SGX Stocks That May Be Undervalued In October 2024

As of late, Singapore's stock market has been characterized by cautious optimism, with investors closely monitoring economic indicators and global trends to gauge the potential for growth. In this context, identifying undervalued stocks on the SGX can be particularly appealing as they may offer opportunities for those looking to capitalize on discrepancies between a company's intrinsic value and its current market price.

Top 3 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.67 | SGD7.29 | 36% |

| Digital Core REIT (SGX:DCRU) | US$0.585 | US$0.82 | 28.5% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.83 | SGD1.42 | 41.7% |

| Seatrium (SGX:5E2) | SGD1.98 | SGD3.04 | 34.8% |

Let's take a closer look at a couple of our picks from the screened companies.

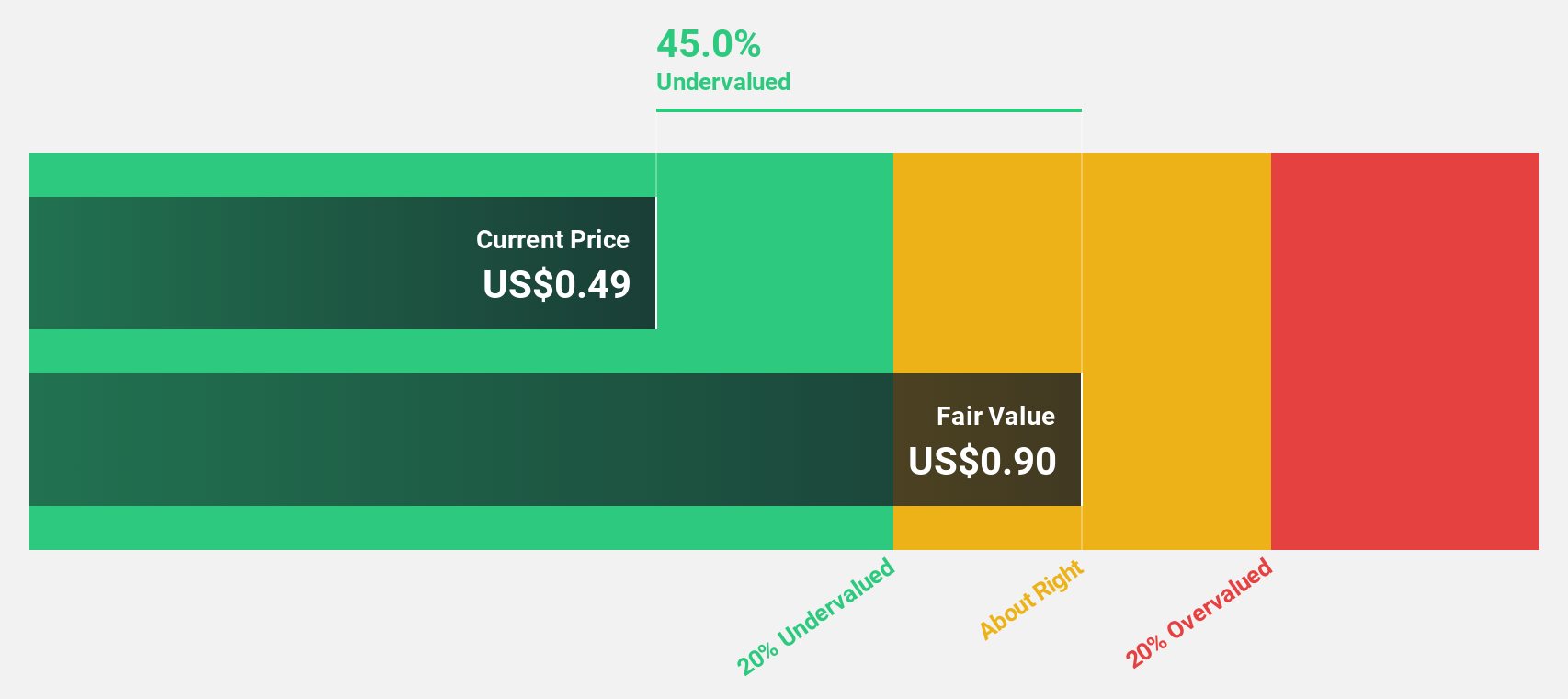

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a prominent Singapore-listed data centre REIT sponsored by Digital Realty, with a market cap of $760.33 million.

Operations: The company's revenue primarily comes from its REIT - Commercial segment, generating $70.76 million.

Estimated Discount To Fair Value: 28.5%

Digital Core REIT is trading at approximately 28.5% below its estimated fair value of US$0.82, with a current price of US$0.59, highlighting potential undervaluation based on discounted cash flow analysis. Despite a decrease in revenue to US$48.26 million for the first half of 2024, net income rose significantly to US$18.63 million year-on-year, suggesting improved profitability prospects as earnings are forecast to grow substantially by 96% annually over the next three years.

- The analysis detailed in our Digital Core REIT growth report hints at robust future financial performance.

- Get an in-depth perspective on Digital Core REIT's balance sheet by reading our health report here.

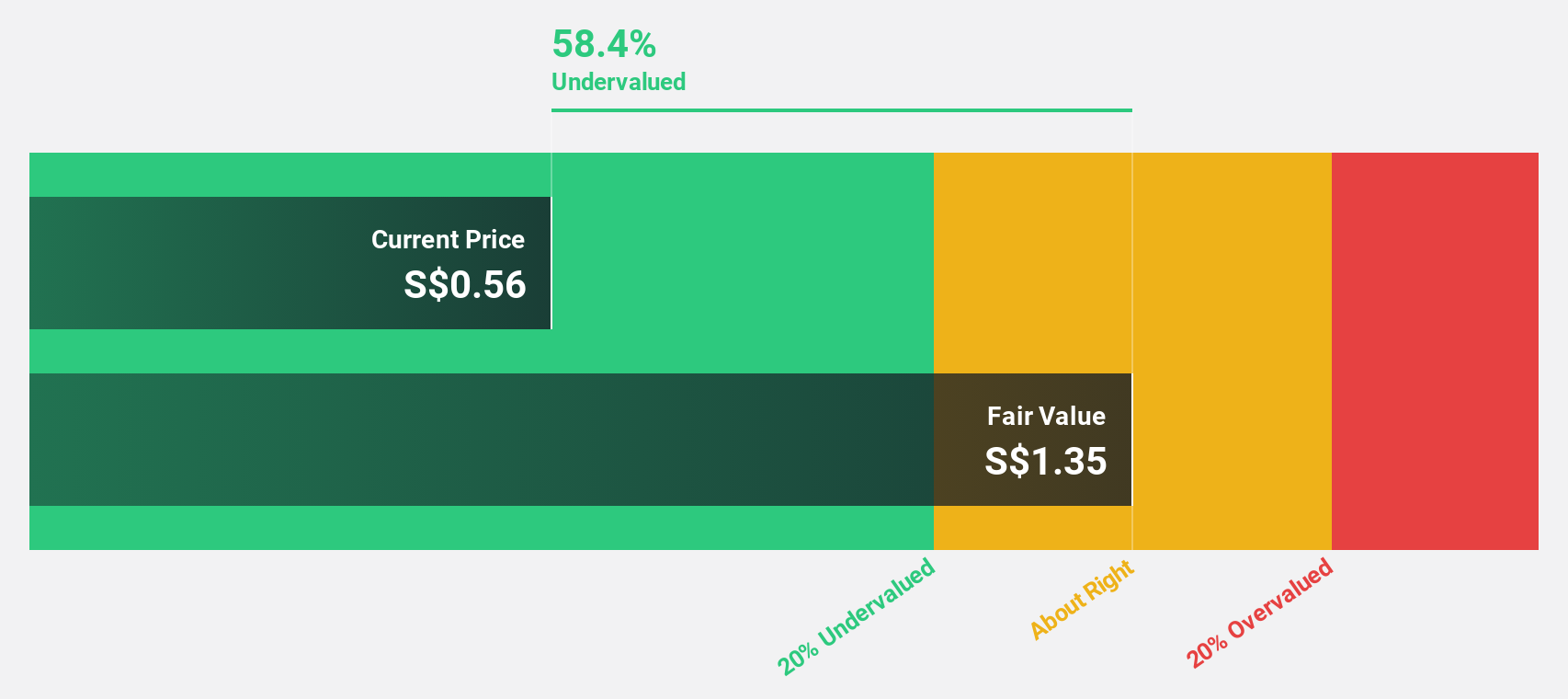

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD540.39 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue is primarily derived from its Advanced Materials segment at SGD153.32 million, followed by Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen contributing SGD1.40 million.

Estimated Discount To Fair Value: 41.7%

Nanofilm Technologies International is trading at S$0.83, significantly below its estimated fair value of S$1.42, suggesting potential undervaluation based on discounted cash flow analysis. Despite a net loss of S$3.74 million for the first half of 2024, revenue increased to S$82.65 million from the previous year. Earnings are projected to grow substantially by 54% annually over the next three years, outpacing market expectations and indicating robust future prospects despite current challenges in profit margins.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Nanofilm Technologies International with our comprehensive financial health report here.

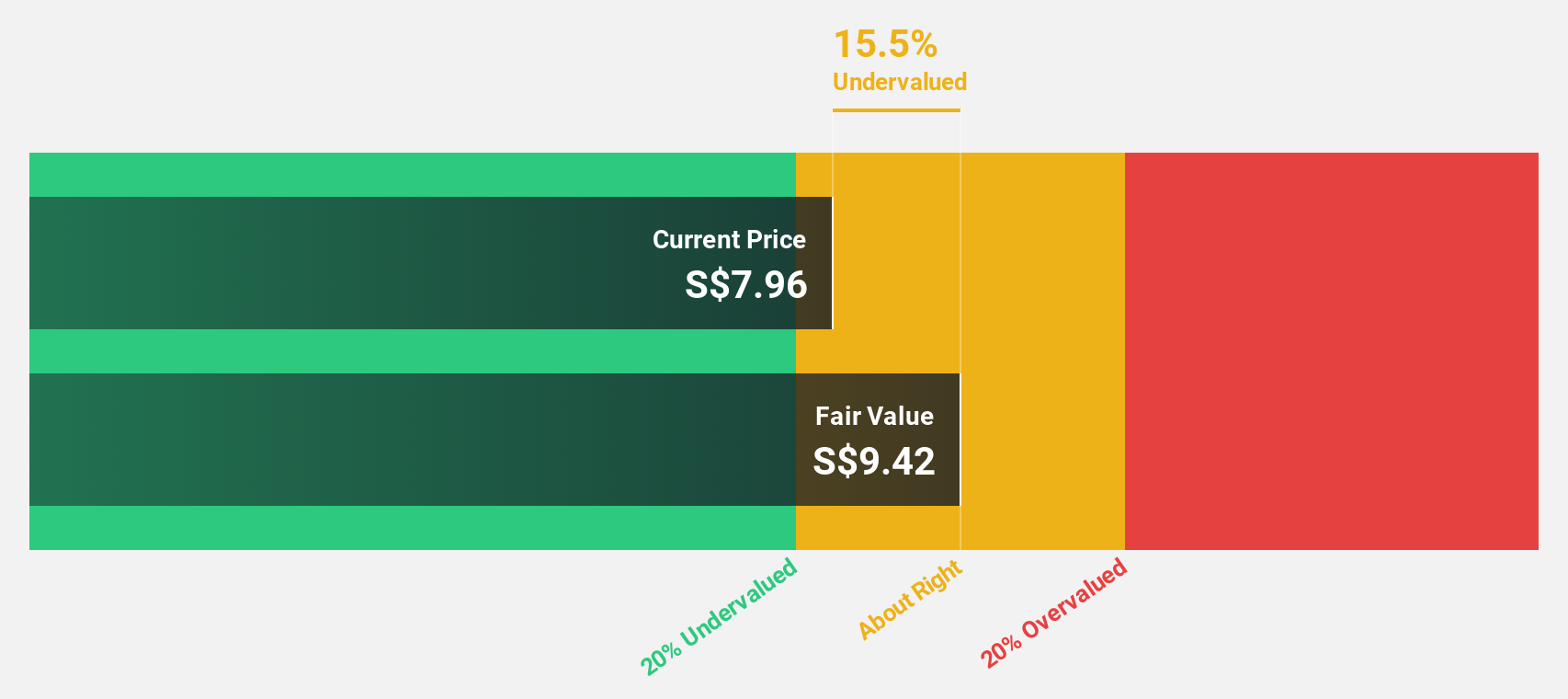

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market capitalization of SGD14.56 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace at SGD4.34 billion, Urban Solutions & Satcom at SGD2.01 billion, and Defence & Public Security at SGD4.54 billion.

Estimated Discount To Fair Value: 36%

Singapore Technologies Engineering is trading at S$4.67, below its estimated fair value of S$7.29, highlighting potential undervaluation based on cash flow analysis. Recent earnings showed revenue growth to S$5.52 billion with net income rising to S$336.53 million for the first half of 2024. The company’s strategic alliance with Toshiba Digital Solutions and SpeQtral aims to enhance its quantum security offerings, potentially boosting future revenue streams in critical sectors like government and financial services.

- According our earnings growth report, there's an indication that Singapore Technologies Engineering might be ready to expand.

- Unlock comprehensive insights into our analysis of Singapore Technologies Engineering stock in this financial health report.

Next Steps

- Discover the full array of 4 Undervalued SGX Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal