Euronext Amsterdam's Top 3 Dividend Stocks To Consider

Amidst a backdrop of cautious optimism in European markets, the Netherlands has seen its stock market indices rise, reflecting investor hopes for potential interest rate cuts by the European Central Bank. As investors seek stability and income in these uncertain times, dividend stocks on Euronext Amsterdam offer appealing opportunities with their potential for steady payouts.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.31% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.19% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.54% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.92% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.25% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 6.93% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.57% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

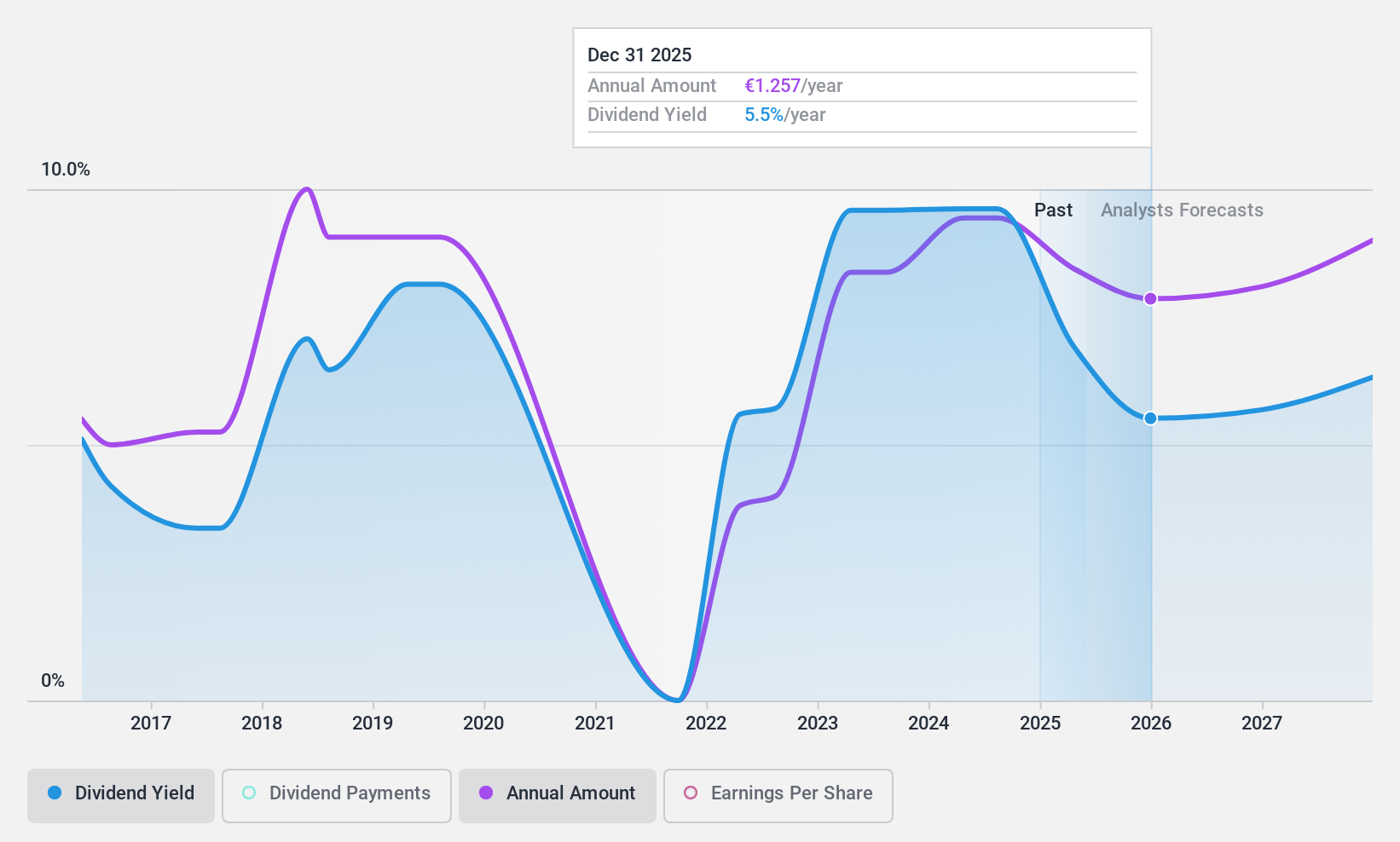

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €13.19 billion.

Operations: ABN AMRO Bank N.V.'s revenue is primarily derived from its Personal & Business Banking segment (€4.02 billion), Corporate Banking (€3.46 billion), and Wealth Management (€1.55 billion).

Dividend Yield: 9.5%

ABN AMRO Bank's dividend yield is among the highest in the Dutch market, yet its track record of less than 10 years shows volatility, with significant annual drops. Despite a reasonable payout ratio of 50.5%, earnings forecasts indicate potential declines, raising concerns about future coverage and stability. Recent interim dividends amounted to €500 million (EUR), but given the bank's unstable dividend history and expected earnings decline, caution may be warranted for long-term investors seeking reliability.

- Get an in-depth perspective on ABN AMRO Bank's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of ABN AMRO Bank shares in the market.

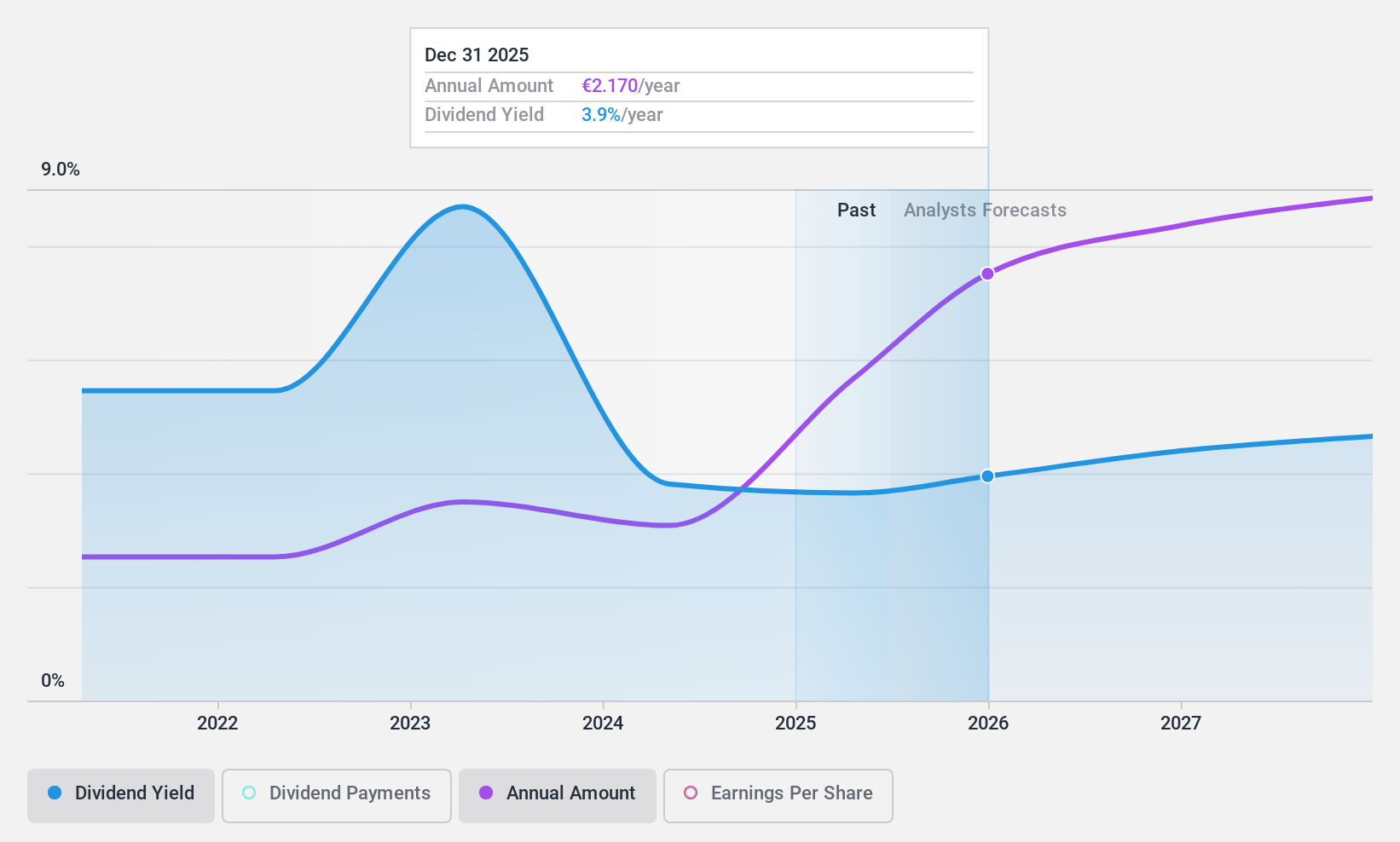

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in the property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €720.27 million.

Operations: Koninklijke Heijmans N.V.'s revenue segments include Connecting at €871.03 million and Segment Adjustment at €1.83 billion.

Dividend Yield: 3.3%

Koninklijke Heijmans' dividend payments have been volatile and unreliable over the past decade, despite a low payout ratio of 30% and a cash payout ratio of 20.7%, indicating strong coverage by earnings and cash flows. While the dividend yield is modest at 3.31%, recent financial performance shows improvement, with H1 2024 sales reaching €1.22 billion (EUR) and net income doubling to €37 million compared to last year, suggesting potential for future growth stability.

- Delve into the full analysis dividend report here for a deeper understanding of Koninklijke Heijmans.

- Our valuation report unveils the possibility Koninklijke Heijmans' shares may be trading at a discount.

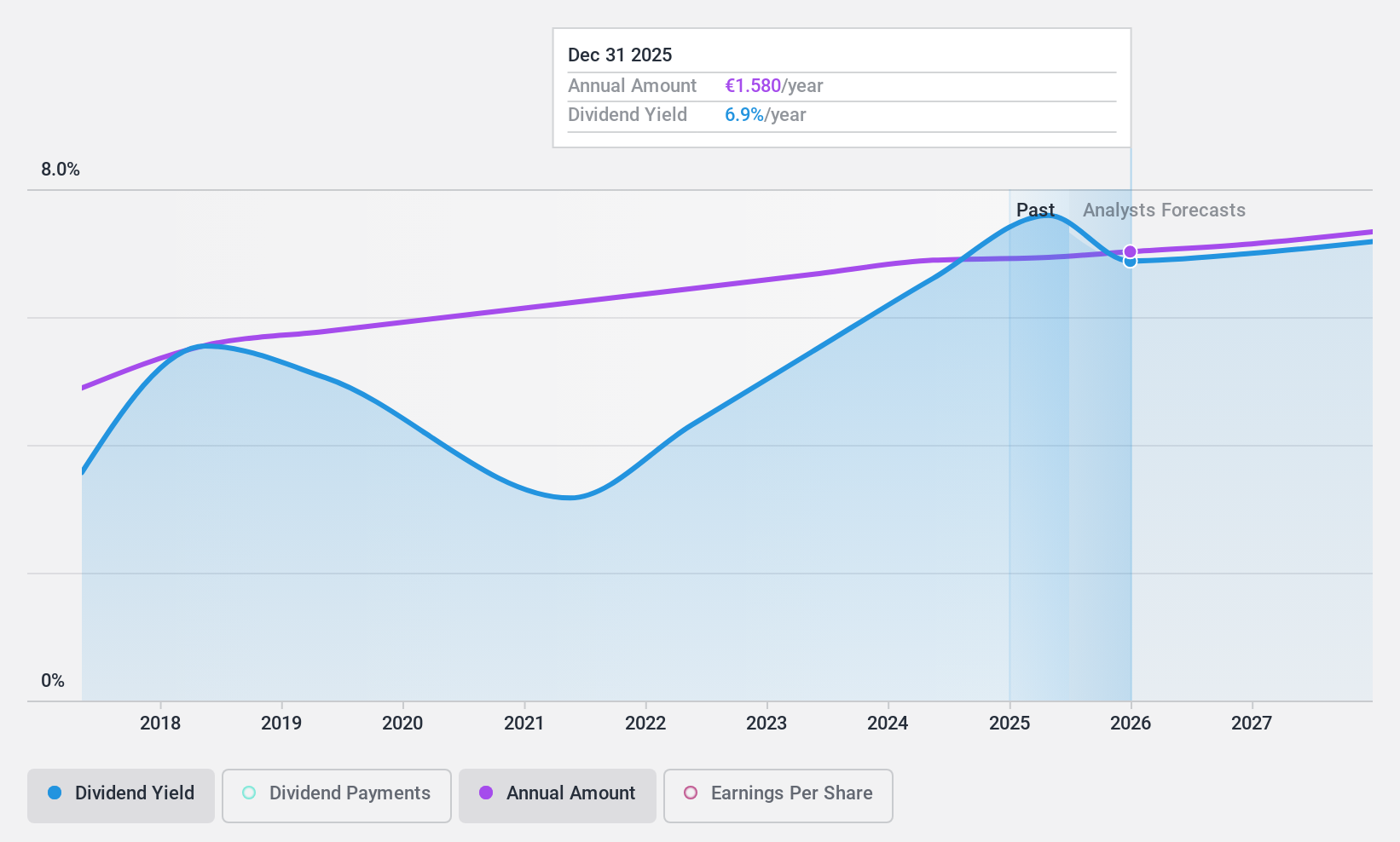

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and internationally with a market cap of €2.83 billion.

Operations: Signify N.V.'s revenue segments include €519 million from Conventional lighting.

Dividend Yield: 6.9%

Signify's dividend yield of 6.92% ranks it in the top 25% of Dutch dividend payers, supported by a cash payout ratio of 34.2%, indicating strong coverage by cash flows. However, its dividends have been volatile over the past eight years, with an earnings payout ratio at 80.4%. Despite recent earnings growth—net income rose to €62 million in Q2 2024—the company's removal from the FTSE All-World Index may impact investor sentiment.

- Click here to discover the nuances of Signify with our detailed analytical dividend report.

- Our valuation report here indicates Signify may be undervalued.

Key Takeaways

- Explore the 7 names from our Top Euronext Amsterdam Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal