There's Reason For Concern Over Jiangxi Hungpai New Material Co., Ltd.'s (SHSE:605366) Massive 41% Price Jump

Jiangxi Hungpai New Material Co., Ltd. (SHSE:605366) shares have had a really impressive month, gaining 41% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

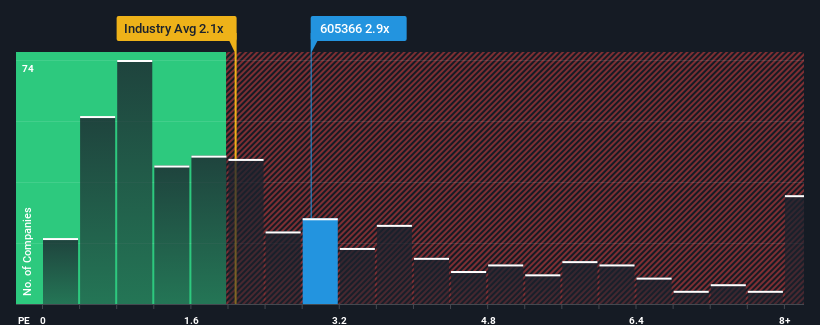

Since its price has surged higher, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Jiangxi Hungpai New Material as a stock to potentially avoid with its 2.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Jiangxi Hungpai New Material

What Does Jiangxi Hungpai New Material's P/S Mean For Shareholders?

The recent revenue growth at Jiangxi Hungpai New Material would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangxi Hungpai New Material's earnings, revenue and cash flow.How Is Jiangxi Hungpai New Material's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Jiangxi Hungpai New Material's to be considered reasonable.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. Pleasingly, revenue has also lifted 47% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Jiangxi Hungpai New Material's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Jiangxi Hungpai New Material's P/S?

The large bounce in Jiangxi Hungpai New Material's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Jiangxi Hungpai New Material revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for Jiangxi Hungpai New Material (1 is potentially serious!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal