October 2024's Top Undervalued Small Caps With Insider Action

As global markets continue to experience fluctuations, with U.S. stocks reaching new highs amid the earnings season and inflation slightly exceeding expectations, small-cap stocks are navigating a complex landscape. The S&P MidCap 400 Index's rise alongside broader market indices highlights opportunities within smaller companies that may be poised for growth despite economic uncertainties. In this context, identifying promising small-cap stocks involves assessing their potential for resilience and growth in light of current market dynamics and insider activity, which can provide valuable insights into the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 21.8x | 1.0x | 40.71% | ★★★★★☆ |

| Tourism Holdings | 9.8x | 0.4x | 37.93% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.6x | 18.08% | ★★★★☆☆ |

| Rogers Sugar | 15.7x | 0.6x | 47.26% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 17.65% | ★★★★☆☆ |

| Essentra | 721.2x | 1.4x | 26.84% | ★★★★☆☆ |

| Genus | 170.1x | 2.0x | -1.50% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 40.05% | ★★★★☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -107.10% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

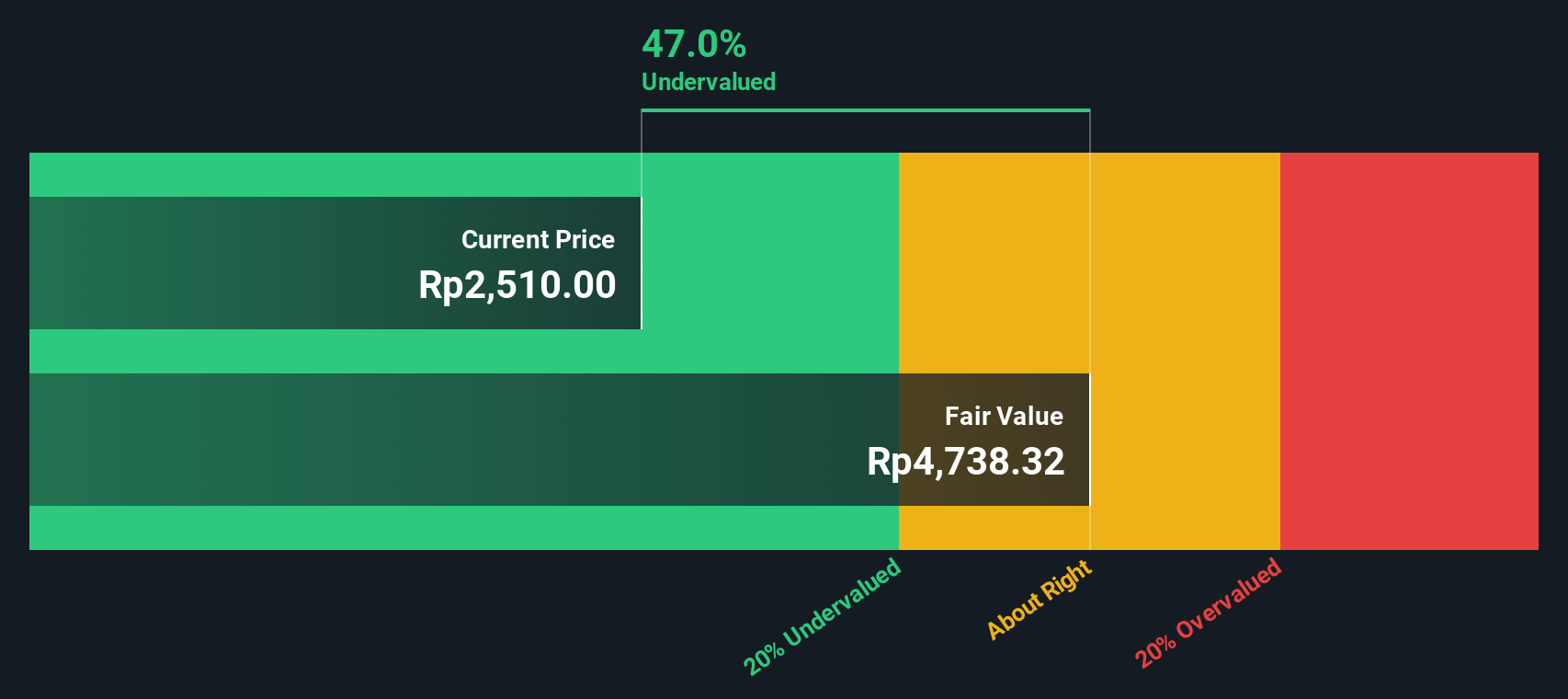

Semen Indonesia (Persero) (IDX:SMGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Semen Indonesia (Persero) is a leading cement producer in Indonesia, engaged in both cement and non-cement production activities, with a market capitalization of IDR 53.71 trillion.

Operations: The company's revenue primarily stems from Cement Production, contributing IDR 33.81 billion, and Non-Cement Production with IDR 13.35 billion. Over recent periods, the gross profit margin has shown a downward trend, reaching 25.72% by March 2024. Cost of Goods Sold (COGS) consistently represents a significant portion of expenses, impacting overall profitability. Operating expenses have remained substantial but relatively stable in comparison to COGS fluctuations over time.

PE: 16.1x

Semen Indonesia, a player in the cement industry, recently showcased insider confidence with Agung Wiharto purchasing 521,139 shares for approximately IDR 2.01 billion. Despite a dip in half-year sales and net income compared to last year, the company remains focused on growth with earnings projected to rise by over 16% annually. Although reliant on external borrowing, this small company aims to leverage its strategic moves presented at recent conferences for future potential.

- Unlock comprehensive insights into our analysis of Semen Indonesia (Persero) stock in this valuation report.

Understand Semen Indonesia (Persero)'s track record by examining our Past report.

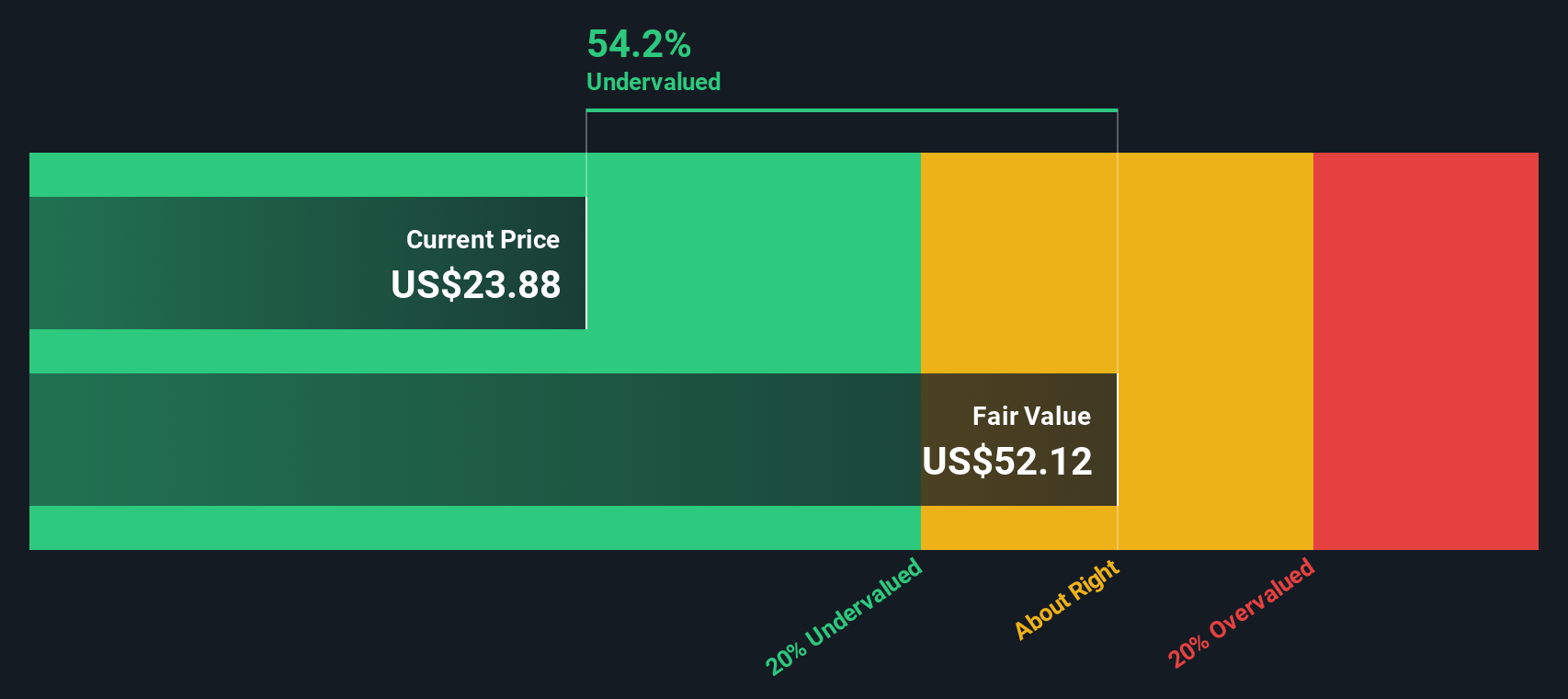

Phibro Animal Health (NasdaqGM:PAHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phibro Animal Health is a company that specializes in animal health and nutrition products, with operations in animal health, mineral nutrition, and performance products, and has a market capitalization of approximately $0.88 billion.

Operations: The company generates revenue primarily from Animal Health, Mineral Nutrition, and Performance Products segments. Over recent periods, the gross profit margin has fluctuated around 30%, with notable changes in net income margin reflecting varying profitability levels. Operating expenses have consistently impacted overall financial performance, with general and administrative expenses being a significant component.

PE: 393.8x

Phibro Animal Health, a smaller company in the animal health sector, has been navigating financial challenges with recent net income dropping to US$2.42 million for the fiscal year ending June 2024 from US$32.61 million previously. Despite this, insider confidence is evident as insiders purchased shares throughout 2024, signaling belief in future prospects. The company anticipates net sales between US$1.04 billion and US$1.09 billion for fiscal 2025, driven by growth in its Animal Health segment and recovery in other areas.

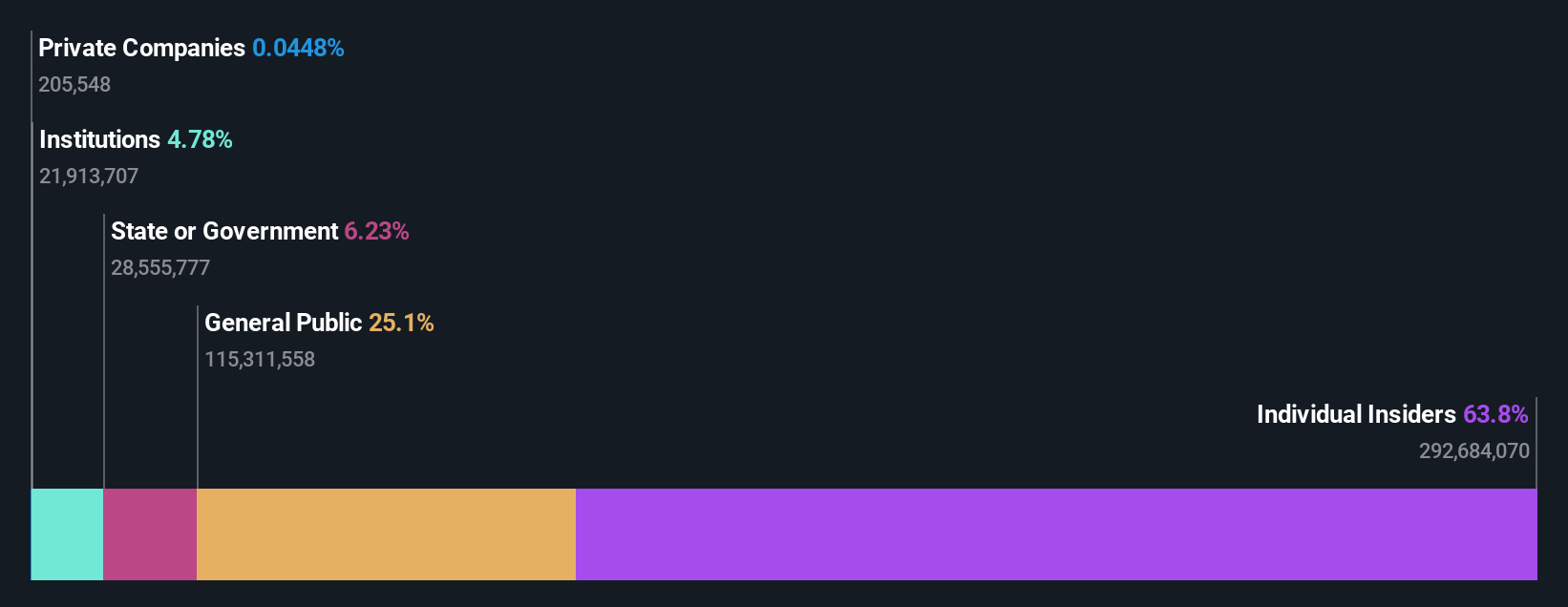

Gujarat Ambuja Exports (NSEI:GAEL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Gujarat Ambuja Exports operates in agro-processing, maize processing, spinning, and renewable power sectors with a market capitalization of ₹66.23 billion.

Operations: The company's primary revenue stream is the Maize Processing Division, contributing significantly to its overall earnings. Over recent periods, the gross profit margin has shown fluctuations, peaking at 30.85% in March 2022 and later adjusting to 27.68% by June 2024. Operating expenses have consistently been a substantial component of costs, impacting net income margins which varied from a low of approximately 3.42% in December 2019 to a high of about 10.18% in March 2022.

PE: 18.2x

Gujarat Ambuja Exports, a company known for its potential in the smaller stock segment, reported a net income increase to ₹767 million for Q1 2024 from ₹709 million the previous year, despite slightly lower revenue. The firm's earnings per share rose to ₹1.67 from ₹1.55 year-on-year. Insider confidence is highlighted by Sandeep Agrawal's purchase of 3,050 shares worth approximately ₹389K in recent months. While funding relies on external borrowing, projected annual earnings growth of 15.93% suggests promising prospects ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Gujarat Ambuja Exports.

Explore historical data to track Gujarat Ambuja Exports' performance over time in our Past section.

Seize The Opportunity

- Discover the full array of 190 Undervalued Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal