Unearthing Undiscovered Gems in India This October 2024

The Indian market has remained flat over the past week but has experienced a remarkable 40% growth over the past year, with earnings projected to increase by 17% annually in the coming years. In this dynamic environment, identifying stocks that combine strong fundamentals with growth potential can offer intriguing opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 19.96% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market capitalization of ₹123.86 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities, which amount to ₹20.25 billion, and also earns from facilities and ancillary services as well as insurance broking and ancillary services. The company's cost structure is not detailed in the provided data.

IIFL Securities, a notable player in the Indian financial landscape, has shown impressive earnings growth of 120% over the past year, outpacing its industry peers. The company has reduced its debt to equity ratio from 117.6% to 67.2% over five years, indicating prudent financial management. Despite a volatile share price recently and some regulatory challenges with SEBI resulting in penalties totaling INR 4.8 lakh, IIFL's P/E ratio of 20x remains attractive compared to the broader market at 33.7x.

- Navigate through the intricacies of IIFL Securities with our comprehensive health report here.

Evaluate IIFL Securities' historical performance by accessing our past performance report.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

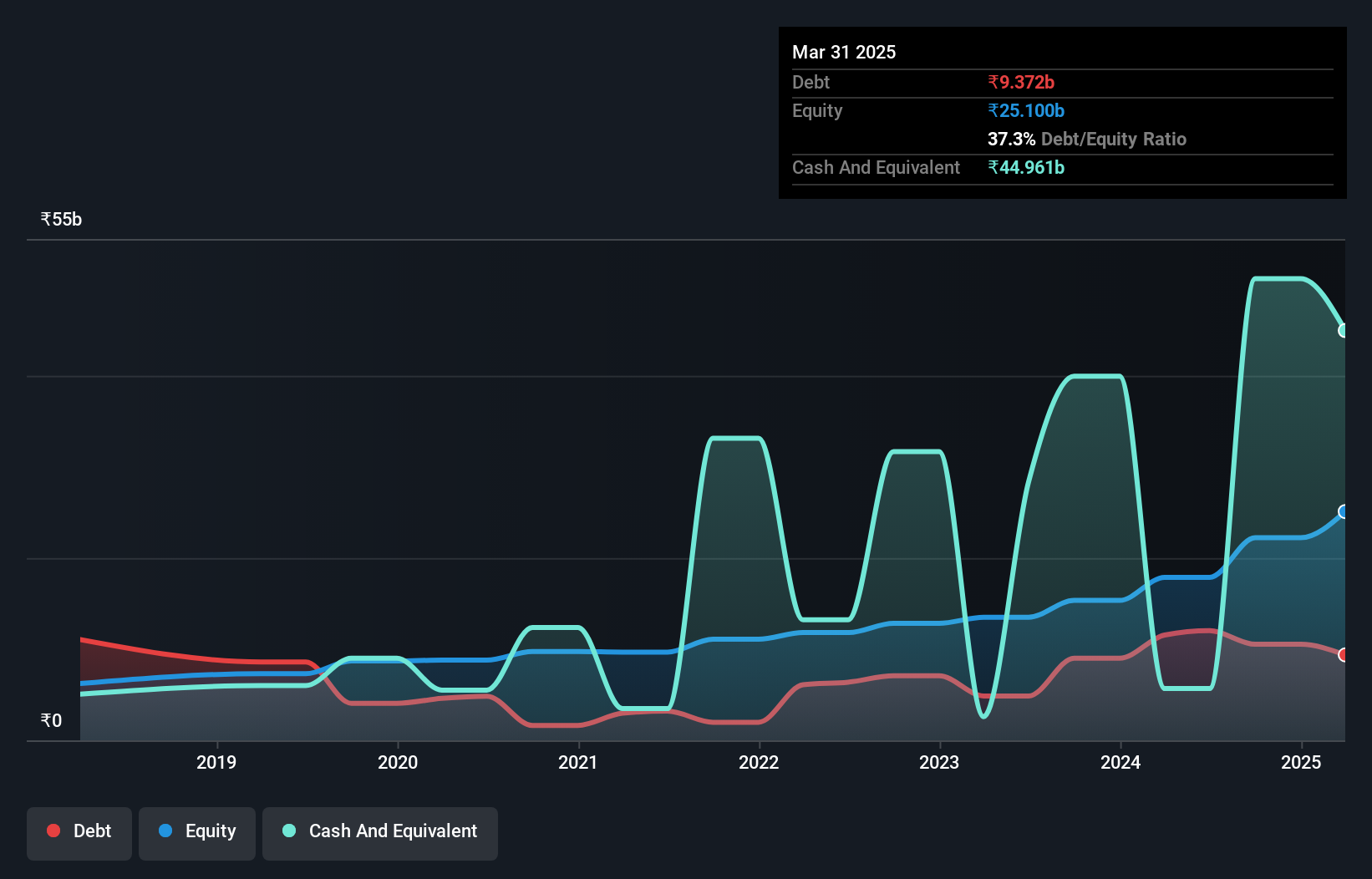

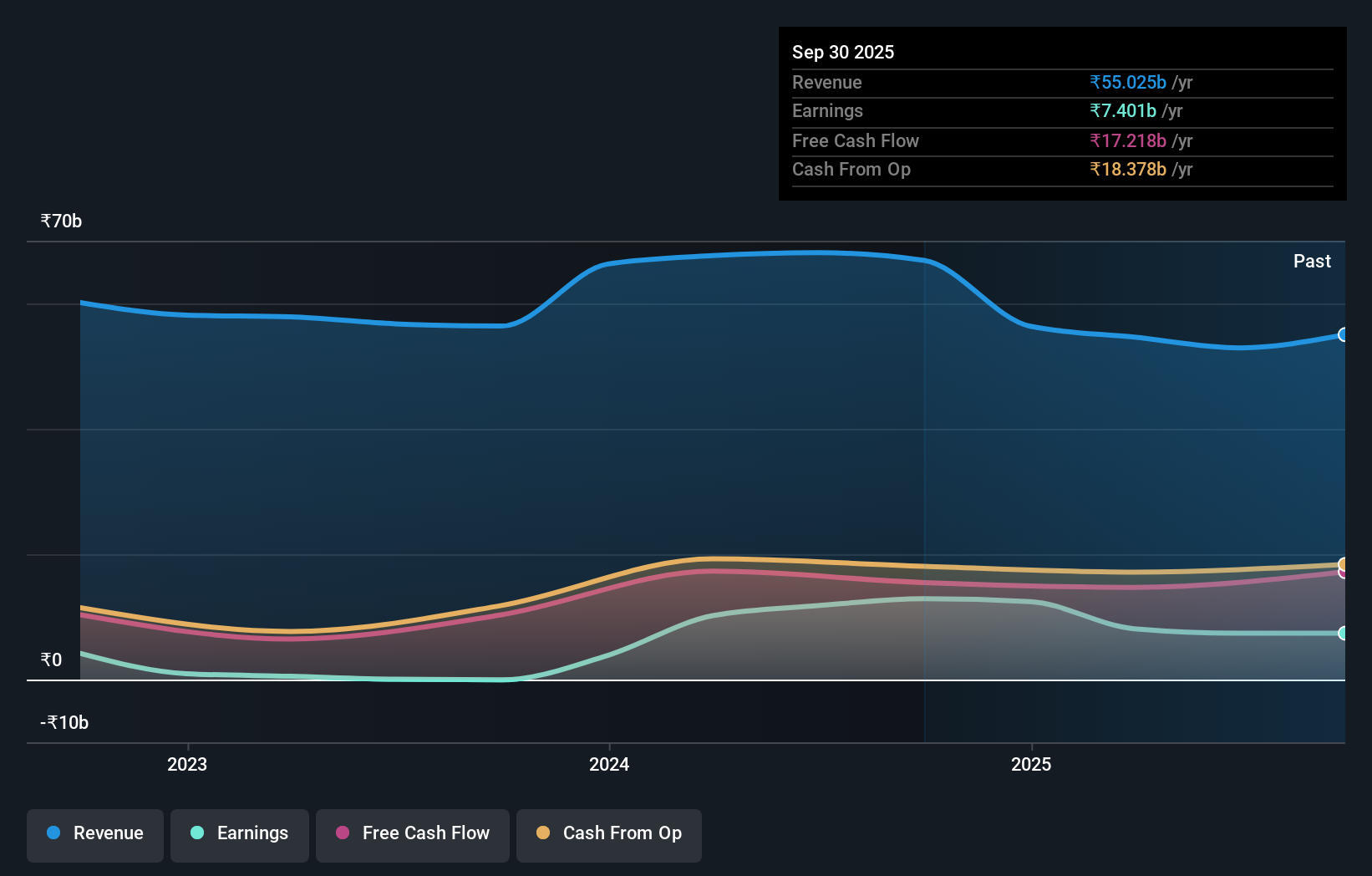

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both in India and internationally, with a market capitalization of ₹146.12 billion.

Operations: The company generates revenue primarily from its power segment, amounting to ₹61.68 billion, and coal segment at ₹6.59 billion.

Jaiprakash Power Ventures, a player in India's renewable energy sector, has shown considerable financial improvement. Over the past year, earnings skyrocketed by 22,969%, significantly outpacing the industry average of 12%. The company's debt-to-equity ratio impressively dropped from 254.1% to 37% over five years. However, a one-off loss of ₹6.9 billion impacted its recent financial results. Despite this setback, their interest payments are well-covered with EBIT at 5.2x coverage and free cash flow remains positive.

- Click here and access our complete health analysis report to understand the dynamics of Jaiprakash Power Ventures.

Assess Jaiprakash Power Ventures' past performance with our detailed historical performance reports.

Tips Music (NSEI:TIPSMUSIC)

Simply Wall St Value Rating: ★★★★★★

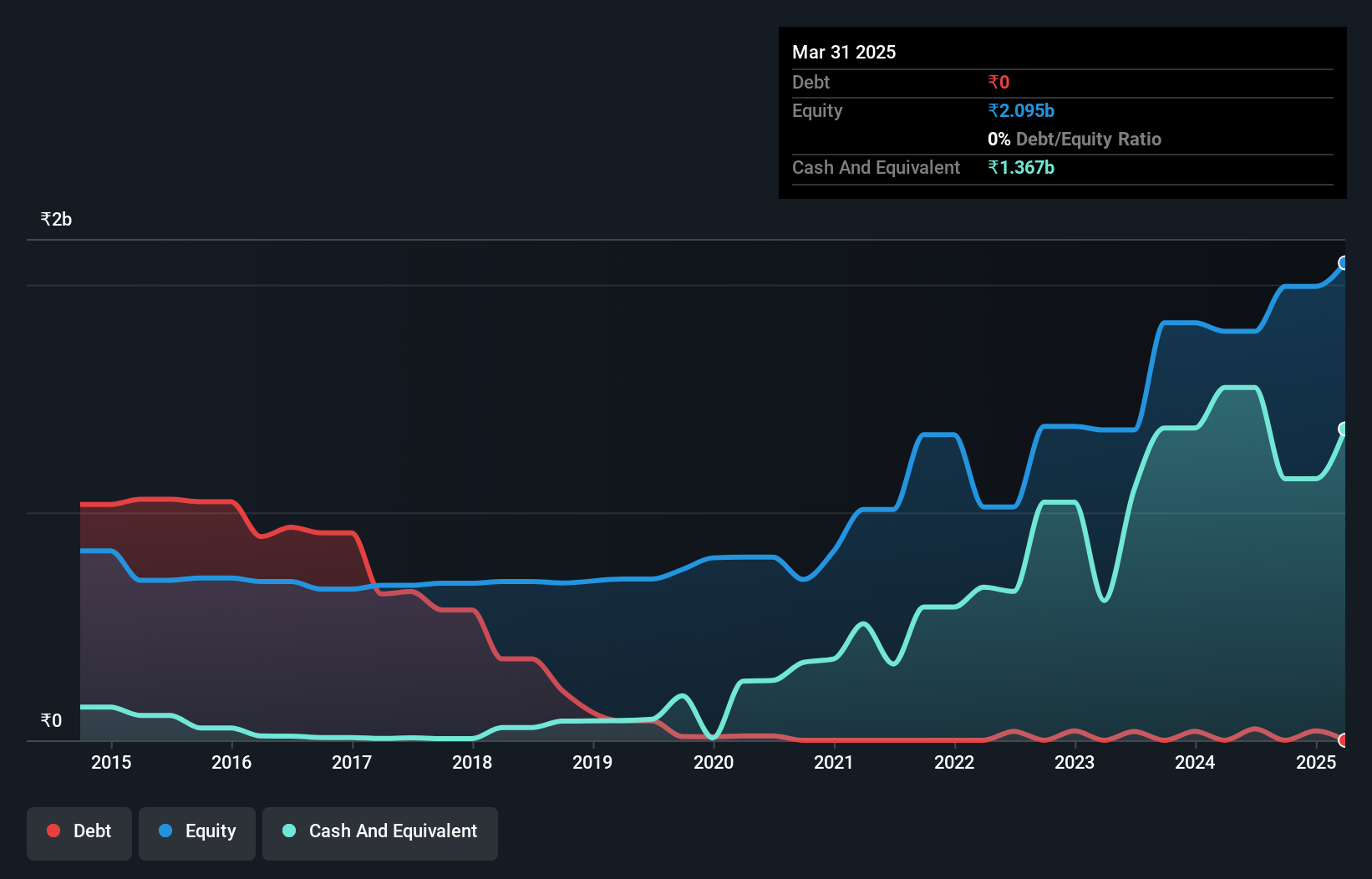

Overview: Tips Music Limited is involved in acquiring and exploiting music rights both in India and internationally, with a market cap of ₹105.69 billion.

Operations: The primary revenue stream for Tips Music Limited is derived from its music segment, which generated ₹2.63 billion. The company's financial performance is highlighted by a net profit margin of 36.5%.

This music company is making waves with a 66% earnings growth last year, outpacing the entertainment sector's 32%. It boasts high-quality earnings and a debt-to-equity ratio that improved from 12.1% to 2.8% over five years. With more cash than total debt, its financial position seems solid. Recent events include a dividend of ₹2 per share and participation in several industry conferences, indicating active engagement with stakeholders and potential for future growth.

- Take a closer look at Tips Music's potential here in our health report.

Explore historical data to track Tips Music's performance over time in our Past section.

Turning Ideas Into Actions

- Click this link to deep-dive into the 471 companies within our Indian Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal