Undervalued Small Caps With Insider Buying In United Kingdom October 2024

The United Kingdom's market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties that impact investor sentiment. In this environment, identifying small-cap stocks with potential for growth can be appealing to investors looking for opportunities that might be overlooked in broader market downturns.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 18.0x | 0.6x | 37.61% | ★★★★★★ |

| Bytes Technology Group | 25.4x | 5.7x | 8.65% | ★★★★★☆ |

| NWF Group | 8.3x | 0.1x | 37.41% | ★★★★★☆ |

| Genus | 168.5x | 2.0x | 9.81% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 26.42% | ★★★★★☆ |

| Essentra | 731.6x | 1.4x | 25.94% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 41.17% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 37.91% | ★★★★☆☆ |

| Oxford Instruments | 22.4x | 2.4x | -26.08% | ★★★☆☆☆ |

| Petra Diamonds | NA | 0.3x | -42.84% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Restore (AIM:RST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Restore is a company that provides secure lifecycle services and digital & information management solutions, with a market cap of £0.61 billion.

Operations: Secure Lifecycle Services and Digital & Information Management are the primary revenue streams. The gross profit margin has shown variability, reaching a high of 44.26% in December 2019 before decreasing to 42.00% by December 2023. Operating expenses have consistently impacted profitability, with significant non-operating expenses contributing to fluctuations in net income margins over time.

PE: 91.2x

Restore, a company with potential in the UK small-cap sector, has seen insider confidence with Charles Skinner purchasing 100,000 shares for £280K. Despite its reliance on external borrowing for funding, Restore's earnings are forecasted to grow by 48.67% annually. Recent financials show a turnaround with net income of £6.4 million for H1 2024 compared to a loss last year. The company's interim dividend increased to 2 pence per share, reflecting improved profitability and shareholder returns.

- Dive into the specifics of Restore here with our thorough valuation report.

Review our historical performance report to gain insights into Restore's's past performance.

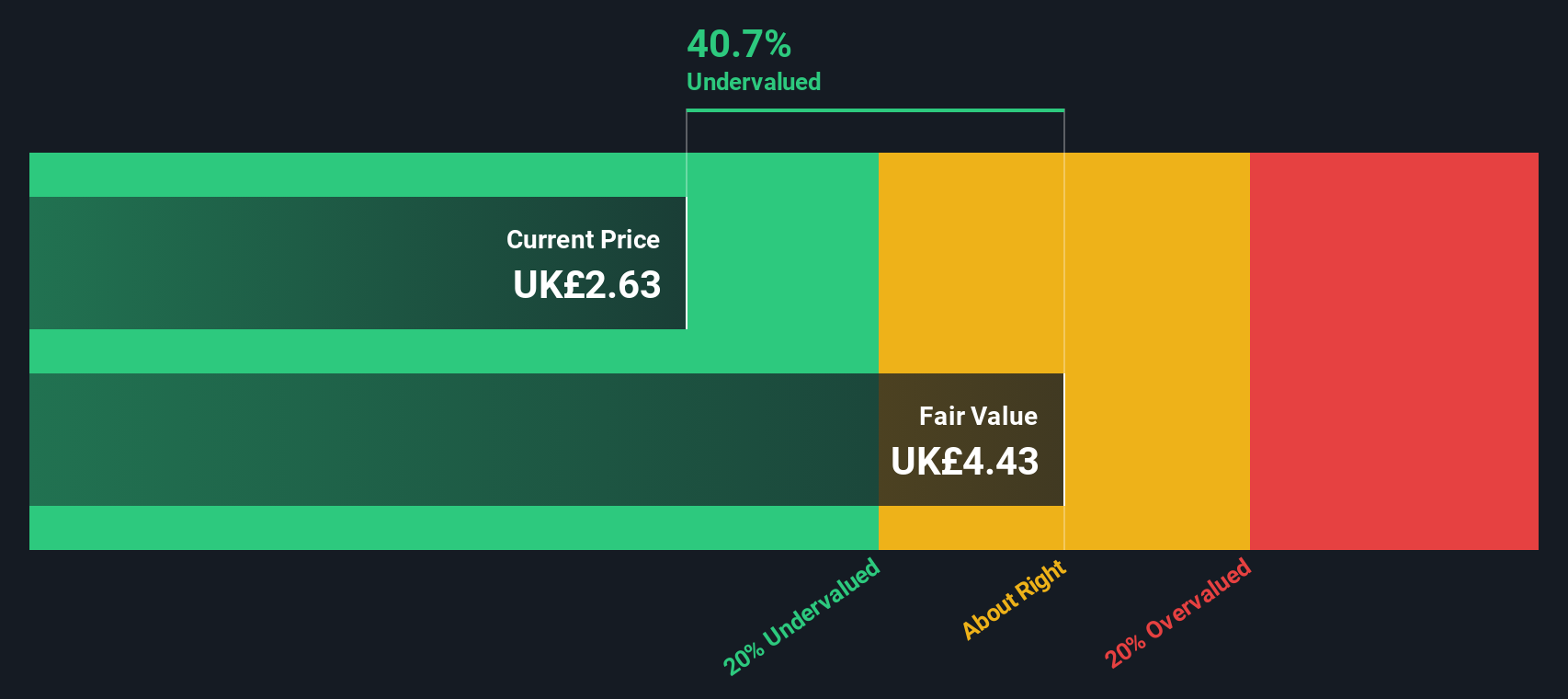

Essentra (LSE:ESNT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Essentra is a global provider of essential components and solutions, specializing in the manufacture and distribution of plastic, fiber, foam, and packaging products with a market cap of approximately £0.77 billion.

Operations: Essentra's revenue streams have shown fluctuations, with a notable increase to £1.04 billion in 2015 before a decline to £309.7 million by 2024. The company's cost of goods sold (COGS) has also varied, peaking at £1.37 billion in mid-2017 and decreasing to £166.8 million by late 2024. A significant trend is observed in the gross profit margin, which reached its highest at 46.14% by October 2024, indicating an improvement from earlier periods where it was as low as -33.44% in mid-2017 due to high COGS relative to revenue during that time frame.

PE: 731.6x

Essentra, a UK-based company with a small market presence, recently announced Rowan Baker as their incoming CFO effective November 2024. This leadership change comes amidst financial challenges, with half-year sales dipping to £159.7 million from £166.3 million the previous year and net income falling to £1.3 million from £6.9 million. Despite these figures, insider confidence is reflected in recent share purchases by executives over the past few months, hinting at potential growth prospects as earnings are projected to increase annually by 2.19%.

- Get an in-depth perspective on Essentra's performance by reading our valuation report here.

Examine Essentra's past performance report to understand how it has performed in the past.

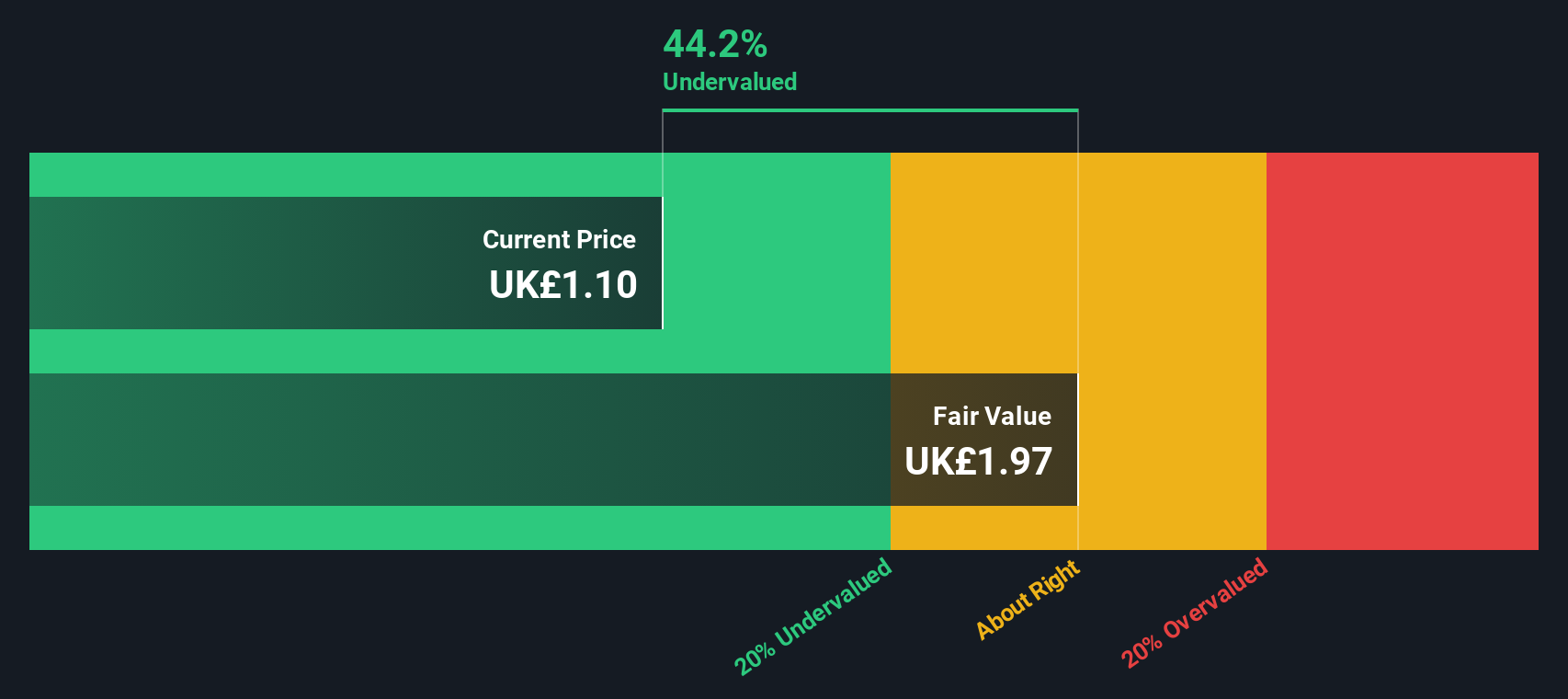

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mears Group focuses on providing management and maintenance services, with a market capitalization of £0.37 billion.

Operations: The company generates revenue primarily from its Management and Maintenance segments, with recent figures showing a combined total of £1.14 billion. The gross profit margin has shown an upward trend, reaching 21.68% by mid-2024. Operating expenses are significant, with General & Administrative Expenses being the largest component within this category.

PE: 8.4x

Mears Group, a UK-based company, recently reported impressive growth with half-year sales reaching £580.04 million, up from £525.64 million the previous year. Net income also rose to £22.73 million from £16 million. Despite this, earnings are projected to decline by 14.7% annually over the next three years due to reliance on external borrowing for funding, which poses higher risk without customer deposits as a buffer. Insider confidence is evident as they increased their holdings in recent months, reflecting potential optimism about future prospects despite current challenges and forecasts of declining earnings.

Where To Now?

- Get an in-depth perspective on all 27 Undervalued UK Small Caps With Insider Buying by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal