Here's Why Mitie Group (LON:MTO) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Mitie Group (LON:MTO), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Mitie Group

How Fast Is Mitie Group Growing Its Earnings Per Share?

Mitie Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Mitie Group's EPS shot up from UK£0.068 to UK£0.10; a result that's bound to keep shareholders happy. That's a impressive gain of 49%.

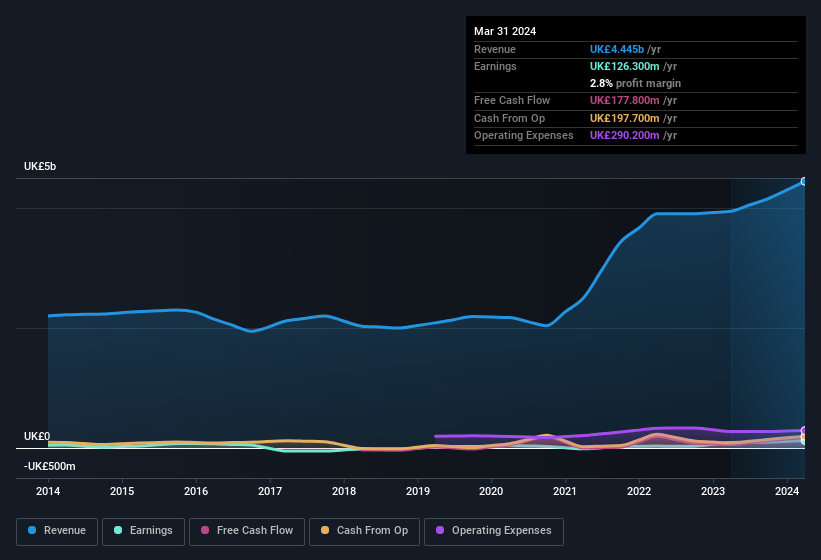

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Mitie Group achieved similar EBIT margins to last year, revenue grew by a solid 13% to UK£4.4b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Mitie Group's forecast profits?

Are Mitie Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Mitie Group insiders both bought and sold shares over the last twelve months, but they did end up spending UK£38k more on stock than they received from selling it. At face value we can consider this a fairly encouraging sign for the company.

Along with the insider buying, another encouraging sign for Mitie Group is that insiders, as a group, have a considerable shareholding. To be specific, they have UK£20m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.3% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Mitie Group Deserve A Spot On Your Watchlist?

You can't deny that Mitie Group has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Before you take the next step you should know about the 1 warning sign for Mitie Group that we have uncovered.

The good news is that Mitie Group is not the only stock with insider buying. Here's a list of small cap, undervalued companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal