3 UK Growth Stocks With High Insider Ownership

The United Kingdom market has been relatively stable over the past week, but it has experienced a 7.5% increase over the past year, with earnings expected to grow by 14% annually. In this context, growth companies with high insider ownership can be appealing as they often indicate confidence from those closest to the business in its potential for future success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 81.3% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Tortilla Mexican Grill (AIM:MEX) | 27.4% | 120.4% |

Let's uncover some gems from our specialized screener.

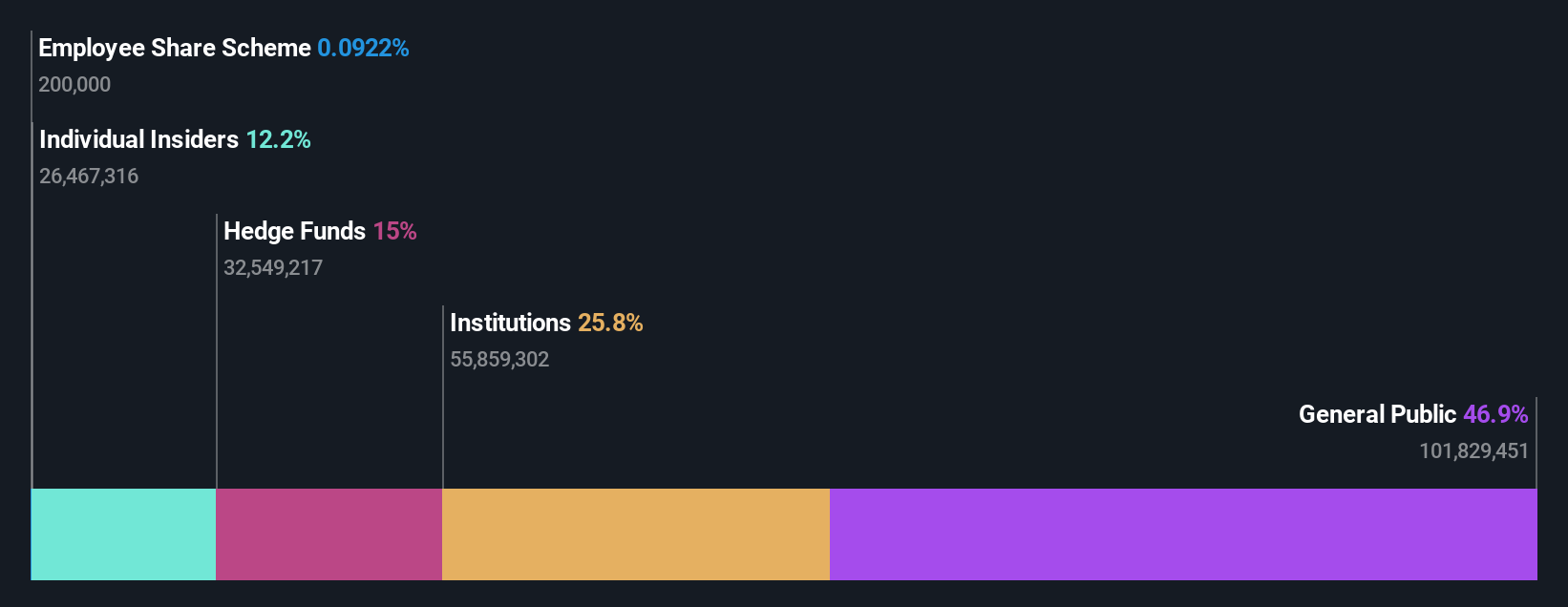

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £292.79 million.

Operations: The company's revenue is derived entirely from the exploration and production of oil and gas, amounting to $115.15 million.

Insider Ownership: 12.2%

Earnings Growth Forecast: 81.3% p.a.

Gulf Keystone Petroleum is experiencing substantial insider buying, indicating confidence in its growth prospects. The company forecasts significant revenue growth of 42.6% annually, outpacing the UK market's 3.5%. Despite a recent $20 million dividend declaration, concerns exist about its sustainability due to limited earnings coverage. Recent board changes include David Thomas as Chair and new appointments like Catherine Krajicek and Marianne Daryabegui, potentially strengthening governance amid evolving strategic goals.

- Get an in-depth perspective on Gulf Keystone Petroleum's performance by reading our analyst estimates report here.

- The analysis detailed in our Gulf Keystone Petroleum valuation report hints at an inflated share price compared to its estimated value.

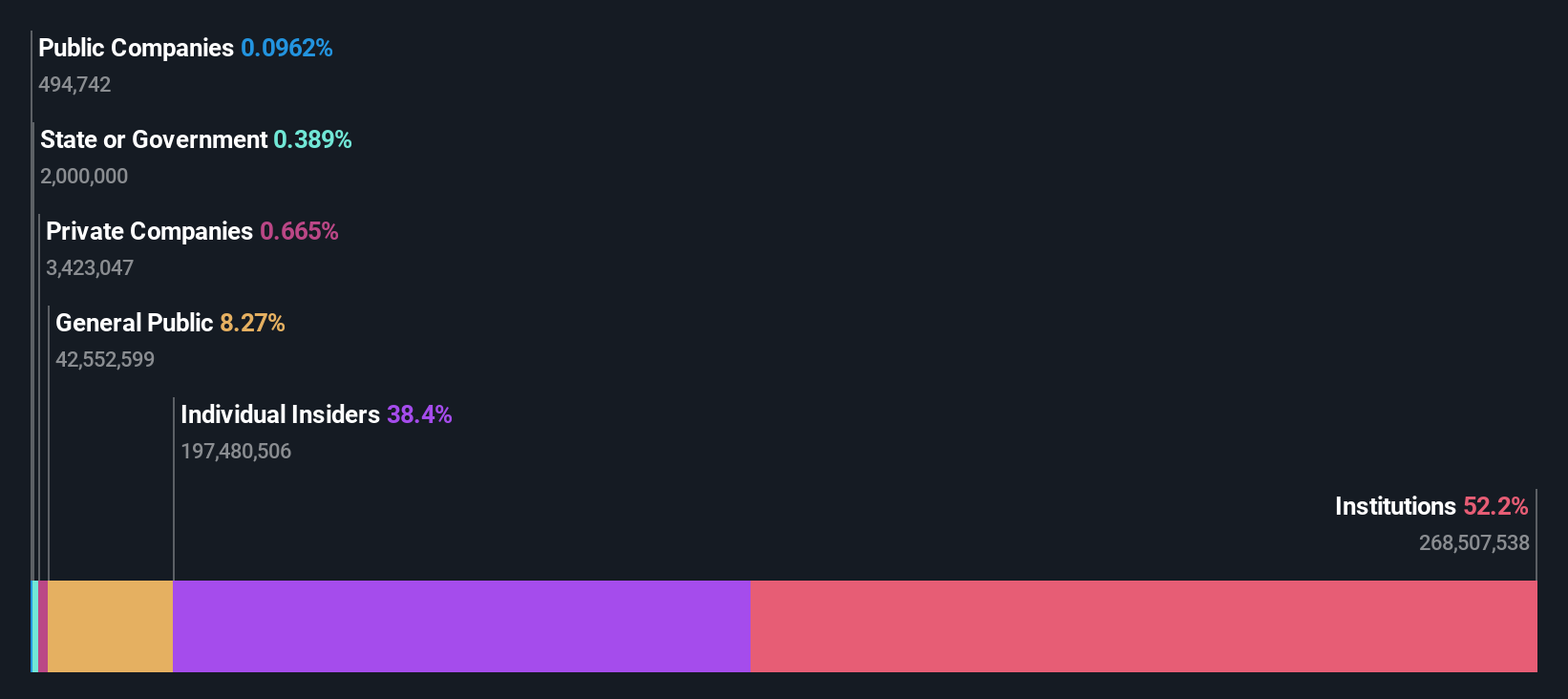

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £1.05 billion.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 49.8% p.a.

Hochschild Mining is trading at a substantial discount to its estimated fair value, with earnings forecasted to grow significantly at 49.82% annually, surpassing the UK market's growth rate. Despite high debt levels and volatile share prices, the company has returned to profitability this year. Recent earnings reports show improved financial performance, with H1 2024 net income reaching US$39.52 million compared to a loss last year, reflecting operational resilience amid production increases in gold and silver equivalents.

- Delve into the full analysis future growth report here for a deeper understanding of Hochschild Mining.

- Our valuation report here indicates Hochschild Mining may be overvalued.

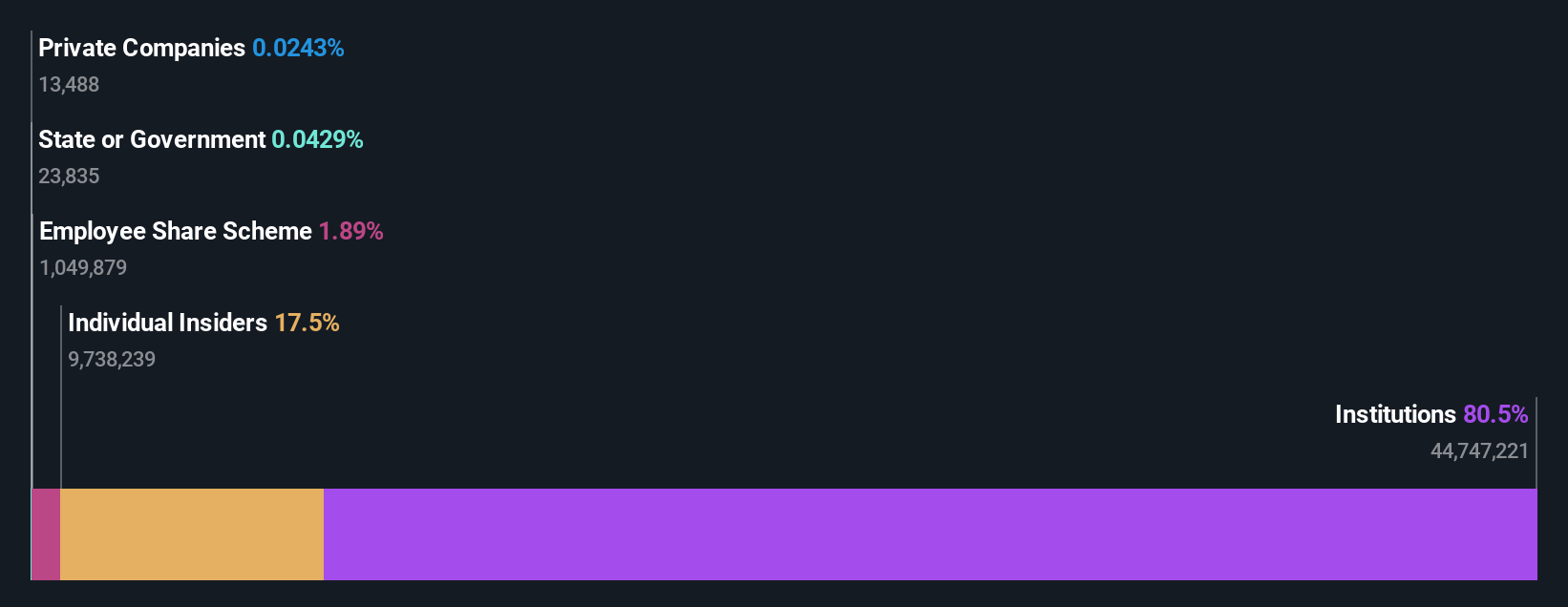

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.45 billion, operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Operations: The company's revenue segments include Uzbekistan Operations, which contribute GEL 236.42 million.

Insider Ownership: 17.6%

Earnings Growth Forecast: 15.3% p.a.

TBC Bank Group is trading at a significant discount to its estimated fair value, with earnings projected to grow 15.3% annually, outpacing the UK market. The bank's revenue growth of 18.9% is also expected to surpass the market average. Recent earnings reports highlight strong financial performance, with net income rising to GEL 617.4 million for H1 2024 from GEL 537.46 million last year, though it maintains a low allowance for bad loans at 76%.

- Take a closer look at TBC Bank Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that TBC Bank Group is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 60 Fast Growing UK Companies With High Insider Ownership now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal