Cautious Investors Not Rewarding CK Hutchison Holdings Limited's (HKG:1) Performance Completely

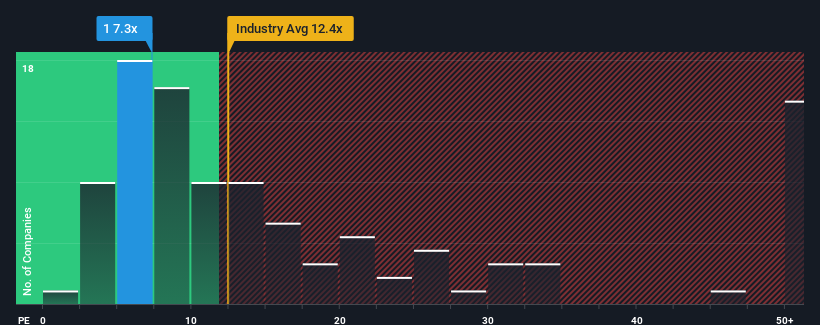

With a price-to-earnings (or "P/E") ratio of 7.3x CK Hutchison Holdings Limited (HKG:1) may be sending bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

CK Hutchison Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for CK Hutchison Holdings

How Is CK Hutchison Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as CK Hutchison Holdings' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 34% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is not materially different.

In light of this, it's peculiar that CK Hutchison Holdings' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From CK Hutchison Holdings' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that CK Hutchison Holdings currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Having said that, be aware CK Hutchison Holdings is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on CK Hutchison Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal