Jiangsu Liance Electromechanical Technology Co., Ltd. (SHSE:688113) Stock Catapults 43% Though Its Price And Business Still Lag The Market

Jiangsu Liance Electromechanical Technology Co., Ltd. (SHSE:688113) shares have had a really impressive month, gaining 43% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

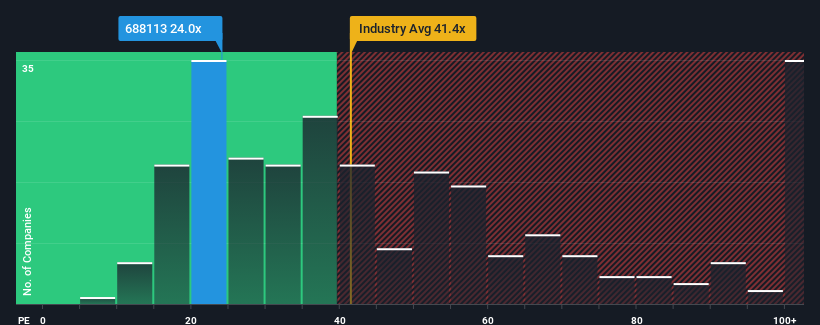

Even after such a large jump in price, Jiangsu Liance Electromechanical Technology may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 24x, since almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 61x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The recent earnings growth at Jiangsu Liance Electromechanical Technology would have to be considered satisfactory if not spectacular. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Jiangsu Liance Electromechanical Technology

How Is Jiangsu Liance Electromechanical Technology's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jiangsu Liance Electromechanical Technology's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 6.3%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 15% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 37% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Jiangsu Liance Electromechanical Technology's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The latest share price surge wasn't enough to lift Jiangsu Liance Electromechanical Technology's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangsu Liance Electromechanical Technology maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Jiangsu Liance Electromechanical Technology (1 is a bit unpleasant!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Jiangsu Liance Electromechanical Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal