Lands' End Up 13% in a Month: Is Now the Moment to Invest In LE Stock?

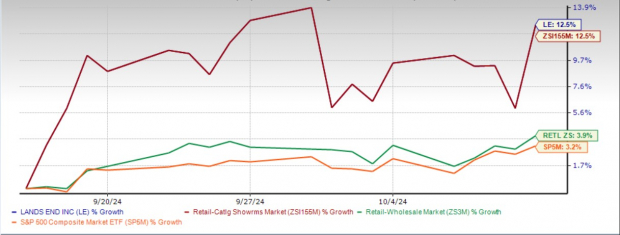

Lands' End, Inc. LE is capturing attention on Wall Street with a remarkable 12.5% surge in its stock price over the past month. While many stocks struggled due to market volatility, LE’s performance has sparked interest among investors seeking promising opportunities. This surge reflects the company's effective implementation of a solutions-based strategy, marked by innovations across its business operations.

As Lands' End navigates the dynamic retail sector, a crucial question emerges: Is this momentum sustainable, and if so, is now the right time to invest in LE stock?

With a clear focus on brand evolution, enhanced product offerings and supply chain optimization, Lands' End is strategically positioned for continued growth in the competitive market of high-quality apparel and home products. While shares of this Dodgeville, WI-based company have moved in line with the industry, they have outperformed the broader S&P 500 and the Retail-Wholesale sector, which saw growth of 3.2% and 3.9%, respectively, in the past month.

LE Stock’s Past One-Month Performance

Image Source: Zacks Investment Research

Closing Friday’s trading session at $17.06, Lands' End is currently trading near the 52-week high of $18.27 attained on July 29, 2024. The current price reflects a slight pullback from the peak, which may be due to some profit booking or hiccups related to geopolitical concerns. However, if the stock manages to break through its 52-week ceiling, it could reignite buying interest and attract new investors.

Technical indicators support Lands' End’s strong performance. The stock is trading above its 50-day and 200-day moving averages, indicating robust upward momentum and price stability. This technical strength reflects positive market perception and confidence in Lands' End’s financial health and prospects.

Lands’ End Trades Above 50 & 200-Day Moving Averages

Image Source: Zacks Investment Research

Is LE Stock’s Momentum Sustainable?

Lands' End has showcased resilience and adaptability in the evolving retail landscape. By embracing innovative product strategies, optimizing operations and executing effective marketing tactics, the company is well-positioned for future growth. Its emphasis on both business-to-business and business-to-consumer channels has broadened its market reach and strengthened its competitive standing.

Product innovation remains a key driver of Lands' End's success, fueling sales growth. The company’s commitment to newness and speed-to-market has enhanced its inventory position, with a notable 21% year-over-year improvement and a 15% increase in inventory churn rate registered in the second quarter of fiscal 2024. Efficient inventory management has enabled quicker responses to changing consumer demand and preserved margins, contributing to a 470-basis point improvement in gross margin for the quarter.

The company's strategic partnerships and expansion into third-party distribution channels have opened up new growth opportunities. Recent collaborations, such as with Nordstrom’s JWN online marketplace, have increased brand visibility and broadened the customer base. Licensing agreements have also created a consistent revenue stream, allowing the company to focus on core operations while diversifying its sources of income.

Lands' End has also made strides in elevating its brand, particularly through digital channels. Its U.S. e-commerce channel, the largest direct-to-consumer segment, has delivered six consecutive quarters of gross margin improvement with an increase of more than 700 basis points in the last reported quarter due to its refined marketing strategy and targeted promotions. The company’s European e-commerce business registered a 26% rise in gross profit driven by full-price sales, lower promotional activity and improved inventory management.

Looking ahead, Lands' End has raised its full-year profit guidance, expecting continued gross margin expansion and mid-to-high single-digit growth in Gross Merchandise Value. The company now anticipates adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) in the range of $90 million to $98 million, up from the prior estimate of $88-$97 million. It now foresees adjusted earnings between 29 cents and 48 cents a share, up from the earlier guided range of 18 cents to 41 cents.

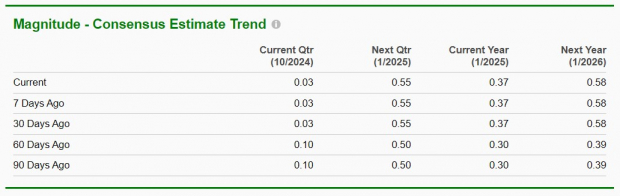

How Do Consensus Estimates Measure Up for LE Stock?

Wall Street analysts have expressed confidence in Lands' End stock by raising their earnings per share estimates. Over the past 60 days, the Zacks Consensus Estimate for the current fiscal year has jumped 23.3% to 37 cents per share, while projections for the next fiscal year have surged 48.7% to 58 cents per share, highlighting growing optimism about the company's future performance.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

What Lands' End's Valuation Reveals About the Stock’s Potential

Lands' End is currently trading in line with the industry but at a premium to the S&P 500, signaling strong investor confidence in the company’s future growth. The company has a forward price-to-earnings (P/E) ratio of 32.98, compared with the S&P 500's 22.09. However, Lands' End's stock is trading below its median P/E of 56.81 reached over the past year, indicating further potential for growth.

The company’s emphasis on product innovation, digital expansion and efficient operations justifies this premium, as investors see it as well-positioned to deliver above-market returns. The company’s Value Score of A further underscores its attractiveness as an investment.

Image Source: Zacks Investment Research

Is Now the Right Time to Buy LE Stock?

Lands' End presents a compelling investment opportunity. It is poised for sustained profitability and shareholder value creation through a strong focus on innovation, market expansion and enhanced customer engagement. The company’s robust gross margin expansion, effective inventory management and success in key product categories are critical factors supporting its optimistic outlook, despite competition from Zumiez ZUMZ and The Gap GAP.

Those who have already benefited from recent gains may hold onto Lands' End stock or even increase their stake. Furthermore, with the stock currently trading at a discount compared to historical benchmarks, potential investors have an excellent opportunity to invest in this Zacks Rank #1 (Strong Buy) company. You can see the complete list of today’s Zacks #1 Rank stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

The Gap, Inc. (GAP): Free Stock Analysis Report

Lands' End, Inc. (LE): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal