Undiscovered Gems In Hong Kong Promising Stocks For October 2024

As global markets experience fluctuations, the Hong Kong market has seen its benchmark Hang Seng Index decline by 6.53% recently, reflecting broader economic challenges and shifting investor sentiment. In this environment, identifying promising small-cap stocks becomes crucial as these companies often offer unique growth opportunities that can thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Uju Holding | 21.23% | -4.96% | -15.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Lvji Technology Holdings | 3.06% | 4.56% | -1.87% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market cap of HK$5.34 billion.

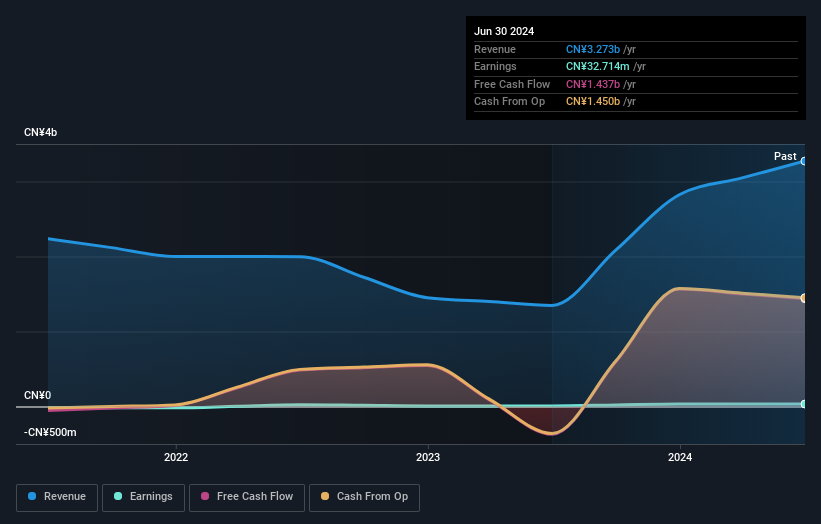

Operations: Sprocomm Intelligence generates its revenue primarily from the wireless communications equipment segment, totaling CN¥3.27 billion.

Sprocomm Intelligence, a small player in the tech scene, has been making waves with its impressive earnings growth of 301.3% over the past year, outpacing the industry's -0.6%. Despite this surge, their net income for the first half of 2024 was modest at CN¥9.86 million compared to CN¥9.51 million last year. The company seems undervalued trading at 93.6% below estimated fair value and has reduced its debt-to-equity ratio from 73.8% to 37.6% over five years, though interest coverage remains challenging at just 1.8x EBIT.

- Unlock comprehensive insights into our analysis of Sprocomm Intelligence stock in this health report.

Understand Sprocomm Intelligence's track record by examining our Past report.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

Overview: Plover Bay Technologies Limited, an investment holding company, designs, develops, and markets software-defined wide area network routers with a market capitalization of HK$5.34 billion.

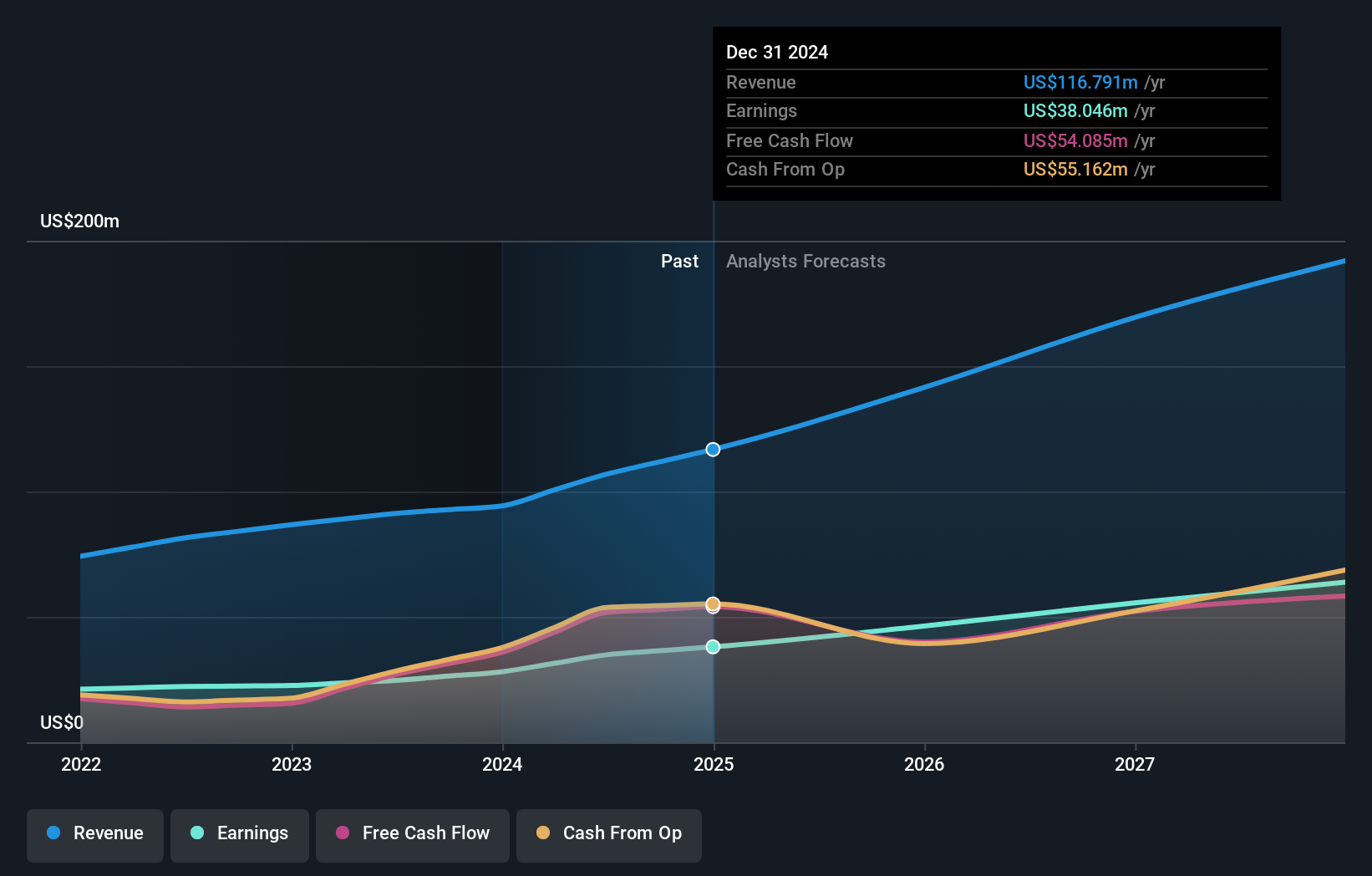

Operations: The company generates revenue primarily from sales of SD-WAN routers, with HK$15.19 million from fixed first connectivity and HK$59.87 million from mobile first connectivity, alongside software licenses and warranty support services contributing HK$31.86 million.

Plover Bay Technologies, a nimble player in the tech space, has seen its earnings soar by 41% over the past year, outpacing the broader Communications sector. The company reported half-year sales of US$57 million and net income of US$19 million, showcasing robust financial health. Despite an increased debt to equity ratio from 2.7% to 8.3% over five years, it remains well-capitalized with more cash than total debt. Recent leadership changes aim to enhance board diversity and expertise in legal domains.

Best Pacific International Holdings (SEHK:2111)

Simply Wall St Value Rating: ★★★★★★

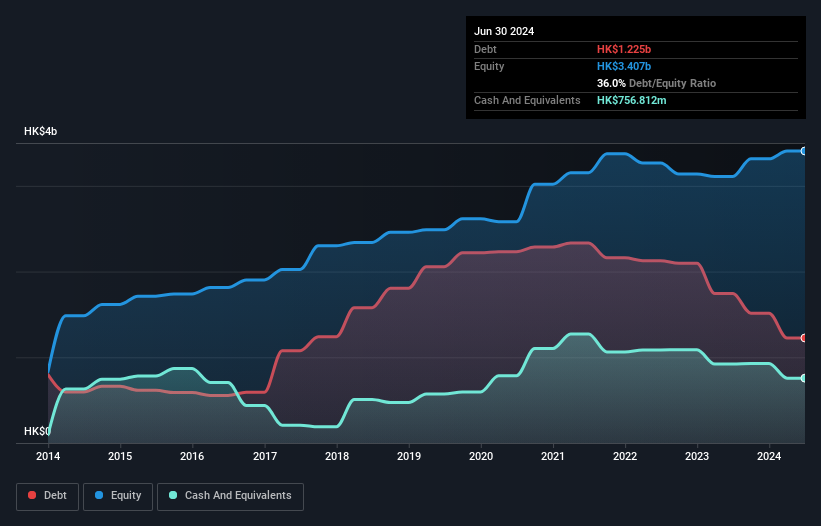

Overview: Best Pacific International Holdings Limited is engaged in the manufacturing, trading, and sale of elastic fabric, elastic webbing, and lace, with a market capitalization of approximately HK$2.82 billion.

Operations: The company generates revenue primarily from the manufacturing and trading of elastic fabric and lace, contributing HK$3.76 billion, and elastic webbing, adding HK$915.53 million.

Best Pacific International Holdings, a smaller player in the market, has shown impressive financial strides. The company reported sales of HK$2.39 billion for the first half of 2024, up from HK$1.91 billion last year, with net income doubling to HK$277 million. Earnings per share also rose to HK$0.27 from HK$0.13 previously. Additionally, it declared an interim dividend of HK$0.13 per share for this period, reflecting robust growth and shareholder rewards amidst strong industry performance.

Next Steps

- Click through to start exploring the rest of the 165 SEHK Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal