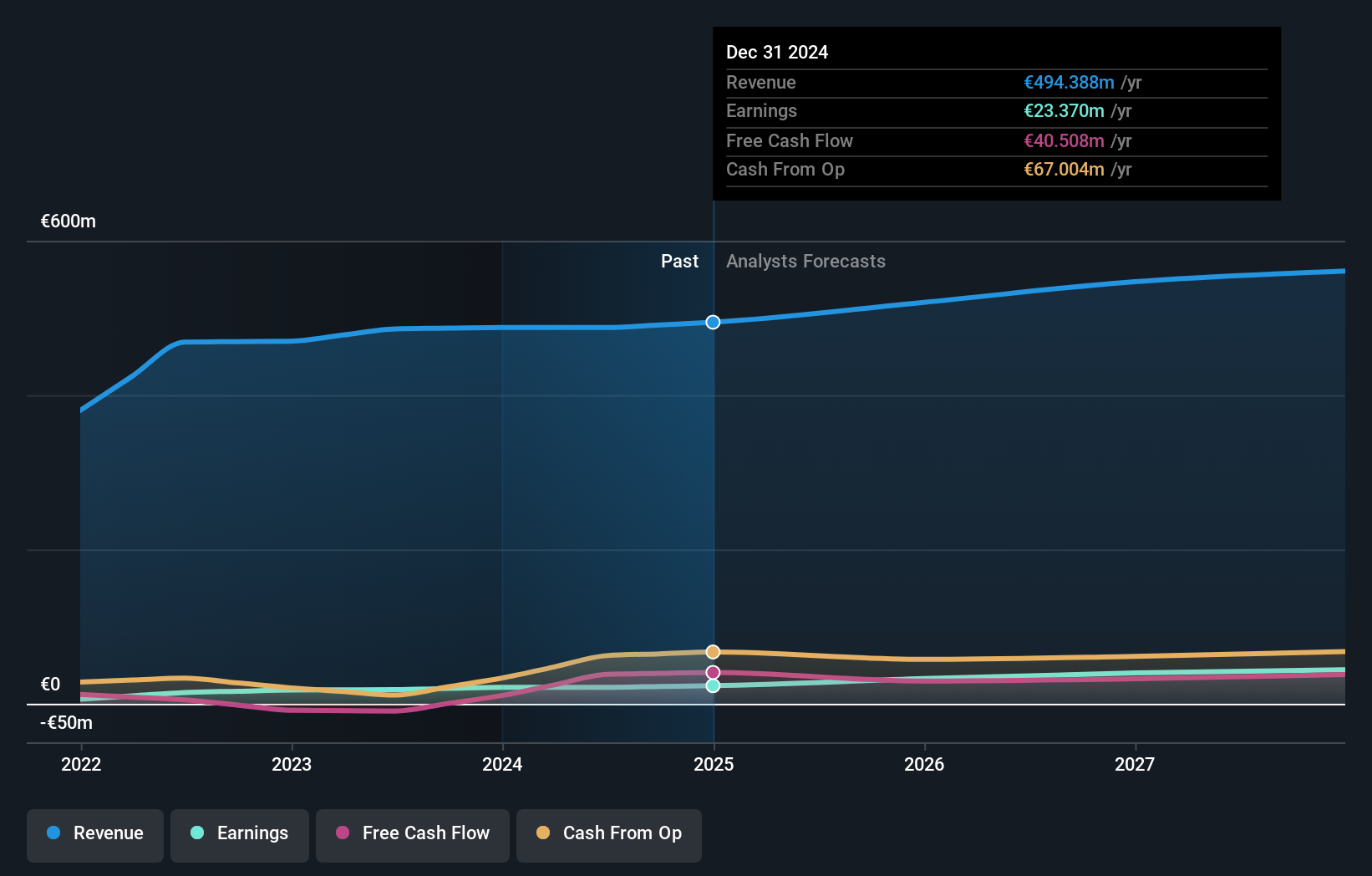

Operations: Axway Software generates revenue primarily through its Subscription segment (€201.19 million), followed by Maintenance (€77.04 million), Services excluding Subscription (€35.49 million), and License sales (€8.46 million).

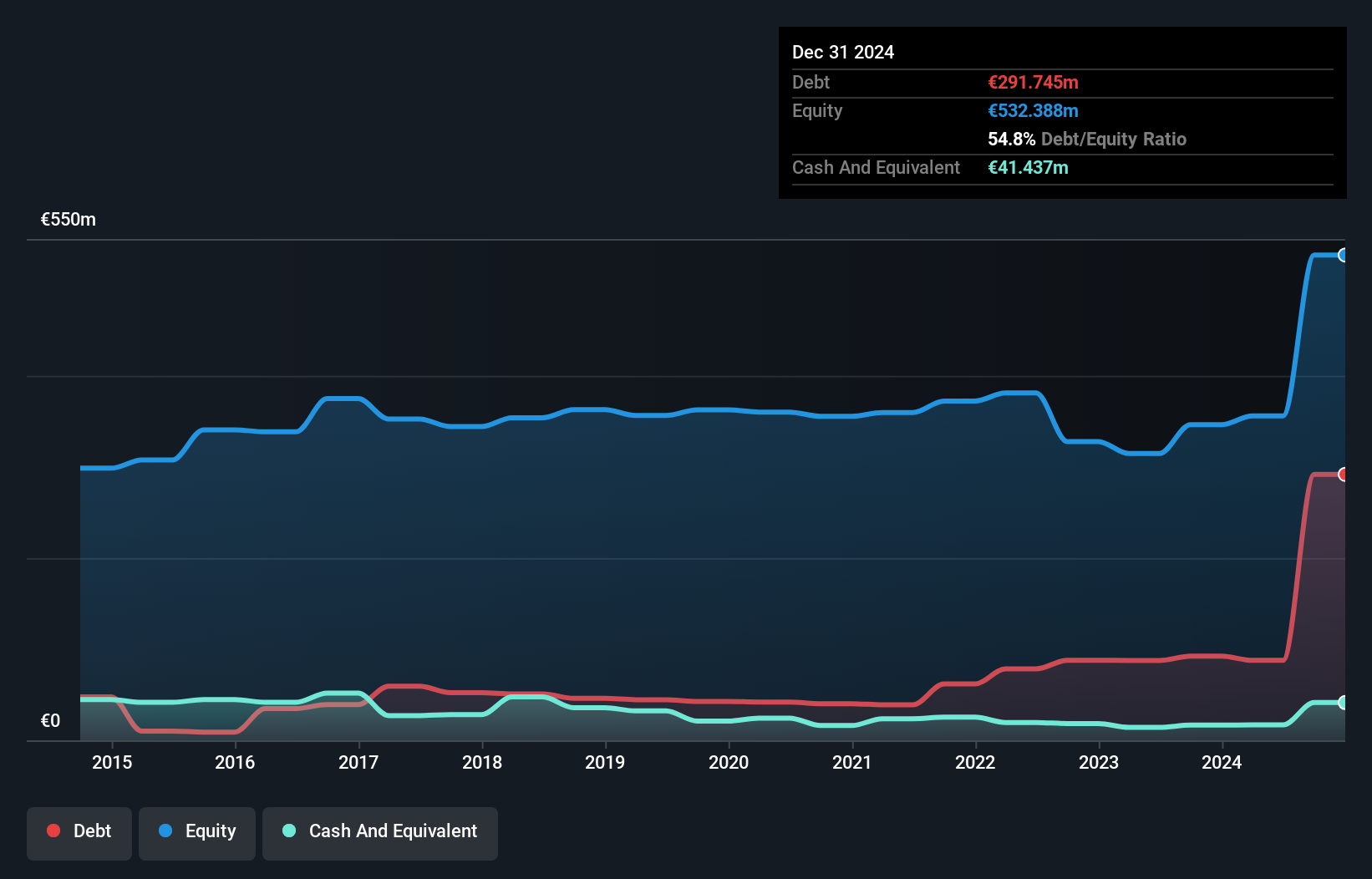

Axway Software, a notable player in the tech sector, has shown a promising financial profile with its net debt to equity ratio at 19.9%, deemed satisfactory. Its price-to-earnings ratio of 20.7x is attractive compared to the industry average of 27.7x, and interest payments are well-covered by EBIT at 10.1x coverage. Despite shareholder dilution last year, Axway's recent profitability and positive free cash flow highlight its potential as an investment opportunity in France's dynamic software market.

- Take a closer look at Axway Software's potential here in our health report.

Examine Axway Software's past performance report to understand how it has performed in the past.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers a variety of banking and financial products and services to individuals, farmers, professionals, businesses, and public authorities in France with a market cap of approximately €977.73 million.

Operations: CRBP2 generates revenue primarily from its retail banking segment, amounting to €626 million. The company's market capitalization stands at approximately €977.73 million.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, with total assets of €42.2 billion and equity of €5 billion, stands out for its robust financial health. Its liabilities are primarily low-risk due to customer deposits making up 91% of funding sources. The bank's earnings growth at 6.2% outpaces the industry average, indicating strong performance. With a bad loans ratio at an appropriate 1.2%, it also boasts a sufficient allowance for bad loans at 115%.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €393.33 million.

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, amounting to €487.56 million.

EPC Groupe, a small player in the chemicals sector, reported steady net income at €12.52 million for the half year ending June 2024, slightly down from €12.57 million previously. Despite high net debt to equity at 42.6%, earnings grew by 17.4% over the past year, outpacing industry trends and indicating robust performance with high-quality earnings. Trading at 54% below estimated fair value suggests potential upside; however, interest coverage remains tight with EBIT covering interest payments only 2.9 times.

- Unlock comprehensive insights into our analysis of EPC Groupe stock in this health report.

Gain insights into EPC Groupe's historical performance by reviewing our past performance report.

Summing It All Up

- Unlock more gems! Our Euronext Paris Undiscovered Gems With Strong Fundamentals screener has unearthed 35 more companies for you to explore.Click here to unveil our expertly curated list of 38 Euronext Paris Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal