Bausch + Lomb Corporation (NYSE:BLCO) Shares Fly 25% But Investors Aren't Buying For Growth

Bausch + Lomb Corporation (NYSE:BLCO) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

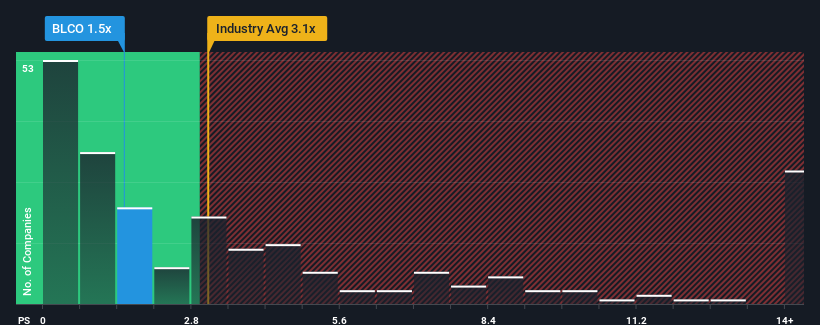

Even after such a large jump in price, Bausch + Lomb may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.1x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Bausch + Lomb

How Bausch + Lomb Has Been Performing

With revenue growth that's superior to most other companies of late, Bausch + Lomb has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Bausch + Lomb will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Bausch + Lomb?

In order to justify its P/S ratio, Bausch + Lomb would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. The latest three year period has also seen a 22% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 6.4% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 9.1% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Bausch + Lomb's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Bausch + Lomb's P/S Mean For Investors?

Bausch + Lomb's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bausch + Lomb maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Bausch + Lomb with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal