Undiscovered Gems In South Korea Top Stocks For October 2024

The South Korean market has been capturing global attention, not only for its economic resilience but also due to cultural milestones like Han Kang's recent Nobel Prize in Literature win, which highlights the nation's growing influence on the world stage. In this vibrant atmosphere, identifying promising small-cap stocks requires a keen eye for companies that can harness both local and international opportunities while navigating broader market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. is a company that focuses on the development, manufacturing, and sale of PCB automation equipment both in South Korea and internationally, with a market capitalization of approximately ₩973.44 billion.

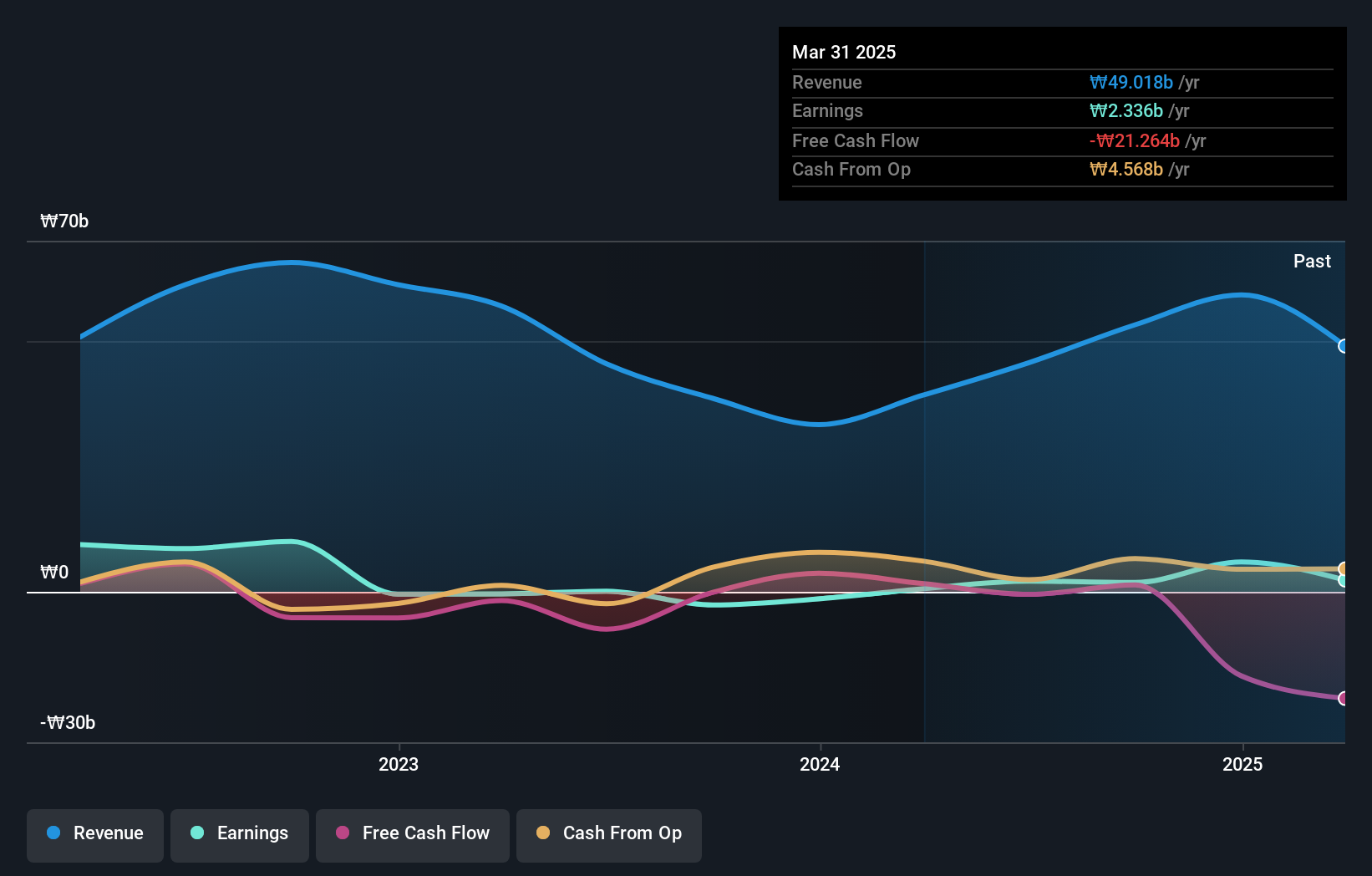

Operations: Taesung generates revenue primarily from the manufacturing and sale of PCB automation equipment, totaling approximately ₩45.68 billion.

Taesung Ltd. has shown remarkable earnings growth of 1482% over the past year, significantly outpacing the semiconductor industry average of -10%. Despite recent shareholder dilution, its debt management remains robust with a net debt to equity ratio of 4.2%, deemed satisfactory. The company's interest payments are well-covered by EBIT at 17.5 times coverage, highlighting financial stability amidst volatility in share price over the last three months. Recently added to the S&P Global BMI Index, Taesung's inclusion suggests growing recognition in global markets.

- Take a closer look at TaesungLtd's potential here in our health report.

Assess TaesungLtd's past performance with our detailed historical performance reports.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company that manufactures and sells machinery and heat combustion equipment, with a market capitalization of ₩1.16 trillion.

Operations: Kyung Dong Navien generates revenue primarily from the air conditioning manufacturing and sales segment, amounting to approximately ₩1.29 billion.

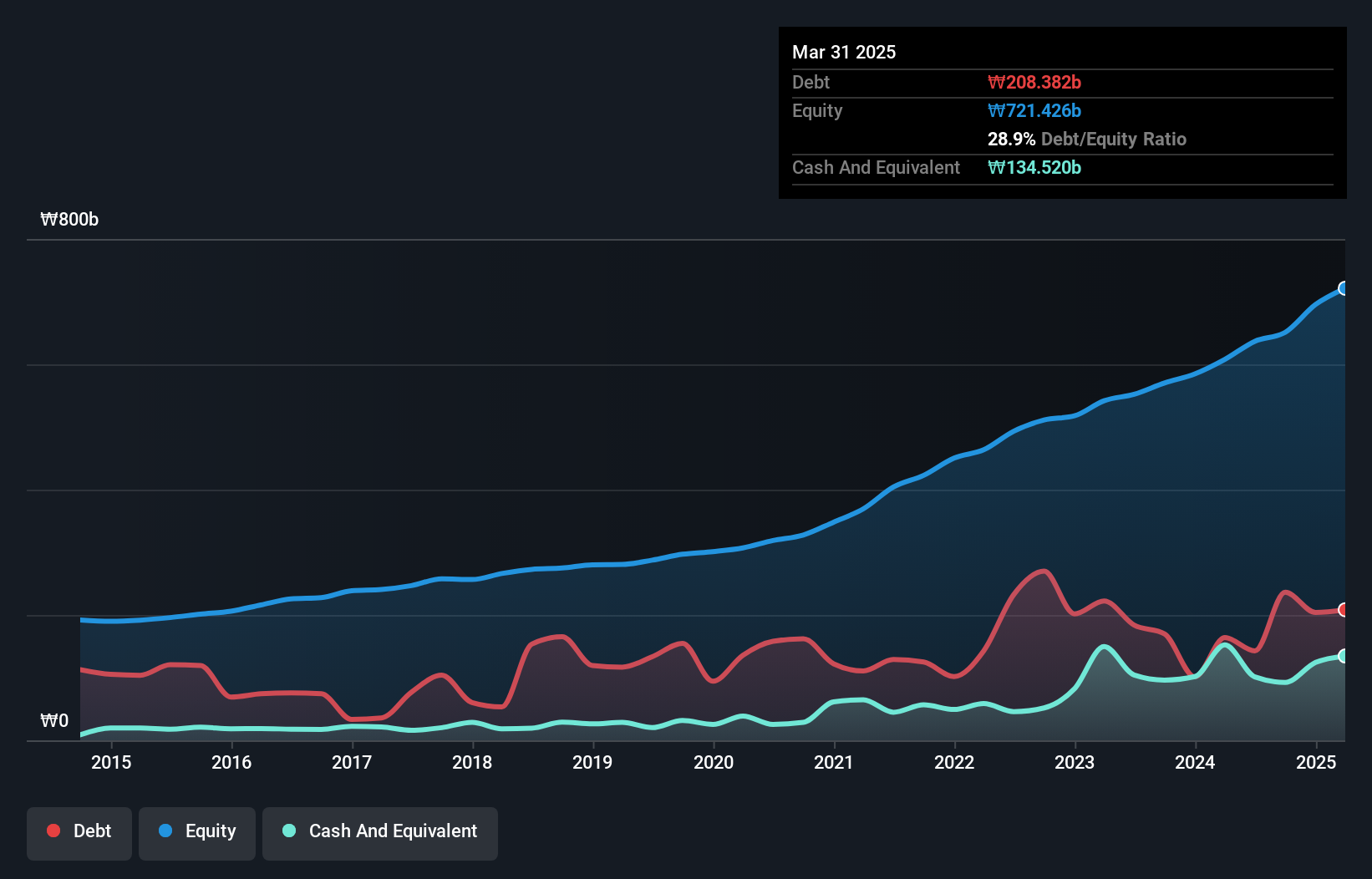

Kyung Dong Navien, a promising player in South Korea's heating solutions market, showcases strong financial health with its interest payments well covered by EBIT at 27.4 times. The company's earnings surged by 86% last year, outpacing the building industry's growth of 29%. With a net debt to equity ratio of 6.5%, it stands on solid ground financially. Over five years, its debt to equity ratio improved from 46% to 22%, reflecting prudent management strategies and high-quality earnings.

- Navigate through the intricacies of Kyung Dong Navien with our comprehensive health report here.

Understand Kyung Dong Navien's track record by examining our Past report.

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dongwon Systems Corporation is a South Korean company that specializes in the manufacturing and marketing of packaging materials, with a market capitalization of ₩1.52 trillion.

Operations: Dongwon Systems generates revenue primarily from its packaging business, which accounts for approximately ₩1.27 trillion.

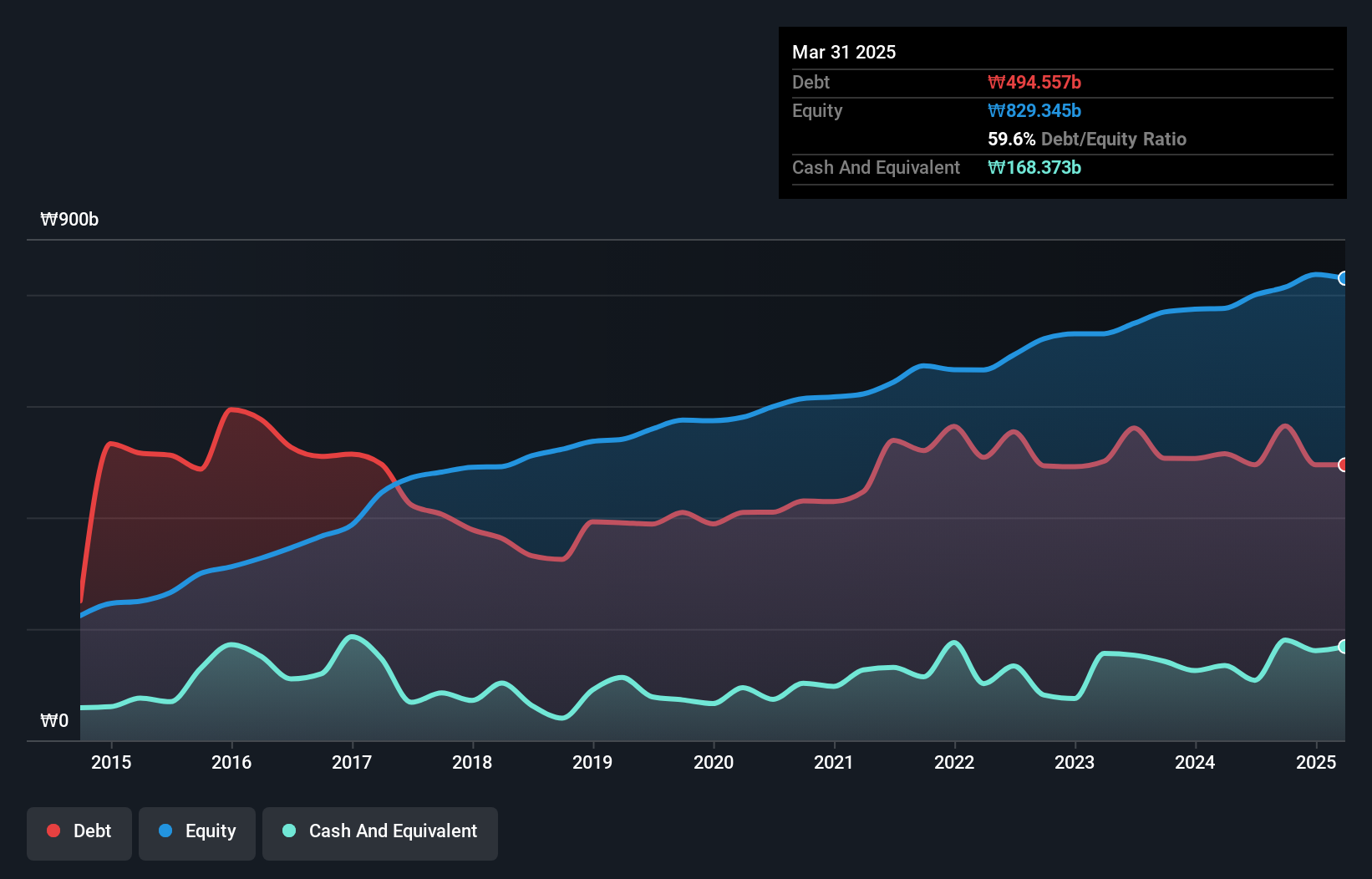

Dongwon Systems, a notable player in the packaging sector, showcases robust financial health despite its high net debt to equity ratio of 48.4%. Over the past year, earnings grew by 4.8%, surpassing industry averages and reflecting high-quality earnings. The company's interest payments are well-covered with an EBIT coverage of 5.2 times, indicating strong operational efficiency. Recent results highlight a net income jump to KRW 22.26 billion for Q2 from KRW 17.90 billion last year, suggesting solid profitability momentum moving forward.

- Click to explore a detailed breakdown of our findings in Dongwon Systems' health report.

Gain insights into Dongwon Systems' past trends and performance with our Past report.

Where To Now?

- Navigate through the entire inventory of 187 KRX Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal